Abbott raised its sales and earnings forecasts for 2024 on Thursday after a better-than-expected second quarter, driven by growth in its medical devices business.

Medical device sales grew by 10.2% to $4.73 billion, with Abbott’s electrophysiology, structural heart and diabetes segments standing out in the quarter. Abbott reported the results on a second-quarter earnings call.

Stifel analyst Rick Wise wrote in a research note that the medical device growth and “‘positive momentum’ commentary” is a “positive sign for MedTech broadly.” Johnson & Johnson, which is often used as a bellwether for medtech earnings, fell short of growth expectations in results reported Wednesday.

J.P. Morgan analyst Robbie Marcus added that the strength in devices translated to a good quarter for Abbott, with “what seems to be a healthy procedural backdrop and product cadence.” However, he cautioned the results likely won’t be enough to fully shake liability fears about preterm infant formula sold by Abbott, after a legal trial started last week.

CEO Robert Ford dismissed the plaintiff’s claims that the formula can cause a serious bowel disease as “without merit,” and spent most of the call discussing Abbott’s medical device products. Ford shared the company’s thinking about the markets for pulse field ablation (PFA) and its first over-the-counter glucose monitor, although he declined to provide specific forecasts.

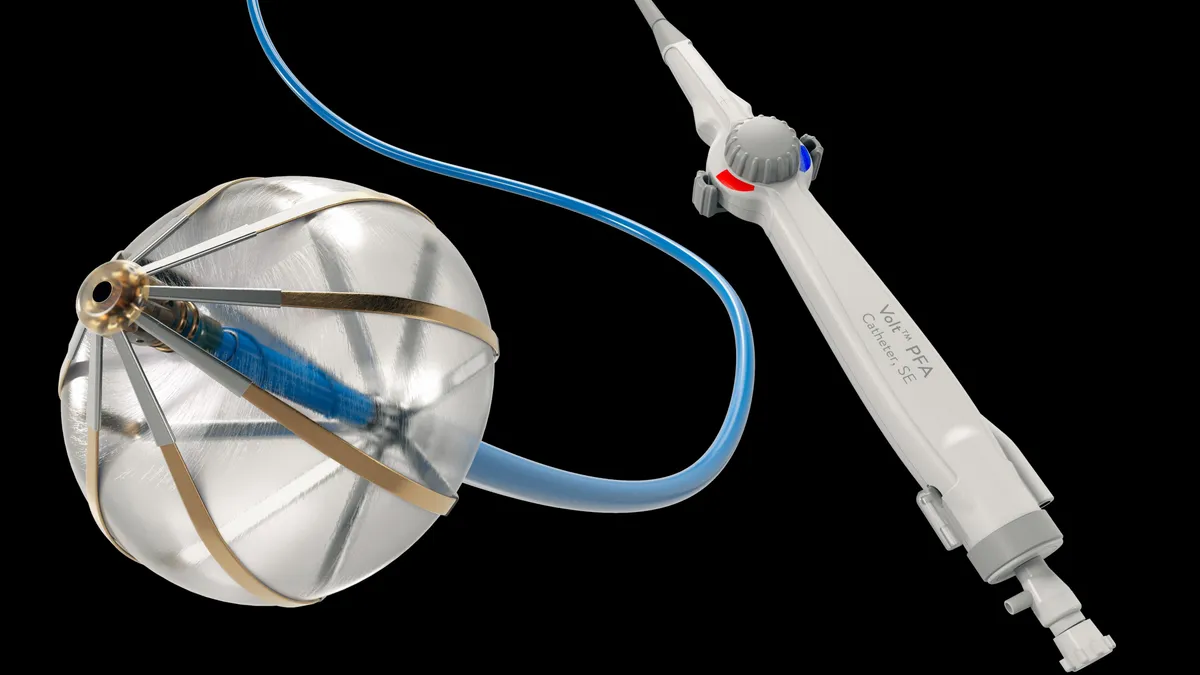

Electrophysiology grows despite PFA competition

Abbott’s electrophysiology sales grew 13% despite competitors Medtronic and Boston Scientific bringing the first PFA devices to market. PFA is a new treatment that uses electrical pulses to treat atrial fibrillation, differing from older forms of ablation that use heat or cold. Ford estimated that PFA could be used in about a third of all ablation procedures.

Abbott is working on its own PFA device that it hopes to bring to market starting in Europe next year, Ford said. In the meantime, the market for Abbott’s current radiofrequency ablation devices is accelerating, he added.

“[Radiofrequency] still plays a role — it’s still an important role — and our business is actually growing faster than what it was growing before,” Ford said.

Abbott’s U.S. electrophysiology business grew 17% year over year, “clearly helped by diagnostic/mapping growth as PFA uptake ‘lifts all boats’, at least in the near term,” Wise wrote.

Over-the-counter glucose monitors

Abbott received FDA clearance for two OTC continuous glucose monitors, among the first to come to the U.S. It will compete with Dexcom, which has its own OTC sensor.

One of Abbott’s devices, called Rio, is intended for people who have Type 2 diabetes and don’t take insulin. The other, called Lingo, is for people who don’t have diabetes.

Ford did not share a specific sales forecast for either product. For Lingo, Ford said “you're looking at a multi-billion dollar opportunity,” assuming a single-digit percentage of 400 million adults in the U.S. and Western Europe buy a few sensors a year. “We’re not there yet,” he added, reflecting on an earlier launch of Lingo in the U.K.

“What I do know based on the U.K. experience is that it takes some time to educate and communicate with a patient population that, while excited about having new tools to drive healthcare habits, they do need some time to understand [them].”

Ford does not expect insurance coverage for Lingo, but he sees a benefit in generating data to communicate the value of the product to physicians and users.