Dive Brief:

- Edwards Lifesciences issued fiscal guidance for 2020 Thursday morning, targeting sales in the range of $4.5 billion to $5 billion, with more than half expected to come from its transcatheter aortic valve replacement (TAVR) business, which is set to increase up to 15% next year.

- The company pegs a growing, aging population, more health systems prioritizing structural heart care, indication expansion, awareness of transcatheter technologies and advancement of the technologies themselves as its key levers for growth.

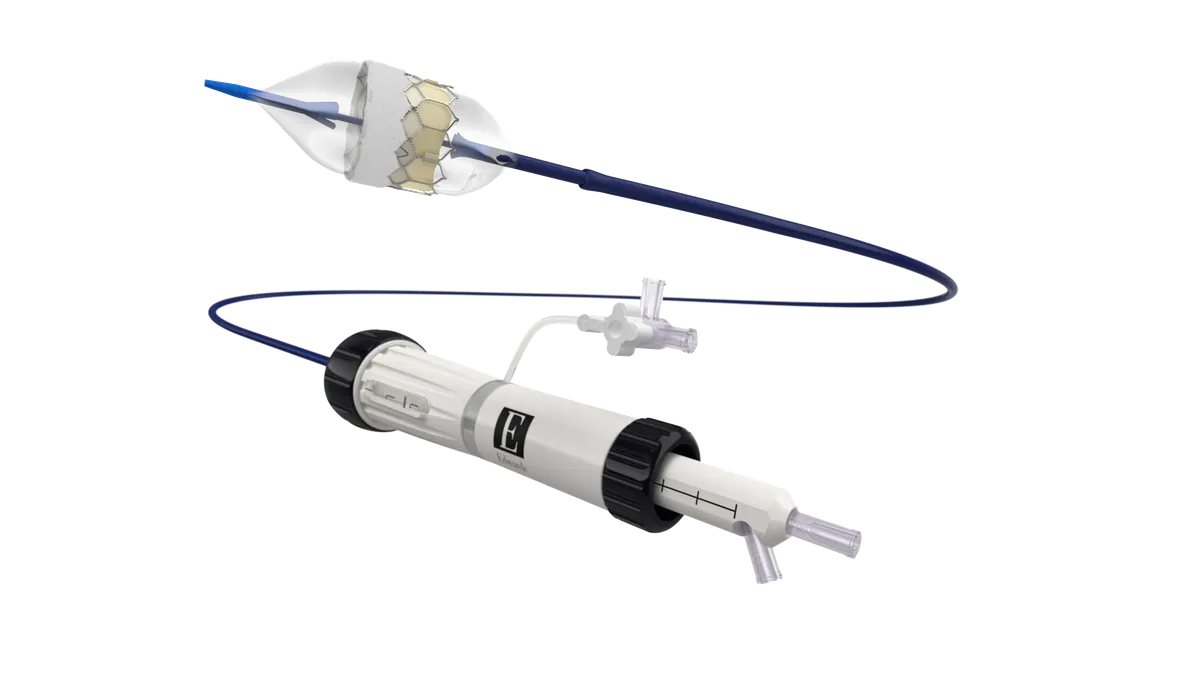

- Edwards said its Sapien 3 Ultra valve will comprise most of its TAVR sales in the United States and Europe next year, as it simultaneously plans a pivotal trial for its next-generation TAVR valve, called X4, within the next 18 months.

Dive Insight:

Across heart valve treatment markets, Edwards projects worldwide transcatheter valve therapy opportunities to exceed $10 billion by 2024. At least 70% lies within aortic valve treatment, with the remainder in mitral and tricuspid therapies.

That latest forecast represents a slight bump to the company's targets offered last year, as it now foresees the TAVR opportunity surpassing the $7 billion mark in the next five years.

Analysts at Jefferies said in a Dec. 3 note preceding the investor event that Edwards has a history of low-balling market estimates. Edwards' outlook represents a 9% CAGR for TAVR compared to Jefferies' 12%, the analysts noted, the latter of which has the TAVR opportunity hitting $7 billion by 2023.

The analysts also pointed out that Edwards in 2014 expected the TAVR market to be worth $3 billion in 2019; in near-term guidance reaffirmed Thursday, Edwards expects 2019 sales to close out approaching $4.3 billion.

Edwards Lifesciences guidance for 2020

| Fiscal Year 2020 Non-GAAP Guidance | Amount |

|---|---|

| Sales | $4.5-5.0 billion |

| TAVR | $2.9-3.2 billion |

| Surgical Structural Heart | $820-860 million |

| Critical Care | $780-820 million |

| TMTT | $50-70 million |

| FX Impact on Sales (at current rates) | ~$40 million unfavorable |

| Gross Profit Margin | 76-77% |

| R&D % of Sales | 17-18% |

| Operating Margin | 30-32% |

| Free Cash Flow | $1.0-1.1 billion |

Source: Edwards Lifesciences