With financial backing from Bill Gates and Becton Dickinson, among others, robotics startup Vicarious Surgical has garnered attention from Wall Street as it looks to take on bigger, established players in the abdominal robotic surgery market.

Vicarious in April announced it has merged with a special purpose acquisition company, giving it a New York Stock Exchange listing and $425 million from investors. The funding will support development of an FDA breakthrough-designated robotic device meant to improve current approaches to abdominal surgical procedures by, among other features, enabling surgeons to access all of the cavity through a single 1.5 cm incision with 9 degrees of freedom per arm and 360-degree visualization.

CEO Adam Sachs, who co-founded the company seven years ago, told MedTech Dive he wants to improve both the cost and efficiency of abdominal procedures as well as patient outcomes.

Sachs contends legacy robotic platforms were introduced with a promise of solving the challenges of open surgery. However, after more than two decades on the market, the CEO contends these surgical robots have fallen short due to prohibitive costs of adoption, limited mobility and capabilities in the body and required space, as well as set up time and lengthy training.

Vicarious is aiming to make a 510(k) submission in 2023 and grow sales to $1 billion by 2027 but will face strong competition from medtech giants such as Intuitive Surgical, Johnson & Johnson and Medtronic.

This interview has been lightly edited for clarity and brevity.

MEDTECH DIVE: What are the current challenges with abdominal surgical procedures?

ADAM SACHS: You have open procedures, which for abdominal procedures has a 20% incision complication rate. You have laparoscopic procedures, which are incredibly difficult to perform really because of the motion and the way that the system pivots about the abdominal wall. And, that's still true for legacy multi-port surgical robots, where the surgeon essentially needs to define the motion profile of the robot for every procedure. That's why we see such disparity between people who perform a thousand procedures with a legacy surgical robot and a hundred procedures, which is a huge barrier to entry.

You also have single-port surgical robots. The existing ones have all been designed around flexible robotics, which have incredible limitations. Existing single-port systems are 25 cm or greater resulting in complication rates from incision of at least about 8%. And, they're incredibly limiting in their motion degrees of freedom and force capabilities. All of this has left [surgeons] doing over 50% open surgery and only about 3% robotic surgery.

How is Vicarious Surgical looking to improve abdominal robotic surgery?

