Dive Brief:

-

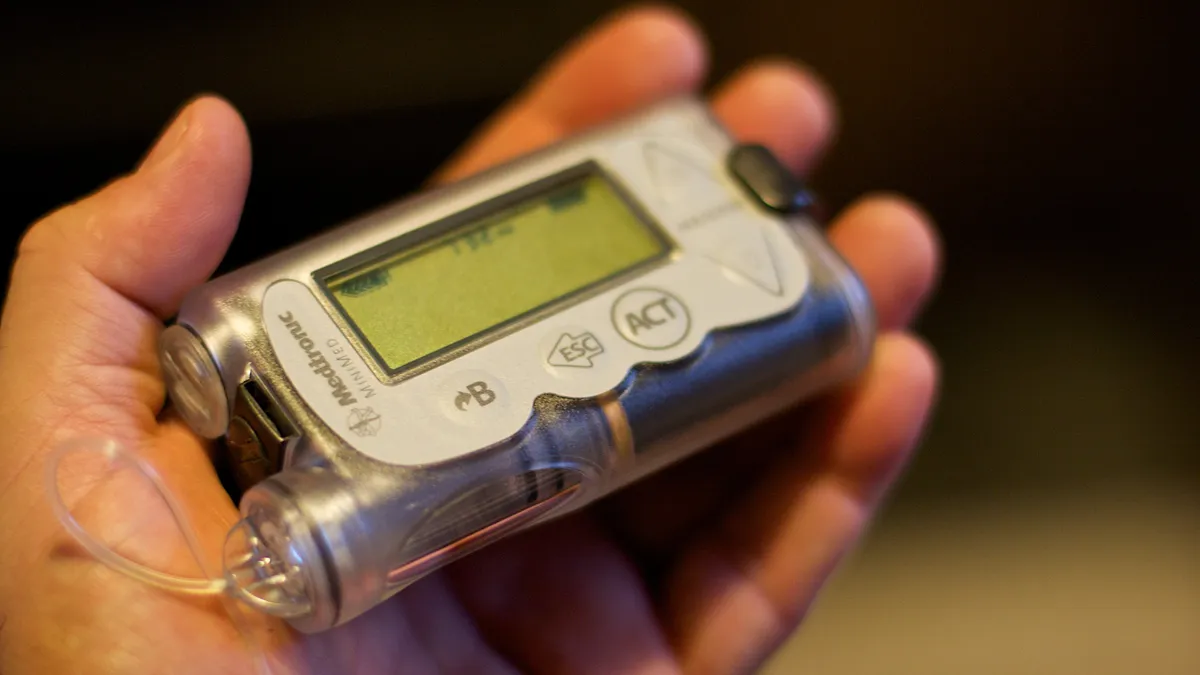

Analysts at Leerink predicted Medtronic will lose insulin pump market share to Insulet and Tandem Diabetes Care in a note to investors Thursday.

-

The outlook is based on a survey of healthcare professionals that also suggested that sales of all diabetes devices, including insulin pumps, are poised for strong double-digit growth.

-

Leerink released the analysis on the day that Medtronic revealed it has worked with IBM to predict the likelihood of low glucose events.

Dive Insight:

The insulin pump market is in a period of change. With established player Johnson & Johnson having announced an exit from the sector in 2017, former rivals with new devices are seeking to increase penetration. Observers expect both the Type 1 and Type 2 diabetes markets to grow. The big unknowns remain how quickly that growth will happen and which companies will benefit most.

To answer these questions, Leerink commissioned a survey of 101 endocrinologists and nurse practitioners in the U.S. who collectively treat 138,992 diabetics. The findings suggest the U.S. insulin pump market may be growing faster than most people realize.

Leerink predicted insulin pump penetration in the Type 1 and Type 2 diabetes markets to increase by around 2.5 percentage points in 2019. The survey suggests both markets will grow far faster than those forecasts, resulting in up to 65,000 more patients starting on pumps for the first time than Leerink originally anticipated.

The bullish forecast comes with the caveat that the results may be skewed by the fact the survey respondents are heavy pump prescribers. However, Leerink thinks its predictions that the insulin pump market will grow 15% in 2018 and 11% in 2019 may be conservative based on the survey.

Leerink's survey also proposed answers to the question of which companies will benefit from the growth of the market. While J&J offered the 90,000 patients on its pumps the chance to transfer to Medtronic devices when it pulled out of the market, Leerink thinks Insulet and Tandem are better placed to benefit from the expansion of the sector.

Based on the survey, Medtronic is forecasted to have gained market share from 2017 to 2018 on the grounds that it will ultimately capture 60% of J&J’s customers. However, the survey suggests Medtronic will cede ground to Insulet and Tandem from 2018 to 2019.

For now, Medtronic will remain the giant of insulin pump market with a forecasted 2019 share of 63.1%. That share figure is down 0.4 percentage points on the 2018 forecast, though, and Insulet and Tandem look to be growing fast in both types of diabetes.

The scale of Medtronic offers it some advantages over its rivals, as is demonstrated by news from another part of the medtech giant’s diabetes business.

Working with IBM Watson, Medtronic announced Thursday it analyzed its data to add a new feature to its Sugar.IQ diabetes app. The new feature, called IQcast, analyzes multiple signals to predict the likelihood of a person on multiple daily injections experiencing a low glucose event in the next one to four hours.