A battle is brewing among three medtech companies seeking to capture a dominant share of an emerging market aimed at treating the painful side effects of diabetes.

Competition stiffened last week after the Food and Drug Administration approved an expanded indication for Abbott Laboratories’ spinal cord stimulation device as a therapy for diabetic peripheral neuropathy.

Abbott’s Proclaim XR spinal cord stimulation device was first approved to treat chronic pain in 2019. The expanded approval now has it fighting for share with Nevro, which specializes in spinal cord stimulation, and Medtronic, one of the largest medical device makers by revenue.

Nevro and Medtronic received approvals for competing devices to treat painful diabetic neuropathy in 2021 and 2022, respectively.

Medtronic had the largest neuromodulation business in 2022

Abbott’s large existing customer base in diabetes “does provide them a bit of leverage in this market,” RBC Capital Markets analyst Shagun Singh said in an interview. Medtronic also has substantial diabetes and neuromodulation businesses. Both companies have large sales forces that could potentially outpace Nevro, which is a smaller company.

The added competition isn’t necessarily bad news for Nevro, Singh added.

“Having big players in the market like that, it’s validating the market and helping build the referral pathway for these PDN patients,” Singh said. “If it was up to them to do all of the market development work, they would get less traction than if there are three companies in the market.”

About 2.5 million patients could be in the “prevalence pool” based on Abbott’s estimates that 34.2 million people in the U.S. have diabetes, about 20% of them will develop painful diabetic neuropathy and about half of them won’t respond to treatment, according to a research note from Singh.

“That’s a huge patient population that doesn't have an option,” she said. “There has been nothing available to these patients.”

Market of $3 billion to $5 billion

Competitor Nevro also estimates that 140,000 to 200,000 people enter this pool annually, implying a total addressable market of $3 billion to $5 billion for spinal cord stimulation treatment, Singh wrote.

“We think it's a really substantial market. And we think it's good to have a lot of treatments available to improve patient access,” Allen Burton, divisional vice president of medical affairs for Abbott's neuromodulation business, said in an interview. “We think one thing that we as Abbott bring to the market is a pretty significant presence in the diabetes space. We have a lot of insights and awareness of the needs of diabetic patients, [and] we have significant interactions and relationships with lots of caregivers and diabetic specialists.”

“Because it's an existing treatment, it has coding coverage reimbursement by CMS and private payers,” Burton added. “So getting this from FDA approval to patients should go pretty fast.”

The procedure is covered by most major insurers. While the devices are expensive, some studies show they can decrease long-term health care costs for patients, Mayo Clinic neurologist Dr. Narayan Kissoon wrote in an email. Implanting a spinal cord stimulator can cost $32,000 for Medicare and as much as $58,000 for commercial insurers, according to the Journal of Neurosurgery.

Chicago-based Abbott is one of the biggest makers of continuous glucose monitors and it released a new product with its Freestyle Libre 3 last year. The spinal stimulation approval should complement Abbott’s existing diabetes devices, and surround patients with more treatment options, Burton said.

Because of Abbott’s existing relationships in diabetes, and insurance coverage already established for this treatment, the company may be able to bring access to patients faster than others that had to do more groundwork, Burton added.

“What it does for us is it really gives us a real very good sense of where unmet needs are in the diabetes community. And I think we have a good idea of how we can position our therapy to optimally help diabetic patients,” he said. “Even though there are other therapies… other competitors in this space, we think there are still some gaps in patient awareness and among [caretakers] that they have some treatment options beyond just medications for their ongoing pain.”

Sales expectations

Currently, companies are bringing in a small amount in sales from these devices for painful diabetic neuropathy, although they expect steady growth. When it first got approval in 2021, Nevro brought in $6 million in related sales. That number increased to $48 million in 2022, according to preliminary earnings results, and Nevro expects between $75 million and $85 million in painful diabetic neuropathy revenue this year.

Nevro claims that the other options are not the same, arguing that its device had the largest randomized clinical trial study spinal cord stimulation in patients with painful diabetic neuropathy and the highest published responder rate and pain relief.

Still, Nevro Chief Medical Officer Dr. David Caraway said the entry of a new competitor in the market will likely “drive more awareness with patients and health care professionals.”

While Medtronic doesn’t break out sales of the device for painful diabetic neuropathy, the company has been “very pleased by the response” of clinicians since receiving approval last year, Medtronic spokesperson Jeff Trauring wrote in an email.

People with painful diabetic peripheral neuropathy “represent a sizeable and undertreated patient population. As such, we are grateful for the efforts of those in the industry, including other manufacturers, who are raising clinician, payer, and patient awareness that spinal cord stimulation can be an effective treatment option,” Trauring added.

