After last year’s barrage of deal-making in the medical device industry, there have been few acquisitions in the first months of 2022. That may change following a report that Dexcom, which makes continuous glucose monitors (CGMs), is in talks to buy Insulet, an insulin pump manufacturer.

A purchase price wasn't given in the report on Monday by Bloomberg News, which cited unidentified people familiar with the matter. Insulet’s market value is about $15 billion. Spokespersons for both Dexcom and Insulet declined to comment on the report.

A Dexcom-Insulet combined company would put both CGMs and insulin pumps under one roof, joining Medtronic as the only other company in the market to offer both devices. The deal would then leave other market leaders Abbott Laboratories and Tandem Diabetes Care offering either just CGMs or pumps, respectively.

Marie Thibault, a BTIG analyst, said that a “big question” facing Tandem is how its relationship with Dexcom will be impacted if the company does acquire Insulet.

“The first question for Tandem will be, will they be able to integrate with their future products with Dexcom’s latest technology, the G7 CGM, and whether there would still be that collaborative spirit between the two companies … if Insulet became part of Dexcom,” Thibault said.

Currently, Dexcom’s CGMs are compatible both with Insulet and Tandem pumps. Jake Leach, Dexcom’s chief technology officer, said in an interview earlier this month that Insulet and Tandem will make their pumps compatible with the new G7 system.

A merger between Dexcom and Insulet could put competitors in a “tough spot” as the diabetes technology industry has been focused on company collaboration, Thibault said, adding that patients also could have fewer options.

“It's certainly a departure from what is the norm in the industry,” Thibault said.

A Dexcom acquisition of Insulet may spur rivals to seek deals of their own, the analyst said.

“The second question, of course, then becomes, If Dexcom picks up Insulet, does Abbott want to consider a similar play in the insulin pump market? And then, of course, Tandem would be something that gets discussed,” Thibault said. “All speculation. It could make some sense. But again, integration-wise, the Tandem system is tied more closely to Dexcom at this point. Certainly opportunity for more integration down the line with (Abbott’s FreeStyle Libre products), but it's not immediately obvious.”

Why Insulet?

Other analysts are skeptical whether a Dexcom acquisition of an insulin pump company makes sense.

J.P. Morgan analysts wrote in a Monday note that both companies would be limiting their options in the diabetes technology market “by essentially excluding other partners.”

They wrote that Dexcom can now combine with any insulin pump or smart insulin pen that is not Medtronic, adding that Tandem currently has a larger install base than Insulet, with about 250,000 users in the U.S. compared to about 170,000 for Insulet.

“We don’t see the possibility to realize the synergies needed to (a) justify the deal premium, or (b) offset the likely lost/stranded sales with partners,” the analysts wrote. “Add in the fact that Dexcom management has been publicly negative on the desire to enter the pump market in the past, and we’re skeptical that a deal [will] come to fruition.”

Along with concerns about Dexcom limiting its options, Thibault said that while the companies seem similar as they are two diabetes tech names that are in new product cycles and are growing revenues year over year at a similar rate with similar margin profiles, there remain larger differences.

“Dexcom has been focused on expanding into a much larger market opportunity of non-intensive Type 2 diabetes patients with their CGM monitoring. And it's not immediately clear to us what buying Insulet would do to further that goal,” Thibault said.

Thibault added that the deal makes more sense for Insulet than it does Dexcom because CGMs can be used to get diabetes patients more familiar with diabetes technology products if patients eventually progressed to needing insulin.

The J.P. Morgan analysts also suggested that there may be a hurdle with the Federal Trade Commission. BTIG's Thibault said that while there may be some anti-competitive questions, “I would be surprised to see this be an FTC hurdle at this stage” as other equivalent technologies are available and there are other players to integrate with.

How can Dexcom benefit?

Margaret Kaczor, an analyst at William Blair, expressed more optimism about the potential deal, writing in an emailed statement that the benefits will come as the market continues to move more toward automated insulin delivery systems (AIDs).

