UPDATE: Aug. 14, 2019: AtriCure announced Tuesday it completed its acquisition of SentreHeart.

Dive Brief:

- In a move to bolster its atrial fibrillation treatment portfolio, AtriCure plans to acquire Redwood City, California-based startup SentreHeart, the company said Monday.

- The deal includes an upfront payment of $40 million in cash and AtriCure common stock. An additional $140 million in milestone payments rides on SentreHeart's clinical trial and FDA premarket approval of a suture delivery device for left atrial appendage closure. The device is intended as an adjunctive treatment to pulmonary vein isolation catheter ablation for patients with persistent or longstanding persistent AFib. Likewise, a $120 million cash and stock payment is tied to reimbursement for therapy involving SentreHeart devices.

- AtriCure predicts its 2019 revenues will total between $224.5 million to $228.5 million, with minimal contribution from the SentreHeart deal. AtriCure said it expects the acquisition to close within the next several days; shareholder approval is not required.

Dive Insight:

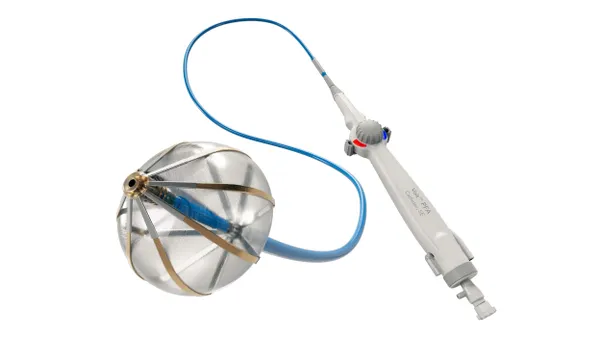

SentreHeart is at about 90% enrollment for the U.S. trial of its suture delivery device, called Lariat, and expects to complete enrollment across 65 sites in early 2020. The goal is to demonstrate the device reduces incidence of recurrent AFib compared to pulmonary vein isolation ablation alone. The anticipated 600 patients will be examined for freedom from AFib episodes longer than 30 seconds one year after treatment. Lariat received a CE mark in 2015.

FDA in 2011 granted AtriCure premarket approval for a cardiac tissue ablation system used to treat persistent or longstanding persistent atrial fibrillation in patients undergoing open concomitant coronary artery bypass grafting or valve replacement or repair. Persistent AFib is a form of the condition requiring medication or treatment to restore heart rhythm, while longstanding persistent AFib lasts more than 12 months.

The Mason, Ohio-based company also sells other pacing and sensing products, cryoablation probes, and soft tissue dissectors. The company claims its AtriClip left atrial appendage exclusion system is the most widely implanted device of its kind worldwide.

AtriCure is also awaiting results of an IDE clinical trial testing an approach to endocardial catheter ablation in the persistent and longstanding persistent AFib populations. In that approach, a surgeon performs closed-chest epicardial ablation followed by an electrophysiologist performing endocardial catheter ablation. The Convergent trial involves AtriCure's EPi-Sense coagulation device.

AtriCure recently reported second quarter worldwide revenues of about $59 million, or 13.7% year-over-year growth, led by stronger U.S. sales in its appendage management and open-heart ablation businesses, contrasting with a softer quarter for U.S. sales of minimally invasive ablation products. In a note following the second quarter earnings report, Needham analyst Mike Matson said the Convergent FDA approval will likely happen in late 2020, which could "materially accelerate" revenue growth.