Shortly after Medtronic won its approval in 2022, J.P. Morgan Analyst Robbie Marcus wrote in a research note that Medtronic’s existing diabetes relationships and salesforce could “give the company a leg up” in growing its PDN business. However, “it will likely be a relatively slow ramp for both the market and Medtronic’s business, which management believes should result in market revenues of >$300M by 2026, which is generally consistent with the ~$105M in Nevro PDN revenue we forecast for calendar 2026,” Marcus wrote.

Who is eligible?

Diabetic peripheral neuropathy is a complication of diabetes, where people feel pain, tingling or numbness in their feet and legs, and sometimes their hands and arms. It can affect people with both Type 1 and Type 2 diabetes.

The first line of treatment for painful diabetic peripheral neuropathy is to manage the condition using medications, including gabapentin, an anticonvulsant, and tricyclic antidepressant medications such as amitriptyline or nortriptyline, Mayo Clinic’s Kissoon said. Topical medications also are an option.

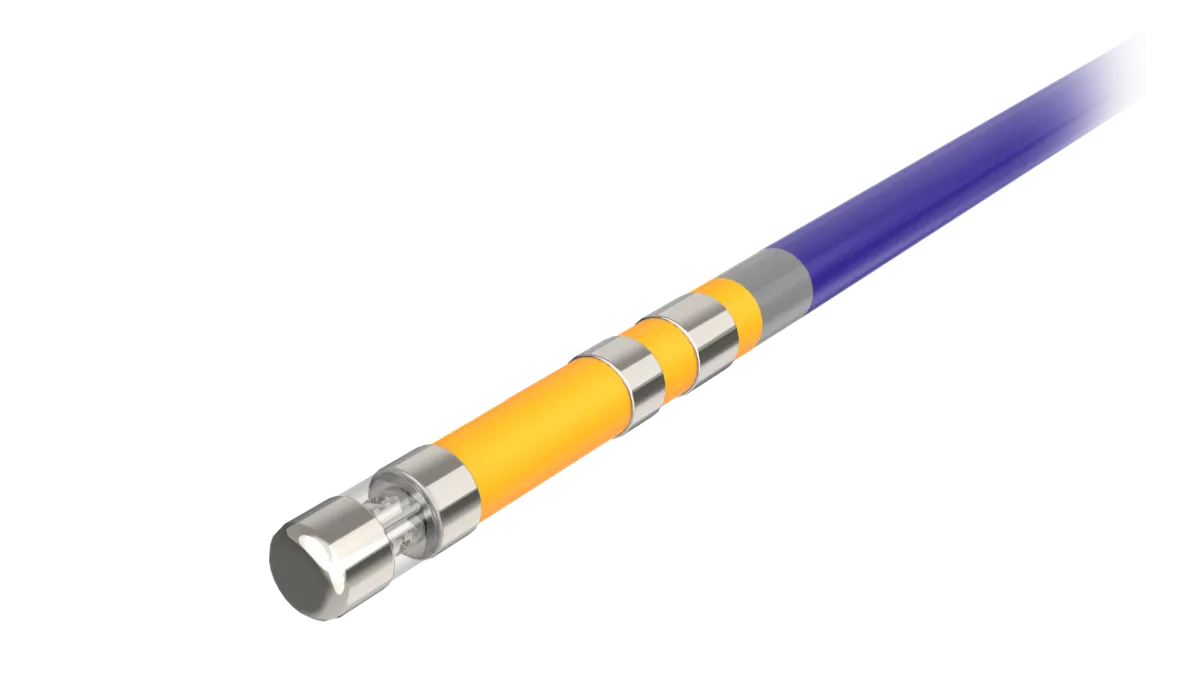

Still, for people who don’t respond to these treatments, spinal cord stimulation could be an alternative. The device is an implant that delivers pulsatile electrical energy to the spinal cord, interrupting some of the pain signals traveling through the spine to the brain.

“And so the patient’s perception of that pain in their legs and feet goes down pretty dramatically,” Burton said.

Kissoon wrote that spinal cord stimulation should be considered after patients have tried two different types of medications for neuropathic pain in different classes, such as anticonvulsants and serotonergic medications. They also need to be candidates for minimally invasive surgery.

To start, patients have a temporary lead placed for a week before they decide whether to proceed with a permanent implant.

Some of the positives include that spinal cord stimulation can let patients decrease the dose or taper off their medications, which often have side effects.

“The pain relief and improvements in quality of life can be substantial with improved sleep and functional improvements. In my experience, the cutaneous allodynia [painful skin hypersensitivity] significantly improves with spinal cord stimulation,” Kissoon said.

Some of the downsides include a 5% chance of lead migration or dysfunction, which would require surgical revision. The batteries also need to be replaced every eight to 10 years, and while there is a 10% to 15% chance of pain where the battery is placed, “usually that is temporary and resolves within 3-6 months following implant,” Kissoon said.