Dive Brief:

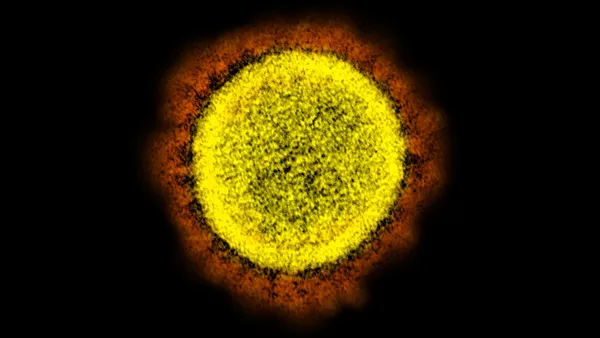

- The delta variant's impact on hospitals that began to emerge mid-July is expected to peak late in the third quarter or early in the fourth, according to a new survey of 40 hospital CEOs and CFOs conducted by Jefferies.

- Elective and non-emergent volumes were tracking down by about 30% in early September, leading Jefferies to expect a net 15% to 20% decline into the year's end.

- As a result, the investment bank lowered third quarter outlook for medical device companies with revenues heavily tethered to surgical volumes, including Boston Scientific, Medtronic and Stryker, to account for the headwinds.

Dive Insight:

Though COVID-19 cases are trending a bit down, the pressure on hospitals that kicked in mid-July as cases rose due to the highly infectious delta variant has extended into September and is unlikely to go away for a while, Jefferies analysts said.

Elevated delta case counts across the U.S., combined with executives' input, led the investment bank to forecast downside pressure for many medical device companies in the second half of 2021. As a result, Jefferies lowered its third quarter outlook for medtechs with high surgical exposure, including Abbott Laboratories, Abiomed, Boston Scientific, Medtronic, Stryker and Zimmer Biomet, to account for at least two months of lower procedure volumes.

Spine tech company NuVasive on Monday in an SEC 8-K filing said that preliminary third quarter sales are expected to be below second quarter results and consensus due primarily to delta variant surges. SVB Leerink analysts noted that NuVasive's update "adds to a growing list of incrementally cautious (3Q) commentary expressed by other MedTech mgmt. teams in recent weeks." The analysts expect other electives-sensitive medtechs and orthopaedics companies "will continue to come under pressure as a result."

Hospitalizations have increased 1% over the last two weeks, per a New York Times tracker, and the U.S. is averaging roughly 1,500 deaths a day, for the first time since March. Some coronavirus hotspots are reporting extremely stressed hospital capacity, with Idaho hospitals this week beginning to ration medical care amid skyrocketing COVID-19 cases.

Utah-based Intermountain Healthcare announced on Friday that it is postponing all non-urgent surgeries and procedures requiring a hospital admission or postoperative inpatient monitoring in the health system's trauma and community hospitals. The postponement starts on Wednesday and will last for several weeks as Intermountain continues to evaluate the situation.

"COVID-19 cases have continued to significantly increase in Utah — resulting in consistently high volumes in hospital ICUs and acute care units across our system. Our teams are overwhelmed and we’re running out of staffed beds for patients," Intermountain's announcement said.

According to HHS, more than 80% of ICU beds in the country are currently in use, with seven states — Alabama, Arkansas, Florida, Georgia, Kentucky, Mississippi and Texas — reporting 90% or more of their ICU beds are filled.

Many expected hospitalizations to drop this summer following the vaccine rollout. But inoculation rates have lagged, and the holdouts are fueling current COVID-19 outbreaks, leading President Joe Biden to announce plans Thursday to require employers with 100 or more workers to mandate COVID shots.

The findings from Jefferies' new survey of 40 C-suite execs jibes with the investment bank's hospital tracker, which continues to indicate volumes have reverted to about 15% to 20% below pre-COVID-19 levels.

Nearly 60% of respondents reported seeing up to 30% declines in elective procedures coinciding with elevated delta variant cases through early September, in line with warnings from other healthcare companies finding a rise in hospitalizations offset by contracting outpatient and non-COVID-19 volume.

Hospital leaders expect those headwinds to persist into the late third quarter and early fourth, Jefferies found, with majority of execs surveyed saying they think delta cases will peak in that timeframe.

The consensus is that elective procedures will decline between 17% and 28% through the end of 2021, Jefferies said, with those headwinds partially offset by the continued return of care that was delayed earlier in the pandemic.

Roughly half of executives said they expect to recapture the full volume of delayed care by year's end, while the other half expect those tailwinds to extend into 2022.

Jefferies analysts noted they expect hospitals to begin recapturing those volumes in the fourth quarter, depending on timing for the U.S. delta peak.