Embecta, one of the largest pure-play diabetes care companies, raised its full-year guidance after a quarter in which contract manufacturing and sales to Becton Dickinson helped it beat its internal expectations, and announced plans to develop its own insulin pump, signaling a major shift in its business model.

Spun off from BD last year, Embecta is the largest maker of disposable pen needles and insulin syringes for diabetics. Those older devices face competition from automated insulin pumps, particularly in the U.S. Sales in the U.S. fell last year, while rising internationally on a constant-currency basis, but Embecta increased revenues in its home market in the second quarter.

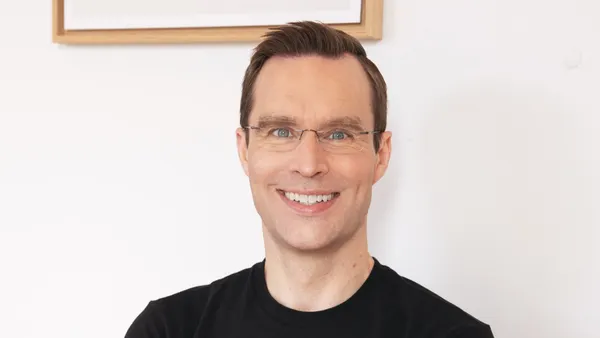

“Our team is really doing an excellent job just strengthening that base business, which is really one of our key strategic objectives for 2023. That's both in terms of the U.S. and international,” Embecta CFO Jake Elguicze said on a conference call with investors.

The 3.6% growth in the U.S. was mainly driven by contract manufacturing and the sale of non-diabetes products to BD. Embecta is still working to add more sustainable drivers of growth to its business, starting with the development of a diabetes pump.

Tidepool partnership

Embecta advanced its pump project by partnering with Tidepool, a nonprofit that hosts software for people with diabetes. Tidepool received 510(k) clearance for a community-developed insulin dosing algorithm earlier this year. Rather than tying the algorithm to a proprietary insulin pump or continuous glucose monitor, Tidepool has made it available for all interoperable hardware.

The 510(k) clearance covers the use of the algorithm in the management of type 1 diabetes. Embecta is targeting the less-penetrated type 2 insulin pump market and plans to work with Tidepool to develop open- and closed-loop systems.

“We literally just signed the agreement, so I don't want to get too far ahead of the team in terms of what the regulatory pathway would look like. But I think, suffice to say, what we do expect is to be able to use the expertise they had in developing the Loop type 1 algo towards an algorithm that is going to be designed specifically for type 2,” Embecta CEO Dev Kurdikar said on the call.

Shares in Embecta rose 6.12%, or $1.77, to $30.69 on Friday.

Forecast

Embecta raised its full-year revenue guidance to between $1.101 billion and $1.113 billion. The forecast reflects a drop in sales of 2.5% to 1.5%, compared to the earlier forecast of a 4.0% to 2.0% decline.