Dive Brief:

- Abbott said Thursday it won the first EU approval for a transcatheter mitral valve replacement device, expanding its potential addressable population of mitral regurgitation patients beyond candidates for valve repair with its blockbuster device MitraClip.

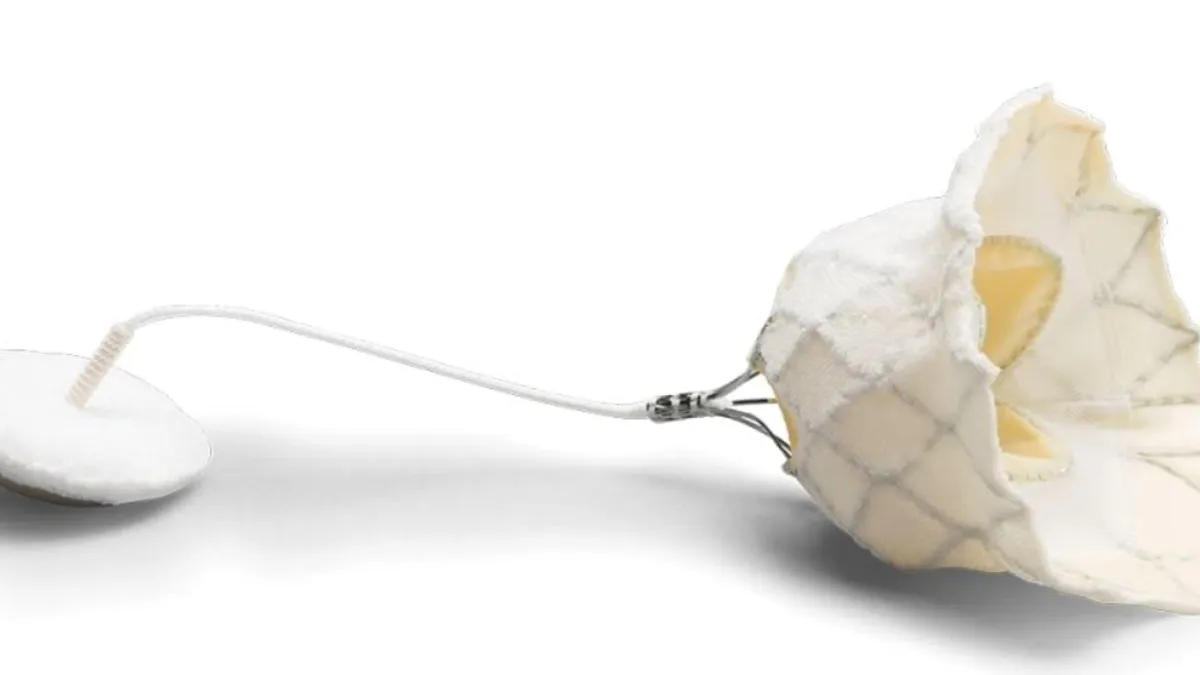

- Called Tendyne, the transcatheter mitral valve implantation system is intended for cases when a mitral valve is too damaged to undergo repair, or in patients at high risk for open heart surgery.

- Abbott plans to eventually submit Tendyne to the FDA and is currently enrolling U.S. clinical trials.

Dive Insight:

Abbott has made minimally invasive treatment of mitral regurgitation, in which a leaky mitral valve can allow blood to flow backward in the heart, one of its main offensive fronts in recent years, primarily through expansion of its mitral valve repair device.

Worldwide sales of MitraClip totaled nearly $700 million in 2019, an increase of about 30% over the prior year. Its prospects could climb higher with better coverage in the Medicare population; a proposed decision memo is due from CMS Feb. 14. While the device is currently only indicated for patients with prohibitive risk for open heart surgery, FDA recently approved Abbott's trial assessing MitraClip's use in patients with moderate risk.

Tendyne targets a segment of the mitral regurgitation patient population past the point of being good candidates for valve repair.

"The self-expanding valve is delivered through a small incision in the chest and up through the heart where it is implanted in a beating heart, replacing the person's native mitral valve," Abbott's announcement said.

Boston Scientific is also working on alternatives to open heart surgery for mitral regurgitation patients, having acquired a transcatheter annuloplasty ring system with the $325 million buyout of Millipede at the start of last year. Edwards expects between $50 million and $70 million in total transcatheter mitral and tricuspid device sales in 2020. Potential competition lessened slightly with LivaNova's announcement in November it would cease efforts to bring a mitral valve replacement device to market.

Like MitraClip, Abbott gained the mitral valve replacement device via an acquisition. Abbott bought the original technology from Minnesota medical device startup Tendyne Holdings, spending a total of $250 million as of late 2015, with potential future milestone payments. Tendyne investors filed a lawsuit in 2018 alleging Abbott failed to make “commercially reasonable efforts” to meet timelines for certain regulatory milestones, including a $50 million payment that would have been tied to a CE mark approval and 70-patients-treated threshold by Dec. 31, 2017.

Abbott last year acquired another mitral valve replacement technology developer, Cephea, for an undisclosed amount.

Abbott expects a few other key approvals for its structural heart business in 2020, including a CE mark for TriClip (a modified version of MitraClip intended for tricuspid valve repair), and FDA approval of Portico, its transcatheter aortic valve replacement system it hopes can take share in a market already saturated by Edwards Lifesciences, Medtronic and Boston Scientific.