Dive Brief:

-

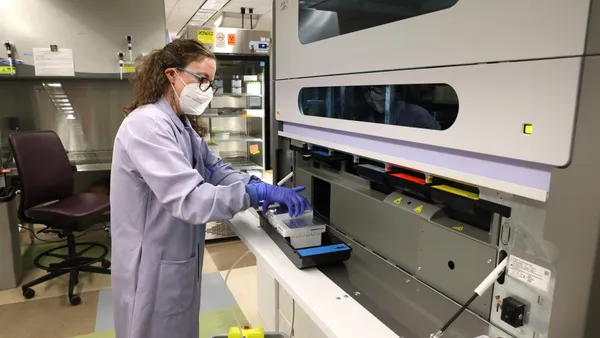

Medicare Administrative Contractor Palmetto GBA has expanded coverage of Adaptive Biotechnologies' clonoSEQ assay, the company said Wednesday.

-

The expanded policy covers use of the assay in the monitoring of minimal residual disease (MRD) in patients with chronic lymphocytic leukemia (CLL) on Medicare.

- Analysts at Cowen think the decision, which arrived earlier than expected, may help Adaptive beat the 62% increase in clonoSEQ sales they currently model for 2020.

Dive Insight:

Adaptive began 2019 by winning Palmetto coverage for the use of clonoSEQ in patients with multiple myeloma (MM) and B-cell acute lymphoblastic leukemia (ALL). That decision covered the use of the assay to look for evidence of MRD in bone marrow samples.

About a year later, Adaptive has secured another positive decision from Palmetto. The new decision expands coverage to CLL. As the Cowen analysts note, the decision is also broader than the existing ALL and MM coverage in some regards.

"Importantly, [Adaptive's] clonoSEQ assay will be covered by CMS in CLL patients for blood specimens. This is notable, considering ALL and MM clonoSEQ assays are only CMS reimbursable for bone marrow specimens," the analysts wrote. Adaptive wants to get clonoSEQ covered in ALL and MM for the analysis of blood specimens — the idea being using blood samples is easier for patients and cheaper for healthcare systems — but is yet to do so.

Adaptive faces some restrictions even after receiving the positive Palmetto decision, which is effective immediately. The company's sales representatives cannot actively market the test in CLL until FDA clears it for use in the indication, although they can note that the test is CMS covered.

The other restriction is that Adaptive cannot receive reimbursement in CLL until Noridian, another Medicare Administrative Contractor, expands its policy to cover the indication. The Cowen analysts expect Noridian to expand its coverage soon as it is often aligned with Palmetto.

How quickly the remaining pieces fall into place may affect Adaptive's prospects in 2020. The Cowen analysts previously predicted sales of clonoSEQ will increase by more than 60% to hit $11.7 million this year. However, the analysts now think that forecast may be conservative, in part because the Palmetto coverage decision arrived ahead of schedule.

In the longer term, Adaptive expects clonoSEQ sales to dwarf the figure predicted for 2020. Talking to investors on a conference call in November, Adaptive CEO Chad Robins called clonoSEQ "a massive opportunity."

"There are more than 600,000 patients in the United States who are newly diagnosed or are living with the types of blood cancers that can be monitored by clonoSEQ, representing a $1.2 billion U.S. opportunity. We are still in the very early stages of clonoSEQ clinical adoption and estimate that market penetration is in the low single digits," Robins said.