Dexcom is launching a registry to track user outcomes in U.S. hospitals where its and rival Abbott's continuous glucose monitors have been allowed for the first time during the COVID-19 pandemic.

While diabetes tech companies have eyed hospital use as a new indication for FDA to approve, the onset of the public health emergency has sped up that goal.

The agency outlined a special enforcement policy this spring temporarily allowing the devices in hospitals to cut down on finger-sticking interactions between healthcare providers and patients in an effort to reduce the risk of virus transmission.

"In our discussions with the FDA, it became clear that leveraging this opportunity to generate real-world evidence was something that was supported," Matt Dolan, head of new markets at Dexcom, said in an interview.

The goal is "a permanent solution that's approved and able to fully launch into the hospital setting,"

Dolan added that a number of sites where the CGMs are now being used are conducting their own independent studies.

While he acknowledges that it won't be an "overnight" approval, Dolan contends COVID-19 "opens the door to potentially accelerate that path simply because we can get a very quick understanding as to whether the sensor is working, it's delivering, and most importantly, it's not creating any incremental risk."

As for Abbott, the medtech has distributed its FreeStyle Libre devices to hospitals in recent months under the special COVID-19 policy, but it didn't share updates on how it might be gathering data on this front or considering a permanent indication when asked for comment.

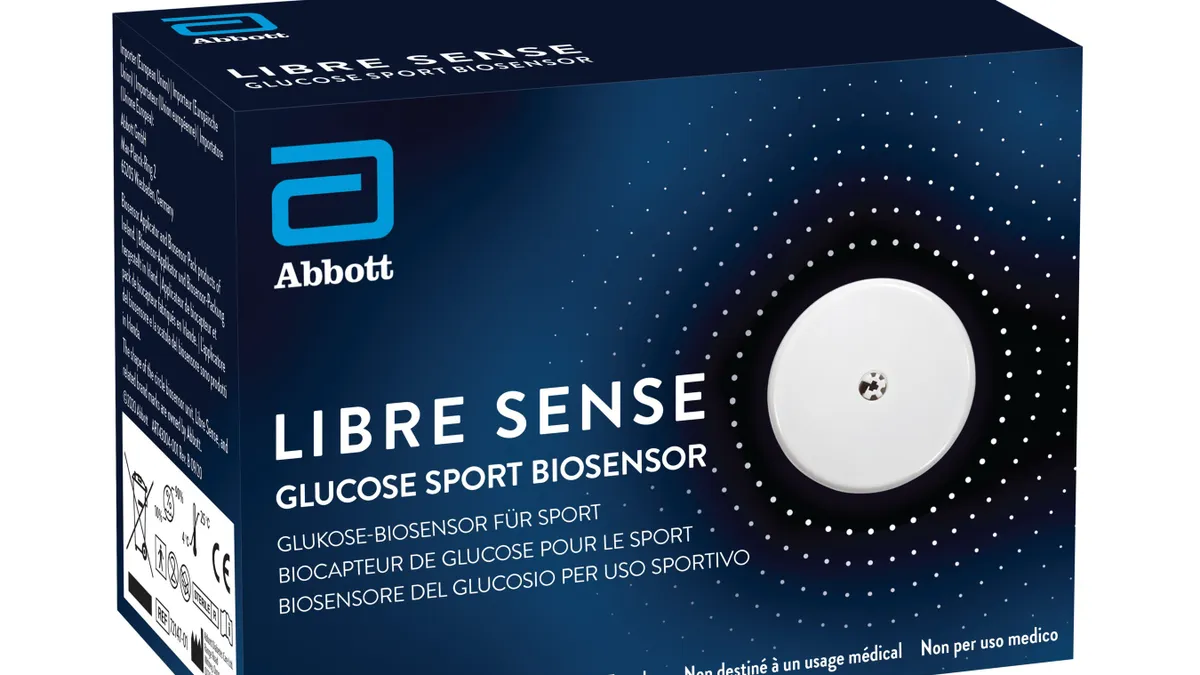

The company did, however, disclose Thursday a CE mark and said it will launch a version of its continuous glucose monitoring technology specifically for athletic use.

The move makes tangible previous comments from Abbott and Dexcom alike that their booming glucose monitoring technologies can be adapted for applications to a more general population.

The device, dubbed the Libre Sense Glucose Sport Biosensor System, is based on the same wired enzyme technology as the existing FreeStyle Libre products for people with diabetes, but the designs differ. The glucose range for the new biosensor product — which is explicitly not intended for use in the diagnosis, treatment or monitoring of disease — is 55-200 mg/dL, to FreeStyle Libre's 40-500 mg/dL.

Goldman Sachs analysts believe the near-term prospects may be muted, but that the medium- to long-term opportunity could be material, particularly if Abbott adds other analytes for monitoring such as ketones and lactate. The analysts noted that at 130 euros per month for two sensors, the new product costs a little more than what a person with diabetes may pay for FreeStyle Libre 2 without insurance.

"This will undoubtedly take time to market and ramp, and we are still very uncertain how many athletes or other non-diabetics would pay this high of a monthly fee for CGM readings, but we think it could be in the hundreds of thousands of people a bit longer term," the analysts said in a note to investors Thursday, estimating that every 100,000 individuals would add $150 million to $175 million in annual revenue for Abbott.

When asked about potential U.S. commercialization, an Abbott spokesperson simply said the company "aims to make the product available in other markets, pending local regulatory approval," but details on launch timing are not yet available. Goldman Sachs analysts noted that U.S. authorization "could be much more complicated as FDA has stricter regulations for marketing of continuous blood glucose monitoring products."

Senseonics makes its case for implantable CGM

The new market updates came the same week much smaller implantable CGM maker Senseonics offered new details on a commercial partnership with global distributor Ascensia announced in August, as Senseonics was on the brink of running out of cash.

Together, the companies are targeting annual sales for the joint effort to reach $150 million to $200 million come 2025, per a presentation Tuesday, compared to last year's total revenue of $21.3 million. Senseonics' Eversense product currently has a 90-day sensor, but the company is planning an imminent 180-day product application to FDA with hopes of a U.S. launch in the second quarter of 2021. The company is aiming to launch a 365-day version in 2024.

Stifel analyst Mathew Blackman noted blood glucose monitoring-focused Ascensia does have real skin in the game in wanting to latch itself onto a successful CGM product "given ongoing CGM cannibalization of the global BGM market."

Other analysts had mixed attitudes on how patient demand could, or could not, materialize. While Craig Hallum analyst Alex Nowak agreed that Ascensia is "the right partner" for Senseonics, "the real question is consumer appetite for a long-term implantable sensor," noting that liquidity will be a problem if demand does not ramp.