Apple, Medtronic, Edwards Lifesciences, Abbott and Philips are among the companies looking to spotlight their technologies targeting patients with atrial fibrillation, heart failure, coronary artery disease and the like at the American College of Cardiology's 2019 annual meeting, which kicks off Saturday and continues through Monday.

MedTech Dive will report the results in coming days, but in the meantime here's some of what's piquing medtech's interest:

Apple

Arguably the most anticipated results coming out of the heart meeting will be Saturday's presentation of the landmark Apple Heart Study, including a subset of its data supporting an FDA De Novo clearance of its irregular rhythm notification feature on Apple Watch last September.

The study of more than 400,000 people aims to determine whether heart pulse-rate data can screen for the risk of atrial fibrillation. The heart condition can indicate an increased risk for heart failure or stroke; about 130,000 deaths are attributed to atrial fibrillation per year, according to the Centers for Disease Control and Prevention.

Physicians will be keenly looking at the quality of the data generated by the irregular rhythm feature. If the incidence of false positives is too high, unneeded procedures and false negatives are a risk, according to FDA's clearance letter.

In December, Apple rolled out the irregular heart rhythm notification feature on Apple Watches with watchOS 5.1.2. The company makes users go through a setup detailing "what the features can and cannot do." But some worry the benefits and risks of screening a broad population are not yet well understood.

TAVR

Transcatheter aortic valve replacement (TAVR) remains a strong avenue for potential growth among structural heart competitors as the minimally invasive procedure gains market share against more traditional surgical aortic valve replacement (SAVR). Edwards Lifesciences, which initiated the U.S. market in 2011 with FDA approval of its first generation Sapien device, has placed the global TAVR market at $7 billion by 2024.

While the technology was originally viewed as an option for patients with risk factors too significant to allow for open heart surgery, that bar has since been lowered to patients qualified as having intermediate risk. Medtechs are pushing adoption to go even further, with TAVR discussions at ACC this year set to center around use of the technology in low-risk patients. U.S. TAVR market rivals Edwards and Medtronic, whose CoreValve system gained FDA approval in 2014, will look to present compelling evidence Sunday from their Evolut and Partner 3 trials, respectively.

For Medtronic, the low-risk patient study comes in contrast to its TAVR presentation at ACC18, which looked at results in "extreme risk" patients five years after CoreValve implantation.

Aside from TAVR, Medtronic's other key late breaking study this year looks at its Tyrx absorbable antibacterial envelope, which aims to reduce infections caused by implanted devices like pacemakers.

In the weeks leading up to the conference, analysts at Jefferies said the data drop has the potential to "usher in the low risk era for TAVR." Among 25 TAVR clinicians polled by the analysts, 58% indicated they believe low-risk cases will be directed to TAVR if the studies presented this weekend demonstrate equivalence to SAVR. That figure jumps to 74% in the event that TAVR outcomes show superiority.

"Equivalence in low risk will lead to significant adoption," the analysts wrote. "A minimally invasive procedure will win over an invasive one when all else is equal."

Edwards has been bullish on the implications of its Partner 3 results, with executives last year predicting a widened U.S. indication for Sapien 3 likely to gain approval in late 2019. The next step will be completing enrollment of a pre-symptomatic patient study in 2020 as the company looks to grow the market size once again.

While potential competitors Boston Scientific and Abbott have lagged in bringing their Lotus and Portico models to the U.S. market, wider support of TAVR by cardiologists and adoption by patients could also set the stage for deeper markets internationally.

MitraClip

Abbott's own TAVR system Portico is not a key player in this year's TAVR buzz, but the company's mitral regurgitation device may get renewed attention with FDA having approved expanded indication of MitraClip just days before Abbott is set to present on aspects of its COAPT trial, formally published in the New England Journal of Medicine in December.

The COAPT evidence has been well received by FDA, with the agency announcing Thursday that MitraClip, first approved in 2013 to reduce mitral regurgitation in patients whose mitral valve abnormalities prohibit direct surgery, is now indicated for patients with normal mitral valves whose heart failure symptoms and mitral regurgitation is brought on by diminished left heart function, and who have already proven not to have responded effectively to combinations of heart failure medications, certain therapies or cardioverter defibrillator implants. FDA cleared the most recent, third-generation version of the device in July.

