Edwards Lifesciences, Medtronic and Inari Medical used this week’s Transcatheter Cardiovascular Therapeutics (TCT) conference in Washington, D.C., to share clinical trial data on their devices.

Read on for MedTech Dive’s look at what the results mean for the companies and the markets for tricuspid valve replacement devices, high blood pressure treatments and clot removal products.

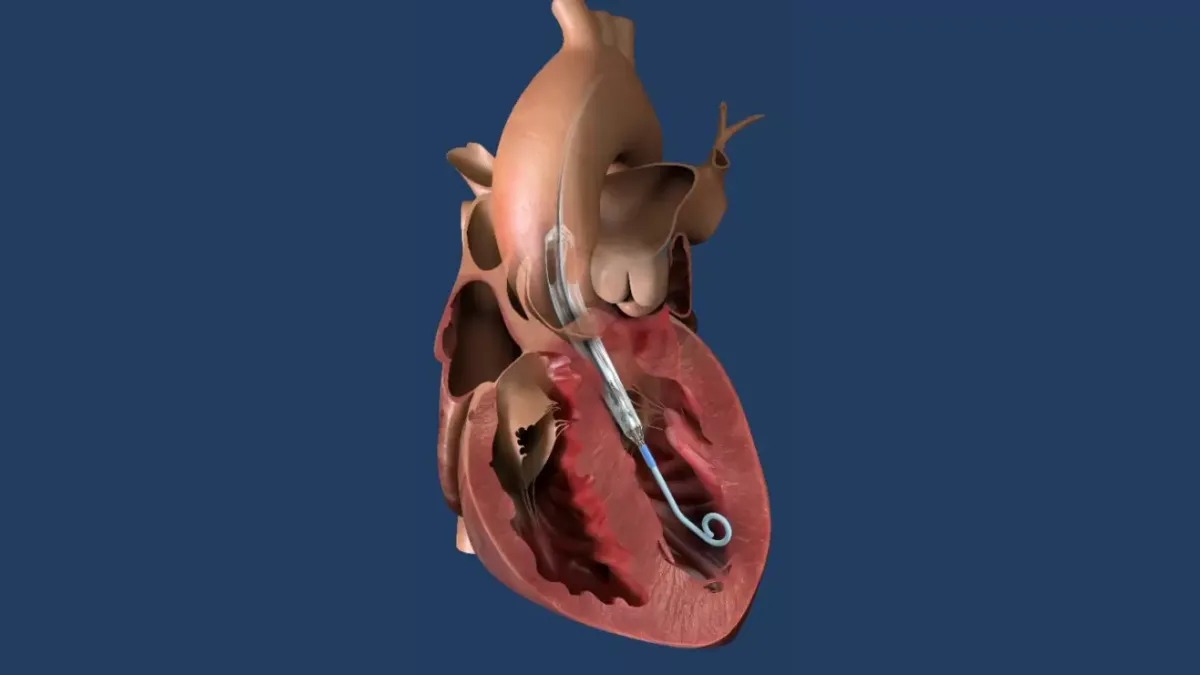

1. Edwards’ tricuspid results

A study of Edwards’ transcatheter tricuspid valve replacement device met its primary endpoint. However, the improvement on the composite endpoint was driven by patient-reported quality of life, and the device had no significant effect on mortality after 12 months.

The trial enrolled 400 patients with severe symptomatic tricuspid regurgitation. Two-thirds of patients underwent valve replacement with Edwards’ Evoque and received medical therapy. The other patients received medical therapy only. The primary endpoint looked at a range of outcomes such as death from any cause and hospitalization for heart failure.

One year after treatment, the valve replacement cohort was performing better than the control group on the composite primary endpoint, according to a paper published Wednesday in The New England Journal of Medicine. The result was driven by changes on the Kansas City Cardiomyopathy Questionnaire overall summary (KCCQ-OS), a commonly used measure of health status, which improved in about 23% of valve patients and 6% of people on medical therapy.

Edwards, which simultaneously provided a closer look at the KCCQ-OS data in the Journal of the American College of Cardiology, reported no significant mortality benefit after 12 months.

Leerink Partners analysts said the result “may be slightly disappointing for some investors,” but they believe most people “were not banking” on seeing a mortality benefit at 12 months. J.P. Morgan analysts echoed that position. The analysts said the trial was more likely to show a mortality benefit after 18 or 24 months, and they still expect Edwards to hit that endpoint next year.

2. Medtronic’s Symplicity update

Medtronic shared two-year data from a trial of its Symplicity Spyral renal denervation device. The update showed that after two years, people treated with the device continued to have lower 24-hour ambulatory systolic blood pressure and office-based systolic blood pressure than patients who underwent a sham procedure.

RBC Capital Markets analysts discussed the data in the context of Medtronic’s efforts to grow sales of the device, which won FDA approval in November 2023. The company is now working to improve payer coverage of the hypertension treatment.

