Dive Brief:

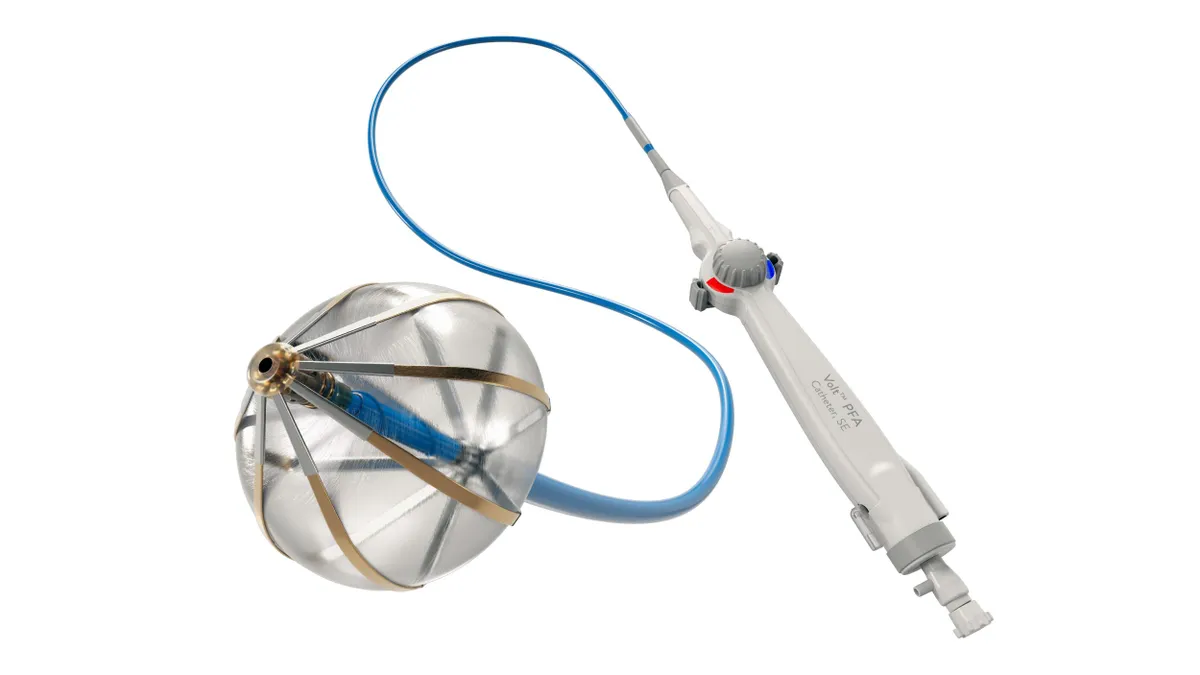

- Abbott has completed enrollment in a global clinical trial of its Volt pulsed field ablation (PFA) system four months ahead of schedule.

- The company secured approval to start the study in the U.S. earlier this year and enrolled almost 400 patients in three months, according to the Thursday announcement. Abbott is developing the device to compete with products from Boston Scientific and Medtronic that pose a potential threat to its electrophysiology business.

- Abbott reported the enrollment milestone alongside news that it has received clearance to sell its Advisor HD Grid X Mapping Catheter and started a trial of its Tactiflex Duo Ablation Catheter.

Dive Insight:

Analysts have identified PFA devices as a threat to Abbott’s $1.9 billion electrophysiology unit, warning that the company’s “wait-and-see” approach to the technology could allow Boston Scientific and Medtronic to win market share.

So far, Abbott has continued to grow. At 17%, second quarter growth of Abbott’s electrophysiology unit was faster than before the pandemic but below the 20%-plus, PFA-enhanced expansion of the broader market, CEO Robert Ford said on a July earnings call.

Ford said the emergence of the new atrial fibrillation technology “is positive for the market, which is why we've invested heavily in our PFA portfolio, which ... you'll start to see hit the market in the, I'd say, next year.” Abbott took a step toward getting Volt to the U.S. market Thursday by wrapping up enrollment.

The trial’s primary efficacy endpoint is looking at the rate of freedom from documented symptomatic or asymptomatic atrial fibrillation, flutter and tachycardia after 12 months.

In parallel, Abbott is preparing to start enrolling around 200 patients in a study of Tactiflex, a catheter for delivering both PFA and radiofrequency energy. Abbott said Tactiflex uses a “focal” or “point-by-point” approach to provide the safety and effectiveness of PFA with more flexible and focused energy, setting it apart from Volt’s “single shot” model.

Although Abbott has yet to bring either catheter to market, the company remains exposed to PFA-driven market growth because it sells mapping technology. Ford said more than 90% of PFA cases in the U.S. use mapping. Abbott’s newly cleared Advisor system provides high-density heart mapping intended to make physicians more aware of electrical signals when placing PFA and radiofrequency catheters.

Ford said Abbott systems are used in around 50% of mapping cases. Separately, Tim Schmid, Johnson & Johnson’s worldwide chairman of medtech, said J&J’s mapping systems are used in 50% of PFA procedures in the U.S. Schmid made the comments at a Wells Fargo conference in September.

Like Abbott, J&J has yet to bring a PFA device to the U.S. market but has provided mapping systems. J&J is hoping to win approval late in 2024 or early in 2025 and has “no doubt that we will regain some of the share that we are seeing move to some of our competitors in the short term,” Schmid said.

A clearer picture of how PFA devices are reshaping the electrophysiology market could start to emerge next week. J&J is set to report its third-quarter results on Oct. 15. Abbott will publish its results one day later. Boston Scientific’s and Medtronic’s earnings announcements are scheduled for Oct. 23 and Nov. 19, respectively.