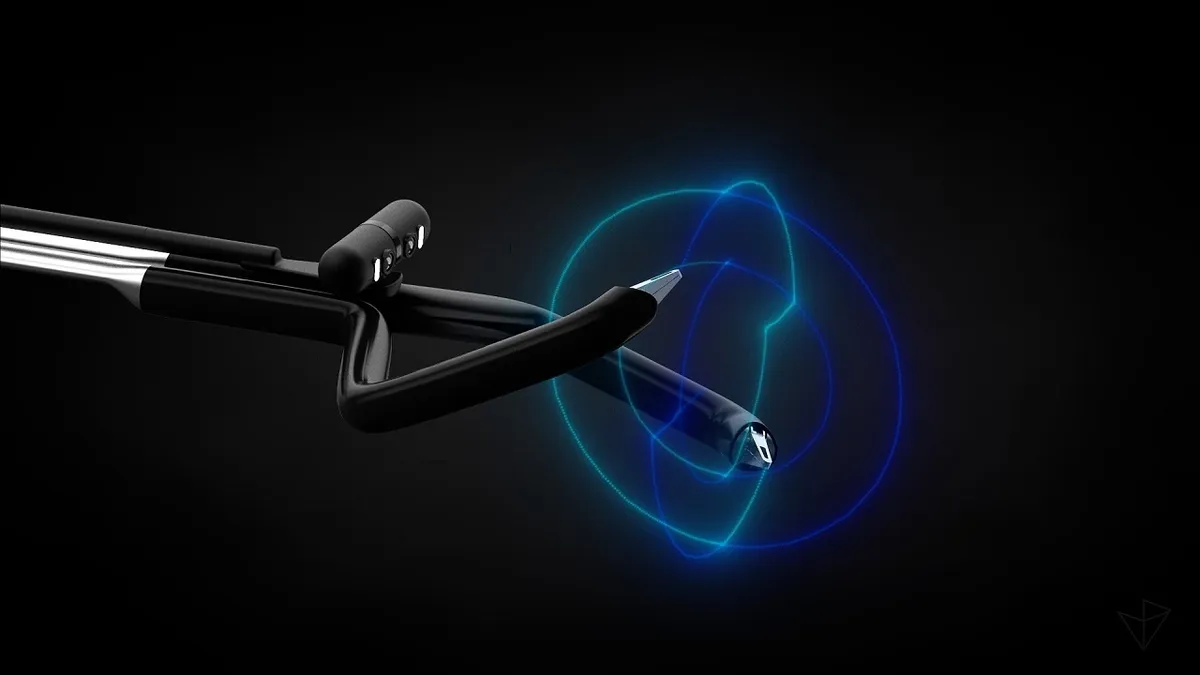

SACHS: We've completely reinvented the way actuators themselves work. It's something that we call a decoupled actuator. What that allows us to do is essentially to have many more joints in motion all inside of the abdomen with incredible force capabilities and all through a 1.5 cm incision. So, we have two arms and a camera. The arms have the same joints as the surgeon's body. The camera pans and tilts following the motion of the surgeon's head.

How do you hope to differentiate your company from competitors and capture market share from behemoths like Intuitive, J&J and Medtronic?

SACHS: We really believe that the fundamental architecture of multi-port surgical robots is what's limited their adoption. When you think about the way that motion works, you have a "wrist on the end of stick" with a legacy system and then most of the motion is essentially generated by the surgeon by pivoting, inserting in and out, and turning within the trocar. That means the surgeon literally defines that kinematic profile of the robot so that it is a different surgical robot for every procedure, depending on where the surgeon makes the incision. From extensive market research, we know that's the thing that leads to it being so challenging for surgeons to perform and learn robotic procedures resulting in procedural times that are much longer and frankly outcomes that are pretty similar.

With our technology, the surgeon can learn what we're doing easily. You just put one incision anywhere in the abdomen and then the robot just works the same way that it's worked every time they've practiced, regardless of where they want to operate. We've proven out our ability to do advanced abdominal wall reconstruction in a fraction of the amount of time and have actually been able to fit multiple additional procedures per day in time testing that we've done.

A recent meta-analysis comparing robot-assisted abdominal pelvic surgery with laparoscopy, open surgery, or both, found that robotic platforms are costly and result in longer operative duration than laparoscopy, but with no obvious difference versus open surgery in terms of the quality of evidence and outcomes. How does Vicarious hope to address the cost issue?

SACHS: All of these are limitations of the existing robotic procedures. That's why we're focused on procedures that have extremely low laparoscopic adoption and are performed with mostly open technique today, where the benefit is pretty obvious. It's all about what you compare it to. [Intuitive's] main technology is like many other legacy systems ... a multi-port system that essentially has these "wrists on a stick."

We targeted a huge reduction in cost of goods. Our cost is 5x to 10x lower and that's literally comparing our cost today in low volume to their cost in production. That really comes from the fact that ours is a much smaller, much simpler device that is less complex than four gigantic robotic arms.

We'll be rolling out a variety of procedures over the course of a few years. We're starting with hernia repairs, then moving to gynecology, biliary procedures. We will be targeting most abdominal procedures, focused primarily and initially on the markets where legacy surgical robots have had very little penetration and where open surgery is actually the dominant way of performing procedures.

It's a huge market and it's mostly performed with open techniques today or laparoscopy. Only 3% of addressable abdominal procedures are performed with robotic techniques worldwide. We have some pretty amazing cost of goods advantages that enable significant price advantages. When we initially launch, our average selling price will be $1.2 million including discounts.