Globus Medical plans to buy spinal cord stimulation company Nevro for about $250 million, the companies announced on Thursday. Globus will pay $5.85 per share in an all-cash purchase, a 27% premium to Nevro’s 90-day volume-weighted average price.

Globus CEO Dan Scavilla said in a statement that the purchase “furthers our mission to become the preeminent musculoskeletal technology company in the world,” giving the company access to neuromodulation, future implant solutions and other technologies.

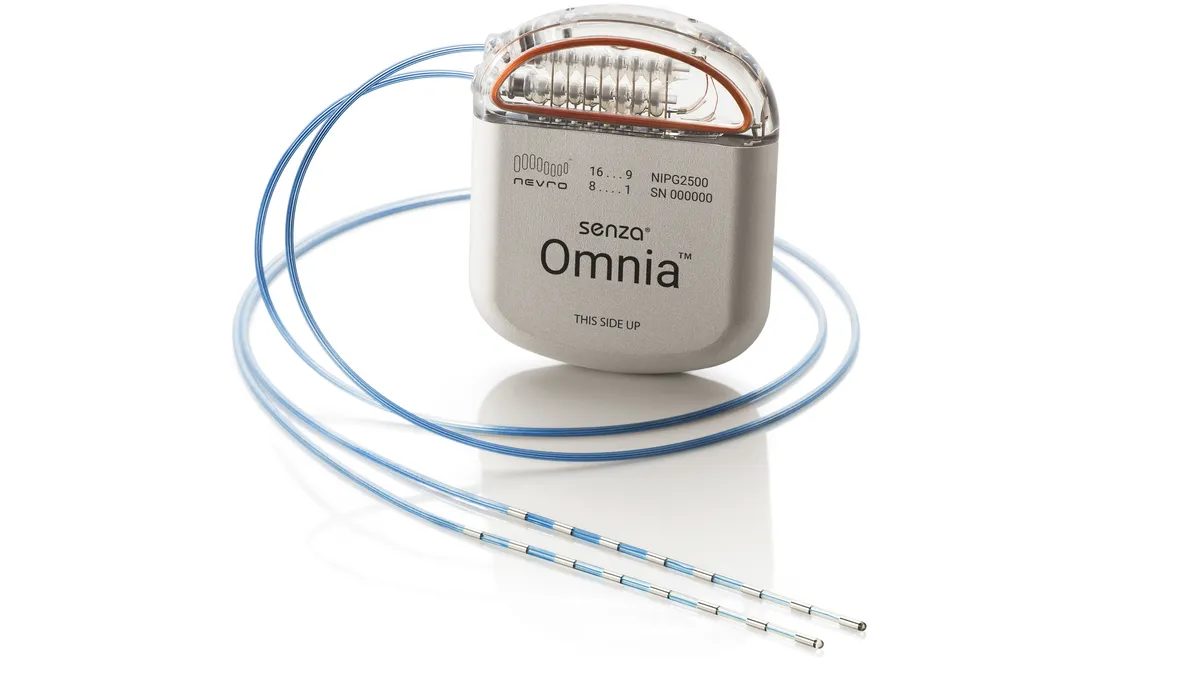

Redwood City, California-based Nevro sells spinal cord stimulation devices for back pain and painful diabetic neuropathy, a complication of diabetes associated with pain or tingling in the arms, legs, feet or hands. The company also offers sacroiliac joint fusion devices for lower back pain after acquiring Vyrsa Technologies in 2023.

BTIG analyst Ryan Zimmerman wrote in a research note on Thursday that the acquisition may surprise investors as Globus had just bought Nuvasive for $3.1 billion in 2023.

“We don’t believe investors expected that [Globus] would move into neuromodulation and(or) pain stim as a market adjacency especially as it digested its largest acquisition to date with NuVasive,” Zimmerman wrote.

However, Globus is paying a small amount of cash, and “we think it’s a fairly low-risk bet,” Zimmerman added.

William Blair analyst Brandon Vazquez wrote in a research note that the price is a “relatively inexpensive valuation,” but could provide Nevro an opportunity to use Globus’ global scale and orthopedic relationships to boost sales and profitability.

Both analysts said Nevro’s sacroiliac joint portfolio could complement Globus’ business.

The acquisition is expected to close in the second quarter of 2025. Both companies’ boards of directors have approved the terms.

Globus expects 2025 net sales of $2.8 billion to $2.9 billion, assuming the deal closes in the second quarter. The company announced preliminary 2024 revenue of $2.52 billion, while Nevro announced preliminary 2024 revenue of up to $409 million.

Globus expects the acquisition to be accretive to earnings in the second year after closing.