Medtronic's plan to acquire first-to-market connected insulin pen maker Companion Medical is the medtech giant's latest example of trying to bolster its diabetes business through M&A, against a backdrop of losing market share to more specialized competitors on other device fronts.

With Dexcom and Abbott coming to dominate continuous glucose monitoring, and insulin pump specialists Insulet and Tandem speeding commercialization of new interoperable technologies, the smaller pure-play companies have seen double-digit growth across recent quarters. By contrast, the medtech giant's diabetes unit has been down, flat or experiencing single-digit growth.

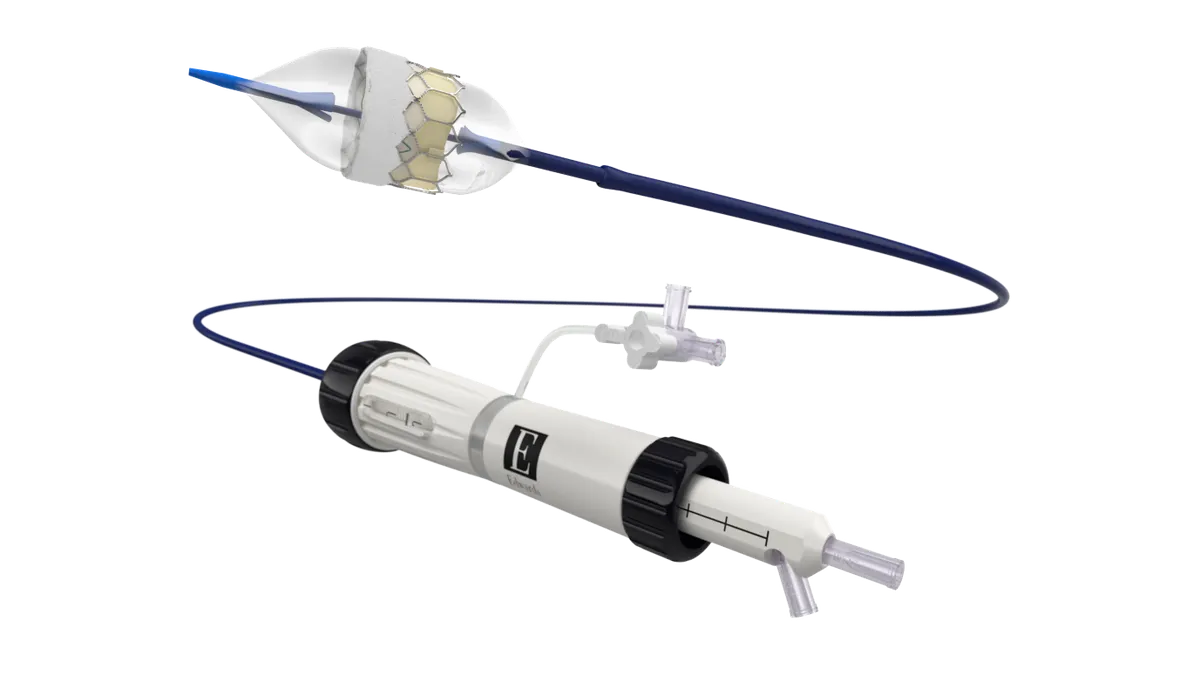

Now, Medtronic is preparing to leap to the front of the pack in targeting people with Type 1 and Type 2 diabetes looking to upgrade their insulin delivery technology without going on pump therapy. The buyout of the startup behind InPen, which in 2016 became the first "smart" insulin pen to gain FDA clearance, is expected to be finalized within a month or two, at which time Companion's employees will be folded into Medtronic's diabetes group.

Analysts at Jefferies estimate InPen will generate between $30 million and $35 million in sales of 50,000 devices this year, roughly tripling its 2019 sales performance. Within the last year alone, InPen has received additional U.S. clearances for expanded pediatric use to children as young as 7 years old and for its bolus calculator for fixed dosing and meal estimation. Medtronic will look to take InPen global.

Despite a quickly widening range of options in the insulin pump space, Medtronic's investment in a connected pen recognizes that among people wishing to incorporate higher-tech solutions to help manage diabetes, a large portion of the Type 1 and intensively managed Type 2 populations are neither ready nor willing to transition to pump therapy from multiple daily injections (MDI).

More than 70% of Medtronic's potential customers are not using pumps and instead inject themselves, said 15-year Medtronic veteran Mike Hill, who headed the company's multiple daily injections business and is newly vice president of marketing analytics and operations in the diabetes unit.

"We understand there [is] a meaningful group of customers who are not interested in just turning over insulin delivery to a machine," Hill said.

"That's why MDI is so important, because it's not like we're going to triple the people on pumps in the next five years," Hill added. "So even though it's a relatively small part of our business today, it's an extremely important part of our strategy and the way we want our business to look tomorrow."

Stifel analysts, in a note to investors following the deal, called the Companion move "another signal" that Medtronic will continue to invest in its diabetes business, and labeled connected pens "a natural entry into the very large T2 market" which pump makers "don't yet adequately address."

Hill estimates that just 5% of people with intensively managed Type 2 diabetes are on pumps. "We want to be able to have offerings [for] the other 95% of them."

Companion's glucose data integration partners include Glooko, Senseonics and, most significantly, Dexcom. A Medtronic spokesperson said the company does not intend to take away InPen's ability to communicate with Dexcom continuous glucose monitors.

Nor does bringing a connected pen product in house change Medtronic's work with Novo Nordisk on pen technology. An announcement from the two companies almost a year ago said Novo Nordisk planned to launch a pair of "smart" insulin pens in 2020, and that Medtronic's Guardian Connect CGM system would be updated to integrate data from the pens. Novo Nordisk did not provide a status update on its NovoPen 6 and NovoPen Echo Plus in time for publication.

Among its insulin-selling counterparts, Novo is not alone in slowly working toward the connected pen market; Eli Lilly also late last year shared its intention to develop a pen- and -pump based platform that integrates with Dexcom CGMs. Similarly, Sanofi late last year said it was partnering with Abbott to integrate FreeStyle Libre data with "insulin dosing information for future smart pens, insulin titration apps and cloud software," but was unable to comment on its latest pen initiatives in time for publication.

Bigfoot Biomedical, an Abbott-backed insulin delivery startup that's raised some $163 million since its 2014 founding, is looking to introduce a FreeStyle Libre 2-integrated pen cap alternative to InPen within the coming months.

The company in July filed the 510(k) submission for its "Bigfoot Unity" system, a multi-version pen cap device that can be used with "every major brand of both long-acting and rapid-acting insulin pens that are offered in the U.S.", and anticipates FDA clearance by the end of this year. Commercial launch is slated to follow immediately, according to Red Maxwell, Bigfoot's chief marketing officer.

"We know first-hand that people with diabetes need to switch out their insulins due to clinical reasons or insurance coverage," Maxwell said in an email.

For Companion's, and soon to be Medtronic's, InPen, the device currently only works with short-acting insulins but long-acting insulin compatibility is in the works.