Diabetes technology companies remain focused on Type 2 diabetes as a source of growth. Despite the questions from investors on GLP-1 drugs that have peppered recent earnings calls, companies highlighted new devices targeted at people with Type 2 diabetes and the impact of coverage decisions that could broaden access.

Leaders with Abbott, Dexcom and Tandem also talked about plans for closed-loop integrations of their continuous glucose monitors (CGM) and insulin pumps and research on whether these automated insulin delivery systems can also benefit people with Type 2 diabetes.

Here are some highlights from their third quarter earnings results:

Insulet

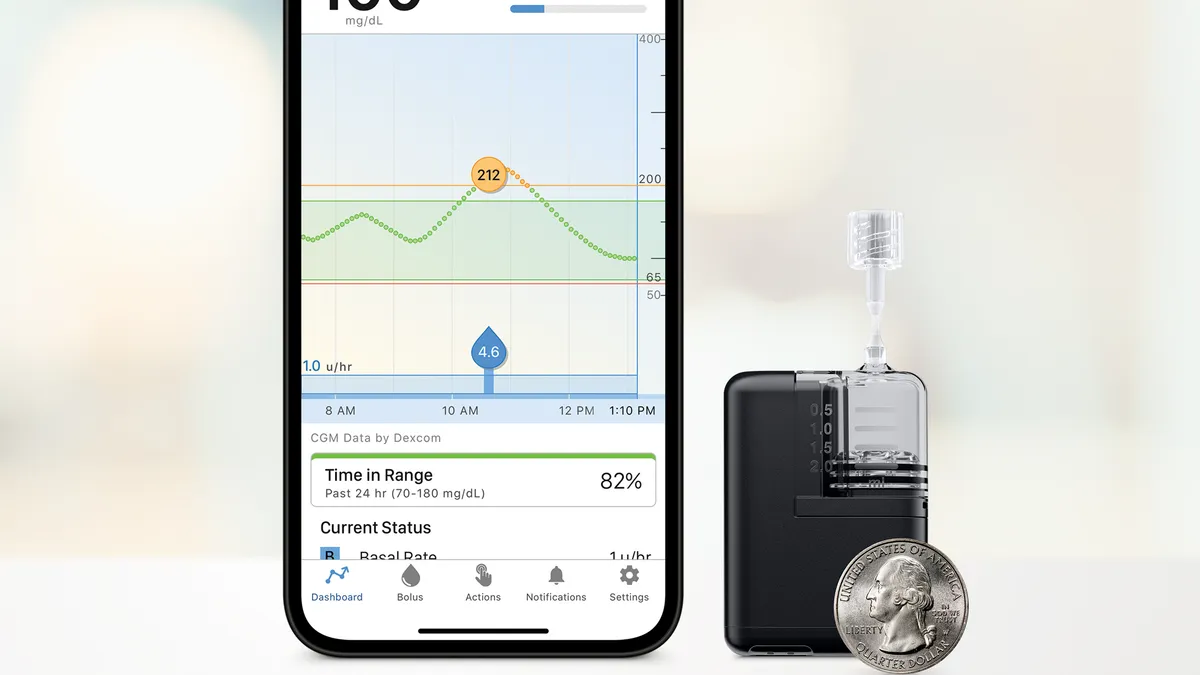

Insulet, which makes tubeless patch-pumps, said sales of its Omnipod devices rose by 29% to $422 million in the third quarter. The company plans for a limited market release of its newest pump, the Omnipod 5, integrated with Dexcom’s G7 in early 2024.

The company is currently running a commercial pilot in the U.S. of Omnipod GO, a tubeless pump designed for people with Type 2 diabetes who take basal insulin. Insulet received FDA clearance for the device earlier this year.

“Even small penetration into this market will meaningfully contribute to our long-term growth trajectory,” CEO Jim Hollingshead told investors on a Nov. 2 earnings call.

The pilot has involved working with primary care physicians, while in the past Insulet has typically called on endocrinologists. The company currently has a presence in the Type 2 market with its Omnipod DASH pump, which is indicated for patients who take multiple daily injections of insulin.

Hollingshead also announced that the company had reached its minimum enrollment goal for a pivotal study of Omnipod 5 in U.S. Type 2 patients. Hollingshead said the study can include up to 400 people and compare Omnipod 5 to their previous therapy over 13 weeks.