“From our recent conversation with the company, we note that [Medtronic] is bullish on the potential for Symplicity Spyral Renal Denervation System to treat hypertension,” the analysts said. “Management recently noted to us that it is having positive conversations with [the Centers for Medicare and Medicaid Services] while it continues to pursue private payers.”

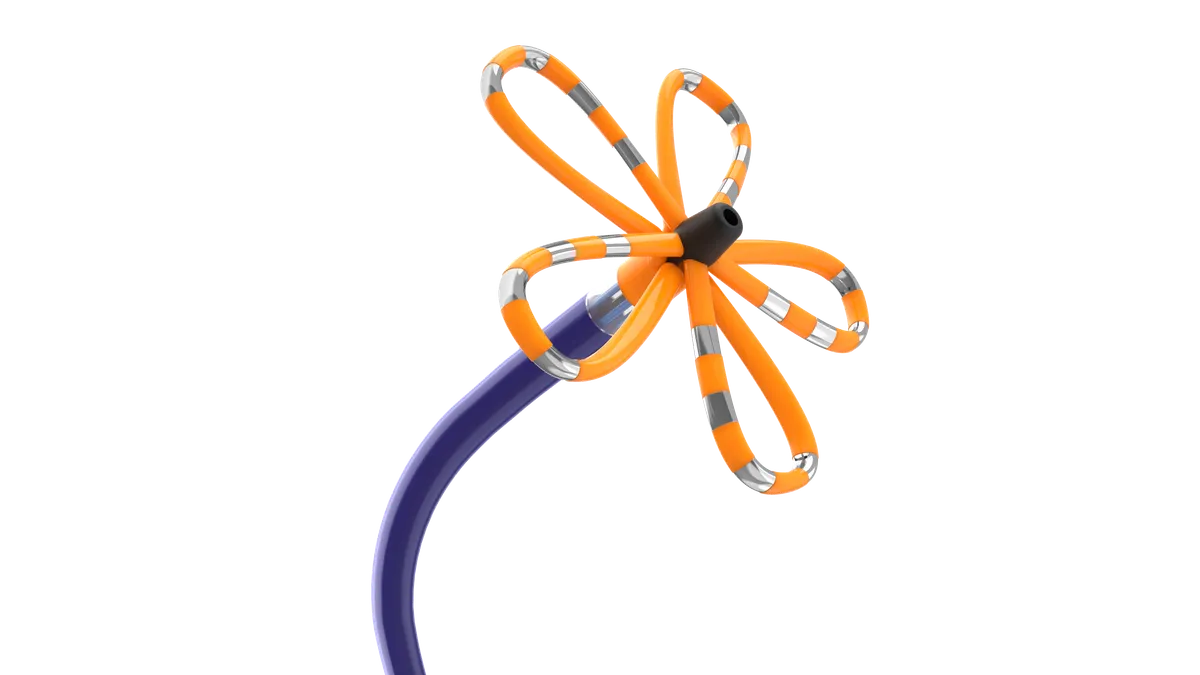

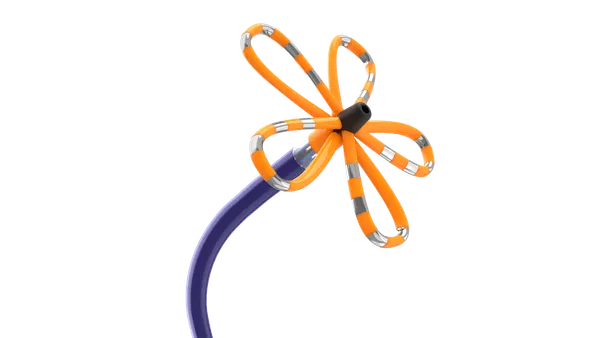

3. Inari’s thrombectomy data

Inari reported data from a trial that compared its mechanical thrombectomy device Flowtriever to catheter-directed thrombolysis (CDT) in 550 intermediate-risk patients with sudden blockages in a lung artery. The trial, which was published Tuesday in the medical journal Circulation, hit its composite primary endpoint, driven by reductions in ICU admission and length of stay.

After the results were released, Inari’s stock price increased by roughly 16% when the market closed Tuesday.

More patients who received CDT experienced clinical deterioration or required bailout therapy.

William Blair analysts picked out the finding as a positive for Inari.

“While the length of stay reduction was unsurprising to us, we believe more severe complications and clinical deterioration in the CDT group should accelerate the adoption of mechanical thrombectomy, and [Flowtriever] in particular,” the analysts said.

However, Truist Securities analysts said “enthusiasm amongst presenters sounded muted during the discussion at the podium.” The physicians’ responses reflected questions about the trial and the data it generated.

“Docs on the podium noted that there were overall low rates of mortality in both cohorts, questioning whether these patients were ‘sick enough,’ and they noted that the subjective ratios that drove overall outcomes can be biased based on local standards,” Truist analysts said.

Inari published the data a day after reporting its third-quarter results. Revenue increased 21% year over year to $153 million. Inari attributed the increase to factors such as an expansion of sales territories and opening of new accounts.