Dive Brief:

- Diagnostic companies may soon initiate and expand restructuring programs and otherwise cut their spending to make cash reserves last longer, according to analysts at Goldman Sachs.

- In a preview of fourth-quarter results, the analysts said they expect testing firms to use upcoming conference calls to disclose reorganization plans. Companies including Cue Health, GeneDx and Invitae have already begun strategic restructuring in recent months.

- The changes are part of the response to concerns about cash runway and profitability. With the share prices of many companies below historic highs, diagnostics businesses may struggle to raise money through stock offerings on attractive terms and are consequently rethinking spending, the analysts said.

Dive Insight:

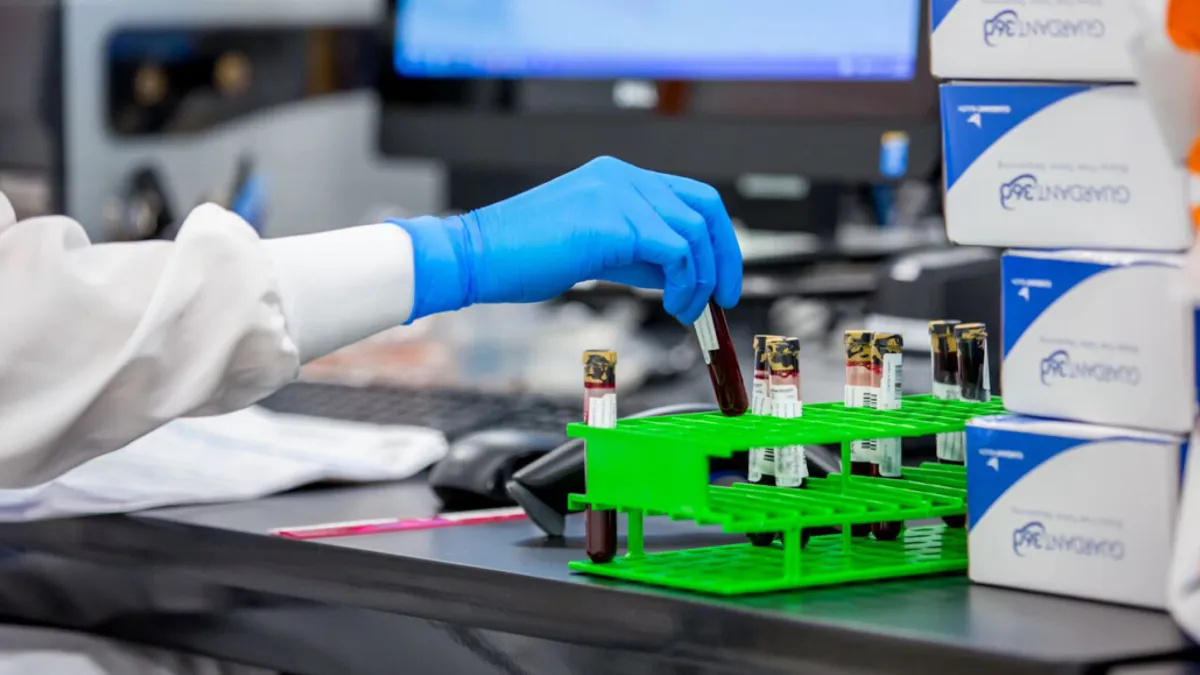

Some of the diagnostics companies covered by the analysts, such as Guardant Health and Exact Sciences, reported preliminary fourth-quarter results last month. Ahead of the release of full results and conference calls to discuss them, the Goldman Sachs analysts shared four themes for the fourth quarter in a note to investors.

Restructuring is the top theme. The analysts commented on the cuts that several companies have made in recent months, calling the changes at Invitae “necessary for them to extend their cash runway and ultimately return to growth,” and expressed the belief that other businesses also will lay off employees.

The prediction is in line with the analysts second theme: capitalization. “Cash runway and profitability remain a key concern for most if not all companies,” according to the analysts, and that is informing spending plans. The analysts said that while Exact Sciences has “worked successfully to rationalize costs and dramatically accelerate path to profitability,” they see a downside to the changes.

“While necessary to maintain the business, we think this cost rationalization is leading to under-funding, delay or cancelation of R&D projects, for example, [Exact Sciences] de-emphasizing investment in [multi-cancer early detection] in pursuit of near-term profitability,” the analysts wrote.

Multi-cancer early detection (MCED) is the third theme. The analysts expect some companies may adjust their strategy in response to data from Guardant’s ECLIPSE MCED study and are looking to hear more about Exact Sciences’ spending plans.

The fourth theme, minimal residual disease, covers Invitae’s attempt to enter a market that is already served by companies including Guardant and Natera.