Boston Scientific CEO Mike Mahoney told investors Wednesday the company expects an impact of about $200 million this year due to the Trump administration’s tariff policies, becoming the latest medtech company to forecast an impact of hundreds of millions of dollars.

However, Boston Scientific, like others that have reported, still expects to perform well in 2025. Mahoney said Boston Scientific is “very bullish” on the year, and the firm raised its 2025 guidance from a growth range of 12.5%-14.5% on a reported basis to 15%-17%, even with the $200 million charge.

“Our ability to absorb the tariffs, I think, is more unique than most companies, given the strength of growth and the leverage that we're driving to absorb the $200 million, which is unfortunate,” Mahoney said during an earnings call. “But we're able to absorb it and still deliver a very high performance.”

CFO Dan Brennan said the impact should mostly occur in the second half of the year, leaving the second quarter relatively undisturbed. According to the company, the largest component of the $200 million is the U.S.-China back-and-forth.

Brennan, who announced his retirement Wednesday morning before the earnings call, said the company expects to fully offset the cost through sales growth and strategies like reducing discretionary spending.

Boston Scientific is the latest medtech company to forecast a meaningful effect from the White House’s aggressive tariff policies. Johnson & Johnson told investors last week that it expects a $400 million charge from tariffs; Abbott CEO Robert Ford said the company plans for an impact of a “few hundred million dollars”; and Danahar CEO Rainer Blaine predicted an approximately $350 million tariff hit, though he added that the current state may ultimately change.

Despite the tariff pressures, Johnson & Johnson raised its guidance and Abbott maintained its guidance.

Boston Scientific still expects a double-digit sales increase in China even with the tariffs and other ongoing economic challenges, such as value based purchasing, which medtech companies had to manage throughout last year.

Mahoney said China “represents 7 or 8% of our sales, approximately. And the team there, despite challenges, does a great job.”

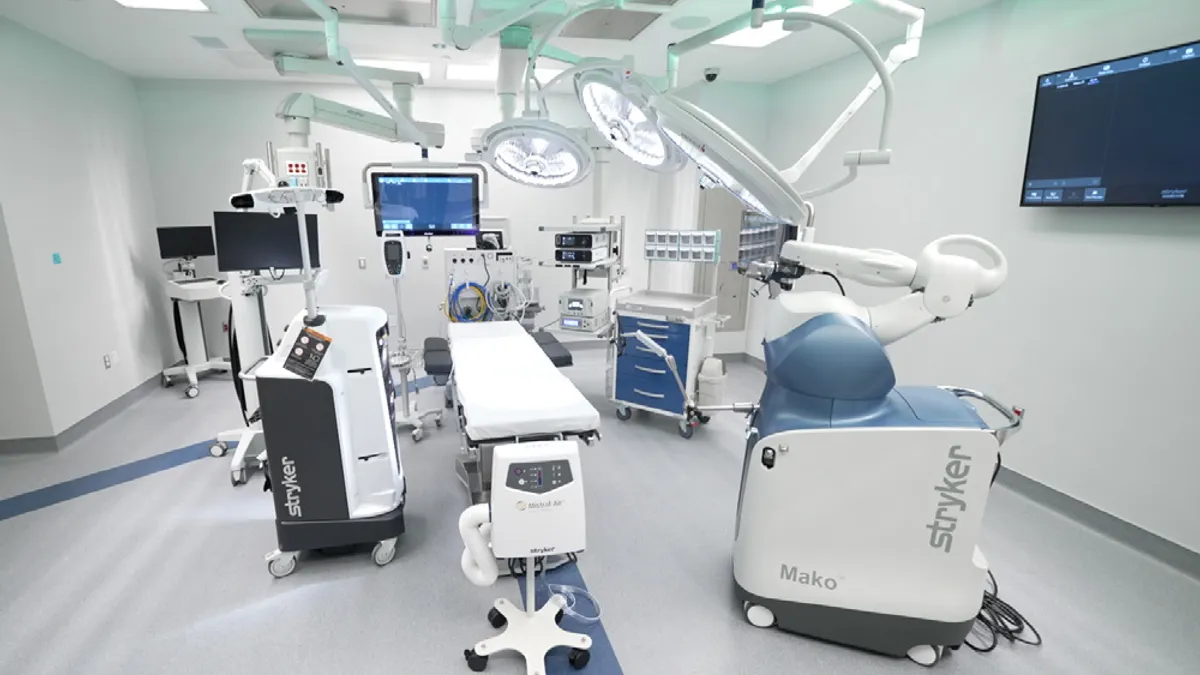

The company doesn’t plan any major manufacturing changes to navigate global tariffs “other than continuing investment to support the long-term growth of the company,” Mahoney explained. Boston Scientific recently opened a new site in Georgia and increased its capacity and footprint at a Minnesota facility. The company has also made manufacturing investments in Malaysia.

“Our manufacturing footprint makes the most sense for the long term,” the CEO added, “and we'll continue to invest in that to grow.”

In the first quarter, the company reported $4.66 billion in revenue, representing year-over-year growth of nearly 21%. The Farapulse pulsed field ablation device once again drove triple-digit sales growth for the electrophysiology unit. As the PFA market is still new, Boston Scientific’s success in it will likely continue.