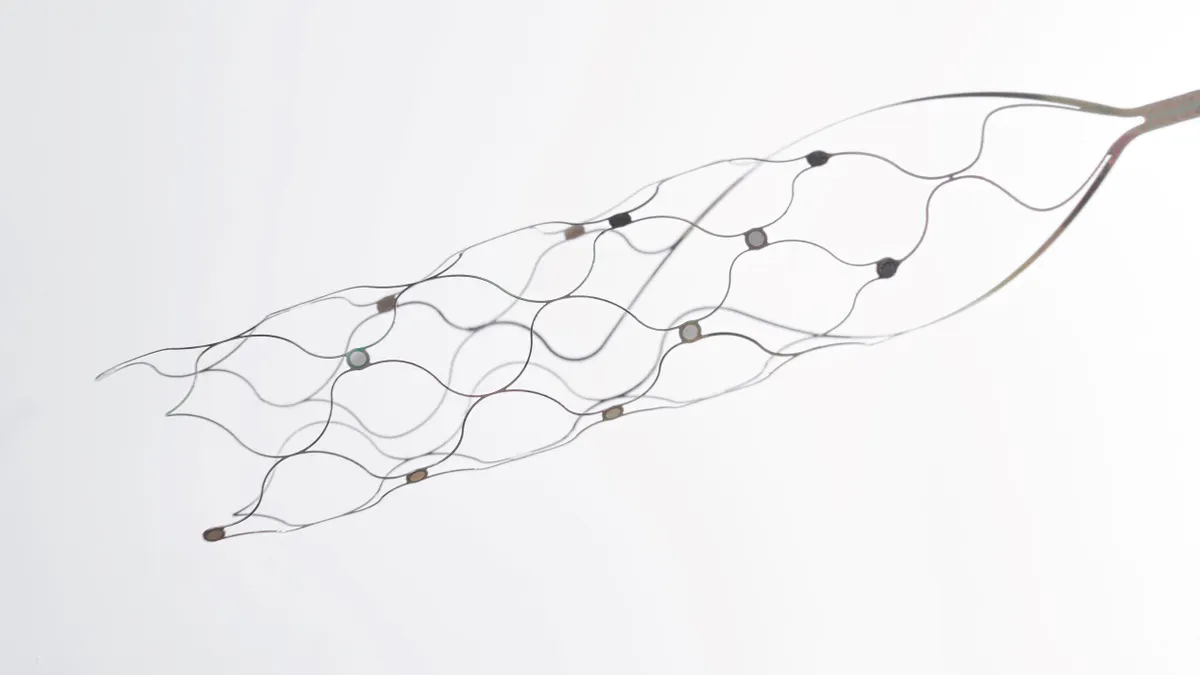

AIDs are made up of CGMs and insulin pumps that are connected through an algorithm to read a patient’s glucose levels and deliver insulin when needed. As CGM and pump technologies have evolved over time, adoption of the systems has become a larger factor in the space.

“The collective impact of an AID with their superior form factor and pharmacy market access should accelerate market conversion to insulin pumps generally, and their form factor in particular,” Kaczor wrote. “Dexcom and Insulet under one roof should accelerate the pace of product innovation, thus improving patient care more rapidly.”

Kaczor added that patients will continue to want options, such as Tandem’s tube pumps versus Insulet’s patch pumps.

“Patients will ultimately pick the best insulin delivery method combination for their needs, and there will remain many patients that will continue to want other form factors, including tube pumps and even injections,” Kaczor wrote. As such, Dexcom will remain incentivized “to continue to innovate on its sensor on its own and make it available to as many market participants as wanted.”

The J.P. Morgan analysts outlined the potential benefits of a Dexcom acquisition of Insulet despite a list of concerns, writing that the scale will help both companies and a combined company “would overnight become the premier diabetes treatment company.”

Still, there are concerns as to how Dexcom would finance an acquisition of Insulet.

Mathew Blackman, a Stifel analyst, wrote in a Monday note that “even at the current depressed [Insulet] $14B valuation” Dexcom would have to “raise a significant amount of capital … in a highly uncertain capital market backdrop” as the company has about $2.7 billion of cash on its balance sheet.

“These are both really well-run, high growth companies that have been very consistent performers. So, from that angle, they make sense,” BTIG’s Thibault said. “But again, overall, we don't quite understand the immediate strategic combination if it were to take place."