Dexcom CEO Kevin Sayer doubled down on benefits of the company's Super Bowl commercial, sidestepping the backlash among some patient groups that arose on Twitter over access issues for its continuous glucose monitors.

The CEO said Thursday during a fourth-quarter earnings call that the company received "great feedback" and increased attention from the ad, which aired Sunday night. When questioned about criticism regarding access and pricing issues for its CGMs, Sayer said that increasing attention to diabetes would ultimately expand access and users and, therefore, drive down costs.

"We do think it is important to acknowledge the community and listen to them, but we also have to run a business and ultimately we felt by making more people aware, we'd have a much more positive effect than negative," Sayer said, as the company posted $399 million in profit for the quarter, compared with $309 million a year earlier.

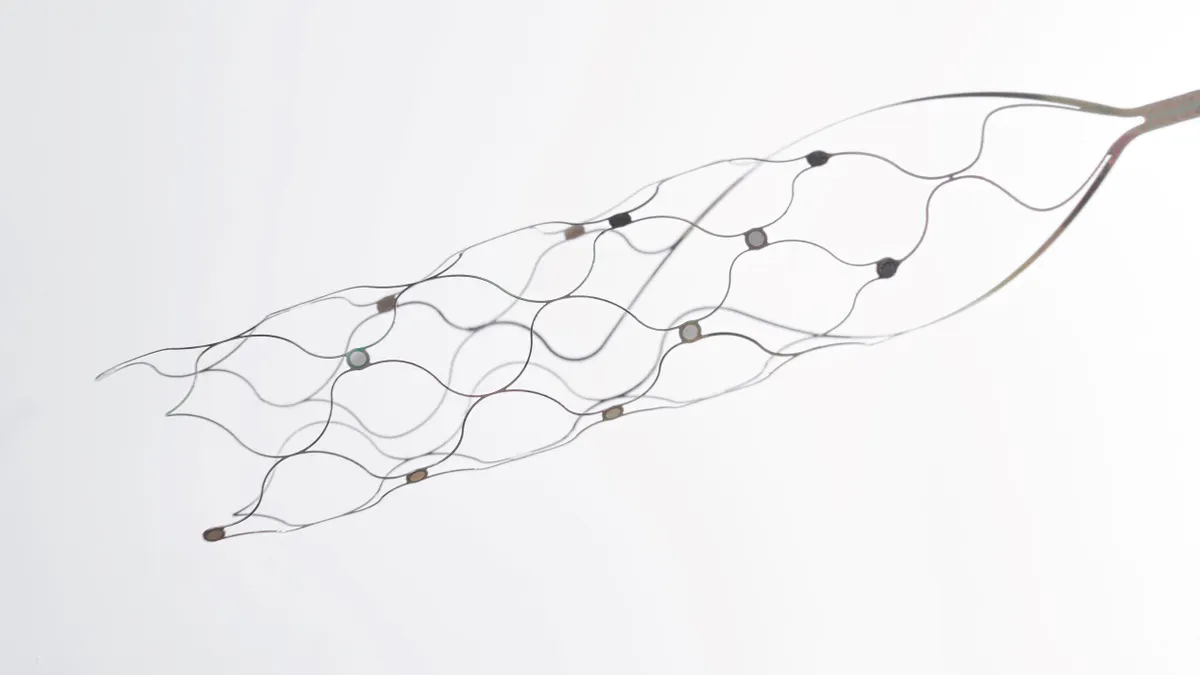

The commercial, which featured pop star Nick Jonas, focused on the benefits of CGMs and asked why patients are still using traditional finger sticks in a world with the most advanced technology.

Some patients with diabetes noted that while the CGMs can improve diabetes management, there are numerous access issues, as they are not always fully covered by insurance. Others praised the Dexcom G6 CGM system as lifesaving. Sayer focused on these responses during the earnings call.

Dexcom has been successful over the last several years, hitting its 2018 five-year revenue goal in about two years and projecting revenue to double by 2025. As the company grows, executives continually point to untapped market potential, which the Super Bowl ad and other direct-to-consumer strategies are aimed at.

"One of the things that I think was just really fascinating coming out of the Super Bowl ad is that we had five times more impressions in the last four days than we had for the entire year of 2020 on the heels of that," CFO Quentin Blackford said during Thursday’s call. "It is just remarkable the type of reach that we're finding with our DTC efforts."

William Blair analysts wrote that the ad and other DTC efforts will be a positive for the company as it looks to expand into new patient populations, like patients with Type 2 diabetes.

"The Super Bowl ad should allow them to broaden their reach beyond their core market and drive awareness among the approximately 250,000 primary care physicians that see a meaningful portion of diabetics, and Type 2 non-intensive and prediabetic patients that may not have even known CGM existed," the analysts wrote.

Dexcom also faced criticism for spending what is estimated to be about $5.5 million for 30 seconds of airtime during the Super Bowl when some patients are struggling to afford their products.

The company declined MedTech Dive's request for comment on how much the ad cost.

A spokesperson for the American Diabetes Association noted that access to diabetes technology like CGMs and insulin pumps can be limited, often for patients who could benefit from them the most.

For example, while Dexcom says that 99% of private insurers cover their devices, the ADA spokesperson said that does not mean individuals actually receive coverage because of the challenges that arise in getting a prescription. This lack of coverage can leave patients with large out-of-pocket costs.

Insurance may also not adequately reimburse for devices, which also leaves patients on the hook for high costs.

Dexcom contends one month of supplies, which include three 10-day sensors, cost $60 or under for over 70% of users with pharmacy coverage in the U.S. and one-third do not have any out-of-pocket costs. But those numbers do not apply to all patients.

Price estimator website GoodRx found the average retail price for three 10-day Dexcom G6 sensors was $424, but $135 for two 14-day sensors for Abbott Laboratories' FreeStyle Libre.

Patients face even more hurdles if they are on Medicare, which the majority of diabetes patients have as their form of health insurance, according to the ADA spokesperson. The diabetes wearables space, which includes CGMs and insulin pumps, has grabbed the attention of Wall Street analysts as companies like Dexcom, Abbott and Insulet have been successful.

And pricing has played a big role in the market.

Abbott's strategy from the beginning for FreeStyle Libre was to target a wider population with a lower-priced product, and it's seen success: device sales grew by 43.1% in 2020.

Targeting lower prices has also been part of a recent strategic shift for Dexcom. The company plans to sell the majority of its products through the pharmacy rather than durable medical equipment channels, which lowers prices and expands the customer base.

Dexcom expects to sell about 75% of its devices through the pharmacy by the end of this year and believes this strategy will help it grow sales by 15-20% to hit a revenue range of $2.21-$2.31 billion in 2021.

Sayer said that more efforts with Jonas are expected.