Dive Brief:

- A study of Edwards Lifesciences’ tricuspid valve replacement system met both its co-primary effectiveness endpoints at six months, showing its superiority to optimal medical therapy alone.

- The trial enrolled patients who had at least severe tricuspid regurgitation (TR). Six months after treatment, 98.8% of patients with a valve replacement had moderate or better TR and 93.8% had mild TR. Edwards presented the results at the Transcatheter Cardiovascular Therapeutics (TCT) 2023 conference on Thursday.

- Edwards presented the data days after Abbott released one-year results on its rival transcatheter edge-to-edge repair (TEER) device. Edwards management cautioned against making cross-trial comparisons because of differences in how the two studies selected patients.

Dive Insight:

Edwards has identified the tricuspid valve market as an opportunity that can keep its business growing as its transcatheter aortic valve replacement (TAVR) business matures. The company already sells a device for repairing valves, called Pascal, which reached the U.S. market last year. Pascal competes against Abbott’s rival valve repair device, TriClip, in Europe.

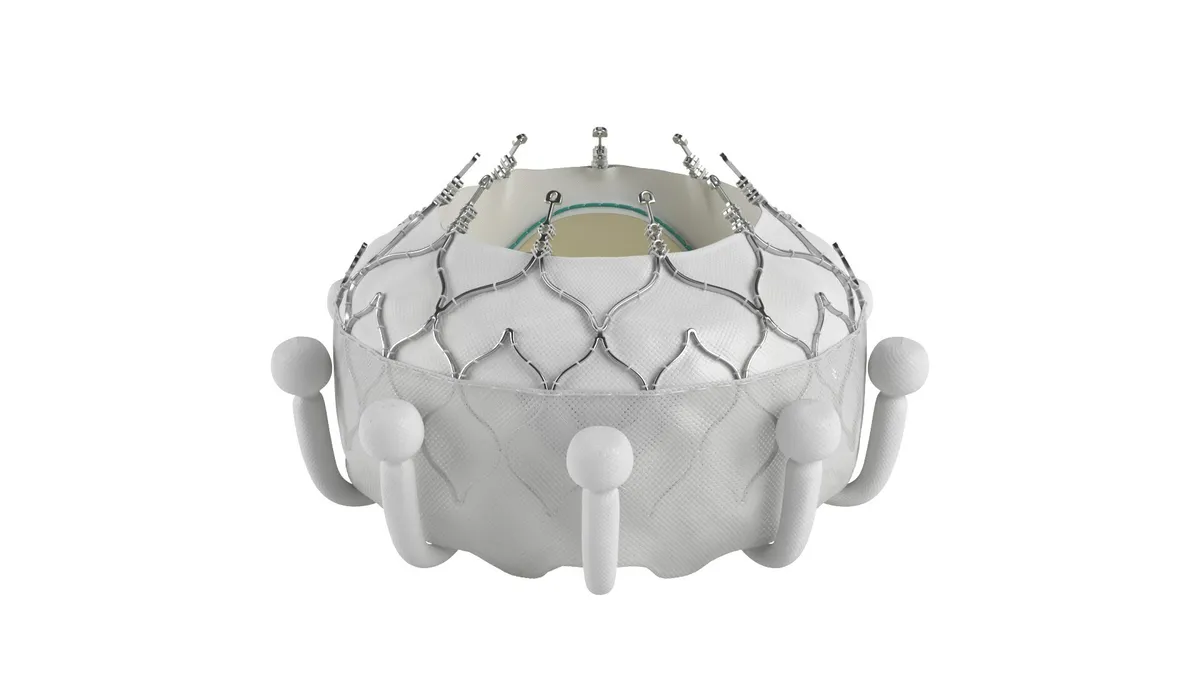

Edwards is also trying to carve out its own niche by developing the Evoque device to replace valves, rather than repair them. The device recently received a CE mark, making it the first valve replacement system to treat tricuspid regurgitation.

The data cover the first 150 patients enrolled in a randomized clinical trial. Edwards originally designated the interim analysis as a chance to course correct before completing enrollment in the 400-subject study. However, the trial enrolled so quickly that all 400 subjects were in the study by the time of the interim analysis, Ted Feldman, senior vice president of medical affairs at Edwards, said at an investor event to discuss the data.

Edwards went ahead with the interim analysis, which compared patients who received Evoque and optimal medical therapy to patients who received medical therapy alone. The major adverse event rate, which included cardiovascular mortality, stroke, severe bleeding and myocardial infarction, was 27.4% after 30 days. Edwards saw significant reductions in TR grade, which translated into significant improvements on a range of quality-of-life measures after six months.

The company is still collecting data, but the initial results suggest Evoque is better at reducing TR than optimal medical therapy. Edwards expects to win approval in the U.S. around the middle of next year, bringing a new competitor to the market for tricuspid repair.

Abbott presented one-year data on TriClip in patients with severe TR this week, revealing that TR reduced to moderate or less in 81% of patients. Feldman outlined the pitfalls of comparing data between the two studies.

“We talked about apples and oranges. This is a little bit more like apples and cows, they're really different,” Feldman said. “All the sites that were involved with the [Evoque] trial were involved with TEER tricuspid technologies as well. So, broadly, these are patients that were felt to be either unlikely candidates for TEER or, at best, probably suboptimal candidates for TEER.”

An investigator involved in trials of the Abbott and Edwards devices said his site screened patients for multiple studies. The screening process resulted in Edwards’ trial featuring more patients with “really severe, torrential TR” and with pacemakers.

RBC Capital Markets analysts responded positively to Abbott’s data, which was published days before Edwards’ presentation. The analysts told investors the one-year data “confirms the safety profile of [Abbott's] Triclip, and reinforces that significantly reducing TR translates to a quality of life benefit and could drive fewer heart failure hospitalization.”

That said, the analysts “believe longer-term follow-up is needed to make meaningful headway in the tricuspid space from a market standpoint.”

The next big event is scheduled for January, when the FDA is set to hold an advisory committee meeting. Edwards expects the experts to discuss Evoque. Analysts at J.P. Morgan said TriClip will be up for discussion as well.