Boston Scientific on Wednesday said it received U.S. regulatory backing for its Farapulse pulsed field ablation system (PFA), a new treatment for atrial fibrillation (AFib) that physicians expect to be widely adopted.

The approval, disclosed in conjunction with the company’s fourth-quarter earnings release, comes on the heels of Medtronic’s PFA approval in December and sets up a competitive race in a fast-growth segment of the large heart rhythm device market.

“The PFA category has garnered a lot of attention and for good reason, looking to address the needs of patients with atrial fibrillation in a better, faster, safer methodology,” Citi Research analyst Joanne Wuensch said in a note to clients after the announcement.

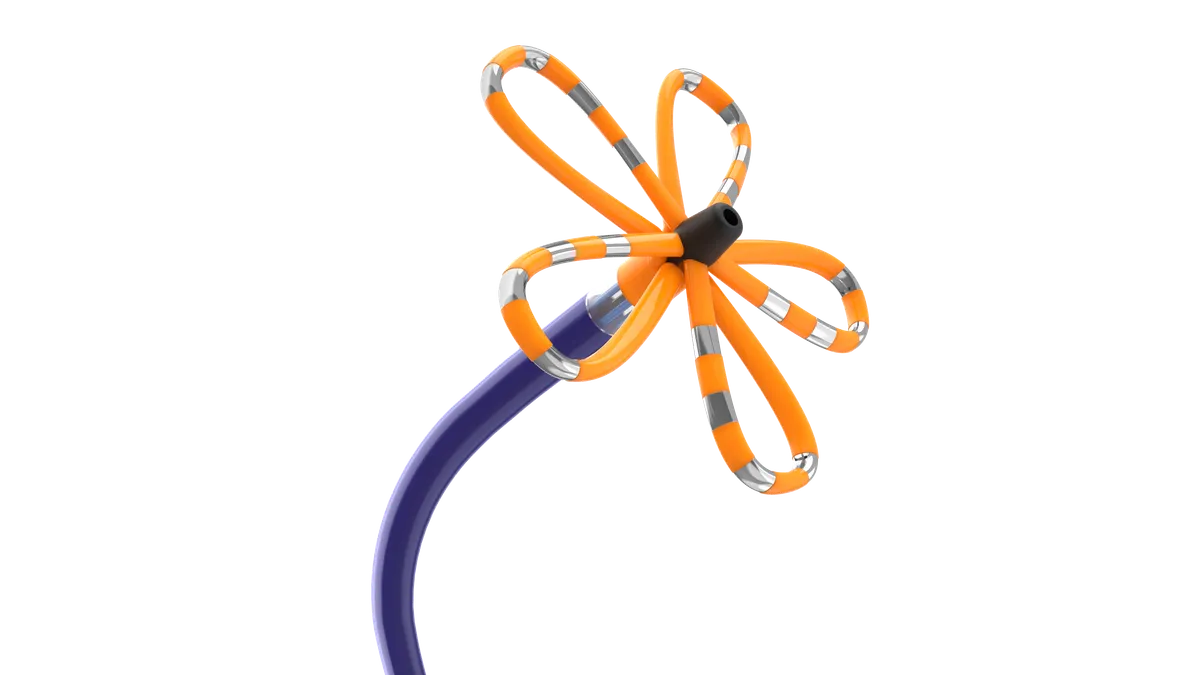

PFA is a catheter-based approach to treat AFib that uses short high-voltage pulses to target cardiac tissue. Other cardiac ablation techniques use either heat or extreme cold to create small scars to block AFib’s irregular heartbeats.

Following a successful launch of the new device in Europe, where more than 40,000 patients have been treated with the device, the company anticipates a big shift to the technology, company executives said.

The device maker earlier this month moved up its expected timeline for gaining the go-ahead from U.S. regulators. The “rapid” approval from the Food and Drug Administration, for patients with intermittent AFib, was based on the strength of its clinical data, according to Kenneth Stein, Boston Scientific’s chief medical officer.

“We are thrilled to enter the U.S. market immediately,” CEO Mike Mahoney said on the call.

Boston Scientific said it has also started enrolling patients in a clinical trial to compare Farapulse to drug therapy in people with persistent AFib.

TAVR setback

However, another key product in the pipeline has now been delayed. Mahoney said the company no longer expects approval of its Acurate Prime transcatheter aortic valve replacement (TAVR) device in the U.S. in 2024.

After reviewing an interim analysis of U.S. data for the device, the company will now await full one-year data, expected near the end of 2024, to decide on its regulatory strategy, Mahoney said. The company said it cannot disclose study data because the trial is still active.

The development comes despite double-digit growth in the structural heart business that was led by the performance of the Acurate Neo2 TAVR device in Europe, Mahoney said.

“We are disappointed that we didn't get Acurate over the goal line for approval in 2024,” he added.

Boston Scientific hopes to take on Edwards Lifesciences and Medtronic in the market for replacement devices for faulty aortic valves.

Watchman drives Q4

Strong sales of Boston Scientific’s market-leading left atrial appendage (LAA) closure platform, Watchman, boosted overall growth in the fourth quarter. The company is fully launching the latest version of the device, the Watchman FLX Pro, in the first quarter, Mahoney said.

The implant seals off the small pouch in the heart’s upper left chamber to prevent blood clots caused by AFib from entering the bloodstream.

Boston Scientific has predicted the LAA market could quadruple to more than $6 billion by 2030.

“There’s no shortage of potential catalysts to keep an eye on between today’s PFA approval, expected double-digit growth in Watchman (we think 20% plus), and continued strength across the breadth of the portfolio,” J.P. Morgan analyst Robbie Marcus said in a note to clients.