Dive Brief:

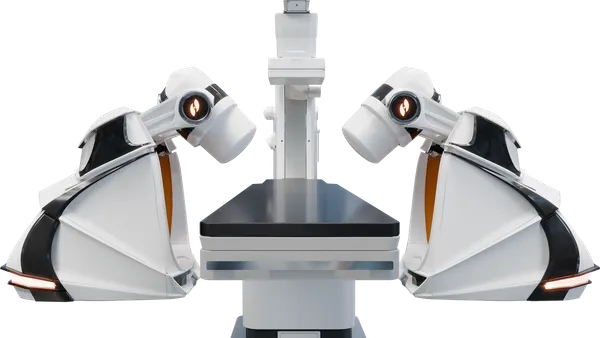

- After nearly a decade under the Novartis banner, Alcon began trading on Swiss markets Tuesday as an independent company specializing in eye care products like contact lenses and surgical equipment.

- Alcon's spin-out, which was the product of a strategic review Novartis began in 2017, marks a major step in Novartis CEO Vas Narasimhan's plans to focus the sprawling pharmaceutical giant more narrowly on higher-margin prescription medicines.

- Since Narasimhan became CEO, Novartis has reached deals to sell its stake in a consumer healthcare joint venture with GlaxoSmithKline and divest parts of its generic drug business in the U.S. In their place, Narasimhan has pushed Novartis more deeply into complex therapeutic areas, buying the gene therapy biotech AveXis for $8.7 billion and acquiring two companies working on radiopharmaceuticals.

Dive Insight:

Even as a standalone company, Alcon will rank as one of the largest eye care device makers globally, with more than 20,000 employees and sales totaling $7.1 billion last year.

Despite that financial heft, Novartis has eyed options for the unit since 2016, when it transferred ophthalmic pharmaceuticals previously held within Alcon to its Innovative Medicines division.

Weakening Alcon revenues at the time spurred Novartis to formally review a range of potential transactions including a sale, initial public offering or spin-out.

While unit sales have now grown for two consecutive years, Novartis views the spin-out as furthering its strategy of focusing on higher-margin pharmaceuticals.

Last year, core profit margins for Alcon's business came in at 18% — well below the 32% recorded for Novartis' pharmaceuticals division, as well as the 20% mark posted by the pharma's Sandoz unit.

"The spin-off gives Novartis a financial profile closer to its pharmaceutical industry peers, including higher group margins," the company said in an April 9 statement.

Novartis structured the spin-out as a dividend-in-kind distribution to its shareholders, giving out one Alcon share for every five Novartis shares or American depositary receipts held as of April 8, 2019.

As a result of the spin-out, shares in Novartis fell by more than 10% Tuesday on the New York Stock Exchange.

Alcon will trade on the SIX Swiss Exchange under the symbol "ALC" beginning April 9, its first day on public markets since former owner Nestle publicly listed 25% of the company in 2002.

Novartis later acquired a quarter of the company from Nestle, with an option to buy the remainder held by the foods company that it exercised in 2010.

With Alcon spun out, Novartis says it will be able to focus "capital allocation and management attention" on its medicines business.

Narasimhan has previously said the pharma plans to spend approximately 5% of its market capitalization, or about $10 billion, on acquisitions each year.

That has played out so far in the CEO's tenure, with deals for AveXis, Endocyte and CellforCure. All three deals are in more complex areas like cell and gene therapy and nuclear medicine — areas in which Narasimhan has appeared eager to invest.

While promising, those areas also come with higher risk and bring unique challenges that aren't present in eye care or generic drugs.

Novartis' streak of divestments has brought questions of the company's long-term plans for Sandoz. There, however, Narasimhan has said the unit remains "an integral part" of Novartis. Still, the drugmaker plans to change things up and recast Sandoz as an autonomous unit within Novartis over the next 18 months.

The Alcon spin-out won't take with it Novartis' ophthalmology pharmaceuticals, which includes Lucentis (ranibizumab) and an experimental medicine known as brolucizumab that the pharma expects will earn blockbuster sales.

In ophthalmology too, Novartis is looking to invest in gene therapy, inking a deal with Spark Therapeutics for European rights to its pioneering retinal dystrophy treatment Luxturna (voretigene neparvovec).

"Through our heritage in ophthalmology and our investment in accelerating gene therapy, Luxturna is bridging the gap between two very exciting areas of science that we believe is just the beginning of things to come in this space," wrote Nikos Tripodis, global head of Novartis' ophthalmology business, to BioPharma Dive.

Through its own research labs, Novartis is also advancing a gene replacement therapy for a type of retinitis pigmentosa.