Dive Brief:

-

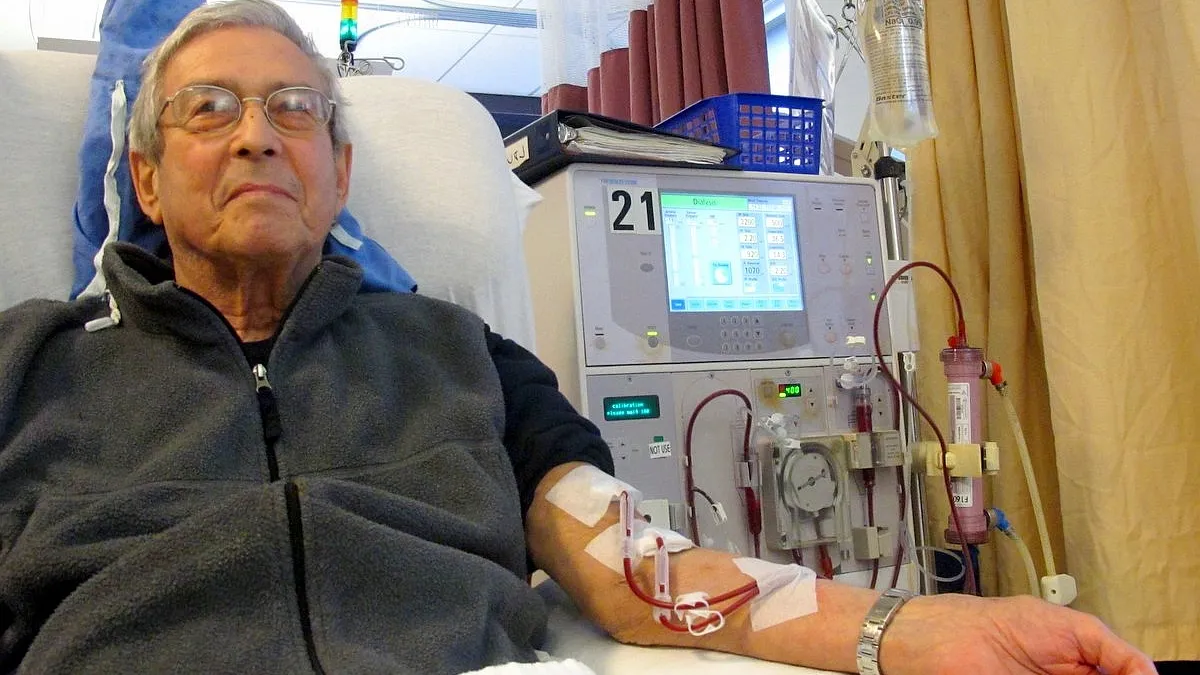

Fresenius Medical Care has set out how it plans to achieve mid-single digit revenue growth through to 2025.

-

In a presentation Thursday, Fresenius executives predicted the pandemic will drive a shift to home dialysis, positioning it to grow sales of devices it has acquired to facilitate the move out of dedicated clinics.

-

Fresenius also identified COVID-19 as a driver of growth in its critical care business. Having increased production of acute dialysis machines by 230% in response to the pandemic, the company has a larger installed base that could support growth as the crisis abates.

Dive Insight:

Fresenius has established a vertically integrated operation that sells products and services for the care of patients with chronic kidney disease. The breadth of the business enabled the company to weather lockdown measures imposed in response to the pandemic. With home hemodialysis rising 41% in North America in the second quarter, COVID-19 has had a net neutral impact on Fresenius.

At Thursday's investor day, Fresenius set out how the pandemic and other forces will shape its business over the longer term. Katarzyna Mazur-Hofsäß, CEO of Fresenius in Europe, the Middle East and Africa (EMEA), said the pandemic will "accelerate decisions" and lead to more patients being treated at home.

Fresenius strengthened its position in the nascent home market last year when it closed its $2 billion takeover of NxStage. In the near term, Fresenius expects the growth of the home dialysis market to be strongest in the U.S. Mazur-Hofsäß sees a "clear intention to move towards home hemodialysis" in EMEA but for now there are barriers to the transition.

"Not all reimbursement systems have already figured out the right set of incentives. Where such incentives exist, for example in the United Kingdom or in Turkey, we see significantly higher share of patients being dialyzed at home, and as expected we see better outcomes at lower costs," Mazur-Hofsäß said.

The move toward home dialysis was one of two pandemic-related growth drivers discussed by Mazur-Hofsäß. Fresenius is also positioned to benefit from the lasting effects of surging demand for its critical care devices during the pandemic. While COVID-19 was originally seen as a respiratory disease, some patients required renal replacement therapy.

Fresenius sells devices used in renal replacement therapy and the treatment of acute respiratory failure, leading it to temporarily ramp up production of its critical care products to meet demand. "This has propelled our business. The increase of installed critical care devices on a global level is also a position to grow beyond the pandemic," Mazur-Hofsäß said.

There are potential downsides to the growth drivers identified by Fresenius. The move to home care may come at the expense of Fresenius’ in-clinic business and the spike in sales of critical care devices could mean hospitals buy fewer machines in the coming period. Yet, with the number of dialysis patients set to continue to rise Fresenius sees opportunities to keep growing its business.