“When you take those two things together: The success of Omnipod DASH in the Type 2 market, [and] the obvious pent-up demand for Omnipod 5 in the Type 2 market once we get the indication for use with a successful result from the SECURE trial, we think it will unlock massive growth for us,” Hollingshead said.

Tandem

Tandem CEO John Sheridan described the quarter as a “transitional time,” as the company works through a limited launch of its new Mobi pump and prepares for integrations with CGMs. The company has faced increased pressure as competitor Insulet has grown quickly with its patch-pumps, and Medtronic brought a new device to the U.S. after resolving a warning letter. Tandem reported total revenues of $185.6 million, a 9% decrease year over year. Shares of the company have decreased by 17% over the past month.

Tandem received FDA clearance for its Mobi device, its smallest durable insulin pump, in July. It also plans to integrate its t:slim X2 pump with Dexcom’s G7 CGM in the U.S. by the end of the year, and is working to integrate with Abbott’s Freestyle Libre 2 sensor in the fourth quarter, with broad availability in the new year, Sheridan said.

The company reduced its 2023 revenue forecast by $20 million to $765 million, due to reduced pump orders from overseas distributors because of the planned product launches and a reimbursement change in France related to its Control-IQ algorithm, which makes automatic adjustments to basal insulin using CGM data.

The company also named Mark Novara as its new chief commercial officer. Novara was a senior advisor at McKinsey & Company, and previously worked for Becton Dickinson, Roche and Sanofi-Aventis.

Tandem made progress enrolling participants in a pivotal trial of Control-IQ for people with Type 2 diabetes, Sheridan said, with the goal of getting an expanded label. The company currently has a submission with the FDA for enhancements to the algorithm that would make it available to younger patients and allow for more personalization.

Q3 earnings results for diabetes tech companies

Abbott

Sales of Abbott’s FreeStyle Libre CGM increased by 31% to $1.4 billion in the third quarter. The company said a total of 5 million people now use its Libre devices, including 2 million in the U.S.

CEO Robert Ford said on an Oct. 18 earnings call with investors that the company “saw a nice impact” from coverage of the devices for people who take basal insulin, a type of slow-acting insulin, especially in international markets. Earlier this year, Medicare began covering CGMs for people with Type 2 diabetes who take basal insulin, where before it had only covered the devices for people with Type 1 diabetes or people who took multiple daily injections of insulin.

Abbott also won indications for coverage in France and Japan for people who take basal insulin.

Mahmood Kazemi, chief medical officer of Abbott Diabetes Care, said in an interview with MedTech Dive that the Medicare decision was “really a welcome one” and led to “much greater coverage by private payers.”

Kazemi said the company is also thinking about Medicaid coverage, which applies to nearly 75 million people in the U.S.

“We've been making progress on a state-by-state basis to help improve access to these devices for the Medicaid population,” Kazemi said. He added that people with Type 2 diabetes who are not taking insulin are another big-picture opportunity for Abbott.

Ford also shared plans for the company’s consumer-facing blood sugar monitoring device, Lingo, which debuted in the U.K. this summer. The company is planning a full launch in the U.K. starting next year and plans to file the device with U.S. regulators by the end of the year.

Dexcom

Dexcom also reported a double-digit sales increase in the third quarter, reporting total company revenues of $975 million, up 27% year over year. Its net income rose by 19% to $120.7 million.

The company also reported record new patient starts for people covered by Medicare in the quarter.

“Some of that does come from basal. There's no question there,” CFO Jereme Sylvain said in the company’s Oct. 26 earnings call. “As we continue to open up reimbursement, the new patients are coming along.”

Dexcom has also been working on a 15-day CGM for Type 2 patients who are not taking insulin. The company has shared few specifics, other than to note the device will be based on its G7 hardware but with a separate user interface and software.

CEO Kevin Sayer said the company has finished the required clinical trial and plans to make a regulatory submission before the end of the year, with the goal of a 2024 launch.

“It took us many years to build the intensive insulin market and get this technology adopted rapidly. I don't believe the curve is going to be near that long in this Type 2 world once people start using this product,” Sayer said in response to a question about the potential market for a non-insulin CGM.

“We do think we can ultimately push toward reimbursement and possibly even creation of a new product category,” he added.

Looking ahead

Both Medtronic and Embecta will report earnings results on Nov. 21.