The 614 patient trial included patients in this secondary category, with investigators comparing outcomes in recipients of MitraClip and optimized medication-based treatment to those without the device. Results indicated a 47% decrease in risk of rehospitalization due to heart failure symptoms in patients with MitraClip, who also saw a 37% decrease in risk of death within two years.

Though MitraClip data have been out for some time, Jefferies analyst Raj Denhoy told MedTech Dive the presentations Sunday will still be important to maintain momentum and excitement around the product's growth. Along with the FreeStyle Libre continuous glucose monitor, MitraClip has been called out by Moody's and others in recent months as one of the most meaningful growth drivers to watch for Abbott and within the medtech industry this year.

Separately, Abbott is presenting a final analysis of patient outcomes with its HeartMate 3 left ventricular assist device (LVAD), an update to two-year data from the Momentum 3 trial data it presented at last year's ACC meeting. The pitch for HeartMate 3 comes as LVAD competitor Boston Scientific initiates a limited European launch of its now CE-marked most recent version of Watchman, which the company announced this week.

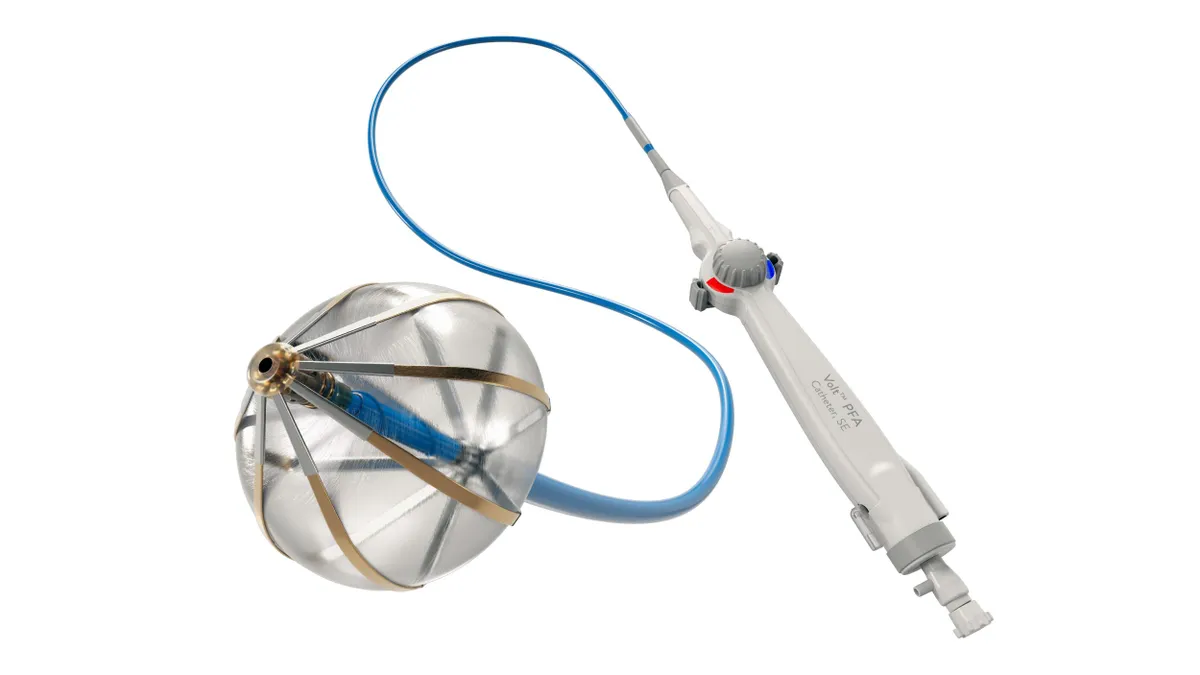

Boston Scientific will not be at the center of attention at ACC this weekend, instead focusing on the European Heart Rhythm Association 2019 Congress, where it will present its first-ever data on a radiofrequency balloon catheter system.

David Lim contributed reporting.