Dive Brief:

-

Grail has begun selling its multi-cancer early detection blood test Galleri in the U.S. to adults with an elevated risk of cancer.

-

The launch is backed by evidence including an interim analysis of data from a 6,629-subject study, in which an earlier version of Galleri accurately detected 29 cancers. Forty percent of the cancers were stage 1 or 2 and therefore likely more responsive to treatment.

- Grail is the subject of a $7.1 billion buyout bid by Illumina, which is facing scrutiny from both U.S. and EU regulators. If the deal falls through, Grail will face the challenges of getting insurers' support for asymptomatic screening and competing with rivals such as Guardant Health, Exact Sciences and Freenome on its own.

Dive Insight:

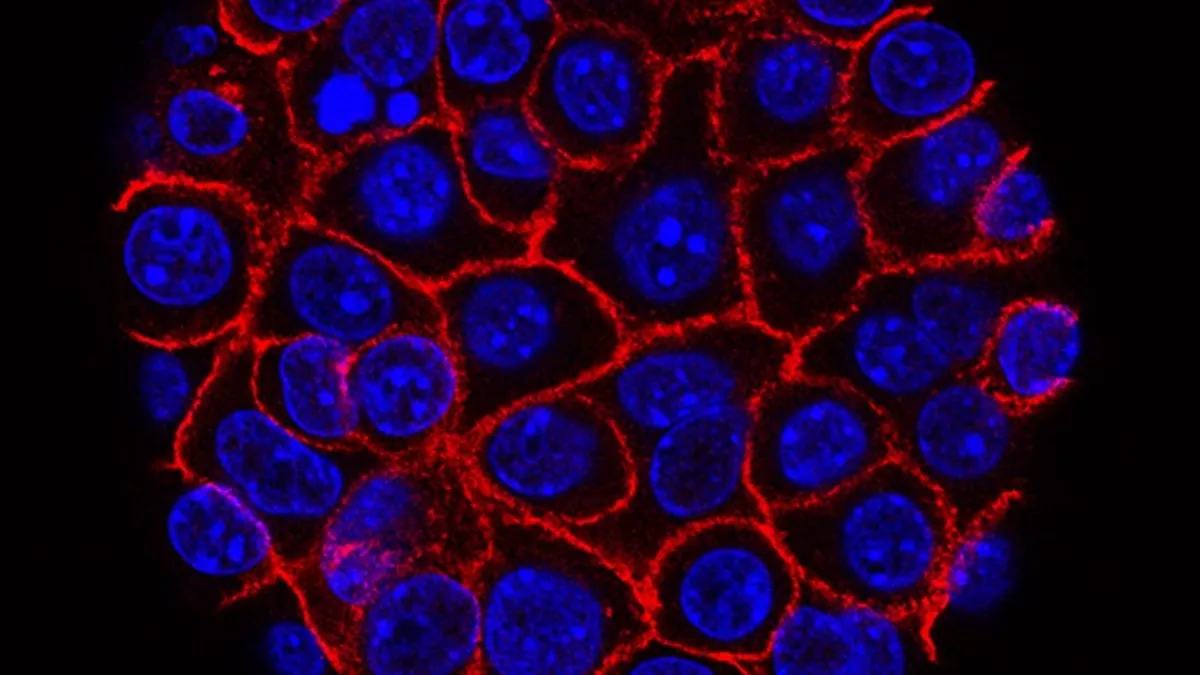

Grail has worked to bring a multi-cancer liquid biopsy test since spinning out from Illumina in 2016. In that time, Grail has raised vast sums of money to run the large studies needed to develop and validate methods for detecting multiple types of cancer at an early stage in blood samples. Now, for the first time, Grail is positioned to start finding out if its big bet will pay off commercially.

Following the roadmap it sketched out in its IPO filing last year, Grail is introducing Galleri as a laboratory developed test. The test is available by prescription to patients with an elevated risk of cancer, such as adults aged 50 years or older, as "a complement to existing single cancer screening tests." Mayo Clinic released a statement about the introduction of the test.

The targeted patient population is in line with the enrollment criteria for Grail clinical studies. Grail used the 2021 ASCO Annual Meeting to share more data on Galleri, including interim results from its PATHFINDER study.

An earlier version of Galleri detected 92 cancer signals in 6,629 participants. Thirty-six of the signals were false positives, 29 were true positives and there is no current diagnostic resolution to the other 27. The rate of true positives was numerically higher in a subgroup of patients who had additional risk factors beyond age, such as a history of smoking.

Twenty-three of the accurate signals were new cancer diagnoses. Nine of the new cancers were caught at stage 1 or 2 and a further four were stage 3. Grail's pitch for Galleri rests, in part, on the idea that it can detect cancer earlier when it is more responsive to treatment.

Grail is now continuing to track the PATHFINDER participants with a view to reporting final data next year. At the time of its IPO filing, Grail planned to seek FDA approval for its liquid biopsy in 2023.

The company is enrolling 35,000 people who are prescribed Galleri in real-world evidence study to understand the experience and clinical outcomes.

The IPO proposal was pulled within weeks of the publication of the paperwork because Illumina put together a buyout bid. However, scrutiny from antitrust regulators in the U.S. and European Union has raised doubts about whether Illumina will be able to close the deal.