UPDATE: May 31, 2022: Dexcom said on Tuesday that it isn't in “active discussions regarding a merger transaction at this time,” following a report that the company was looking to acquire Insulet.

Bloomberg News, citing unidentified people familiar with the matter, reported last week that Dexcom, which makes continuous glucose monitors, was in talks to acquire Insulet, an insulin pump manufacturer. The reported deal would have combined the two diabetes technology leaders, putting both CGMs and insulin pumps under one roof.

Dexcom, which had not yet publicly commented on the deal, denied that such a deal was in the works on Tuesday.

“Like many companies, Dexcom’s Board and management team regularly review opportunities to enhance stockholder value and create benefits for customers, including through mergers and acquisitions. It is generally our policy not to comment on rumors or speculation, however, in light of recent sustained media and market speculation as well as the upcoming American Diabetes Association conference, we wish to confirm that Dexcom is not in active discussions regarding a merger transaction at this time,” the company said in a statement. “We do not intend to comment further on this topic and we assume no obligation to make any further announcement or disclosure should circumstances change.”

The company didn't mention Insulet by name in the statement.

Analysts from BTIG and J.P. Morgan were skeptical about a potential combination as Dexcom had previously not shown interest in expanding to insulin pumps. CEO Kevin Sayer said in an interview last year that the company was not looking to buy a pump of its own.

Insulet’s shares fell 10% in early trading on Tuesday, while Dexcom’s stock gained 7%.

Dive Brief:

- Dexcom is in talks to acquire Insulet in a deal that would combine two leaders of the diabetes technology market, Bloomberg reported Monday, citing unidentified people familiar with the matter. Spokespersons at Dexcom and Insulet declined to comment on the report when reached by MedTech Dive.

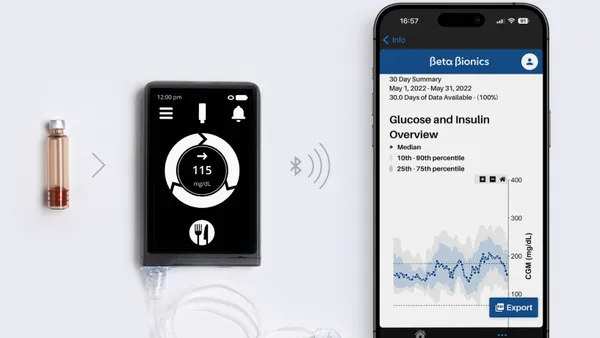

- The transaction would allow the combined company to offer both Dexcom’s continuous glucose monitors and Insulet’s insulin pumps at a time when the market is moving to an insulin delivery system that uses both devices. The companies currently have a partnership to integrate their devices, and the Food and Drug Administration has cleared devices that can work together.

- The deal could be completed in the coming weeks, according to the Bloomberg report. Still, the acquisition could be delayed or not materialize, it added. No potential acquisition price was reported. Insulet’s stock price climbed 5% in early trading on Tuesday, while Dexcom shares fell by 9.2%.

Dive Insight:

The report comes as the CGM market and the insulin pump market are moving closer together through automated insulin delivery systems. The systems allow CGMs to communicate with insulin pumps about a patient's glucose levels and automatically provide insulin when needed.

The combined company would join Medtronic as a competitor in the diabetes tech space that offers both CGMs and insulin pumps. However, by acquiring Insulet, Dexcom may limit its reach as the company's CGMs today can be used with both Insulet and Tandem Diabetes Care products.

The report also comes as Dexcom and Insulet are launching the newest versions of their respective devices. Dexcom received a CE mark for its G7 CGM system in March and is awaiting a decision from the FDA for a U.S. launch. Insulet received clearance from the FDA for its Omnipod 5 pump in January and is awaiting a decision for its CE mark.

Both companies expected regulatory decisions and subsequent launches in 2021. Still, delays forced the companies to push back launches throughout last year and into 2022.

At the same time, Insulet CEO Shacey Petrovic announced on May 5 that she would be stepping down at the end of the month.

Last year, Dexcom CEO Kevin Sayer told MedTech Dive the company will evaluate business opportunities but brushed aside the idea of buying an insulin pump of its own.

J.P. Morgan analysts wrote in a Monday note that they are “very skeptical” that the deal would happen for several reasons, including a history of Dexcom not showing interest in entering the pump market and potential anti-competitive issues.

William Blair analysts in a Tuesday note wrote that they believe the acquisition “would be a compelling new opportunity for DexCom and likely would not slow the company’s growth as the Street may initially believe."

This article was updated to include a statement from Dexcom.