Dive Brief:

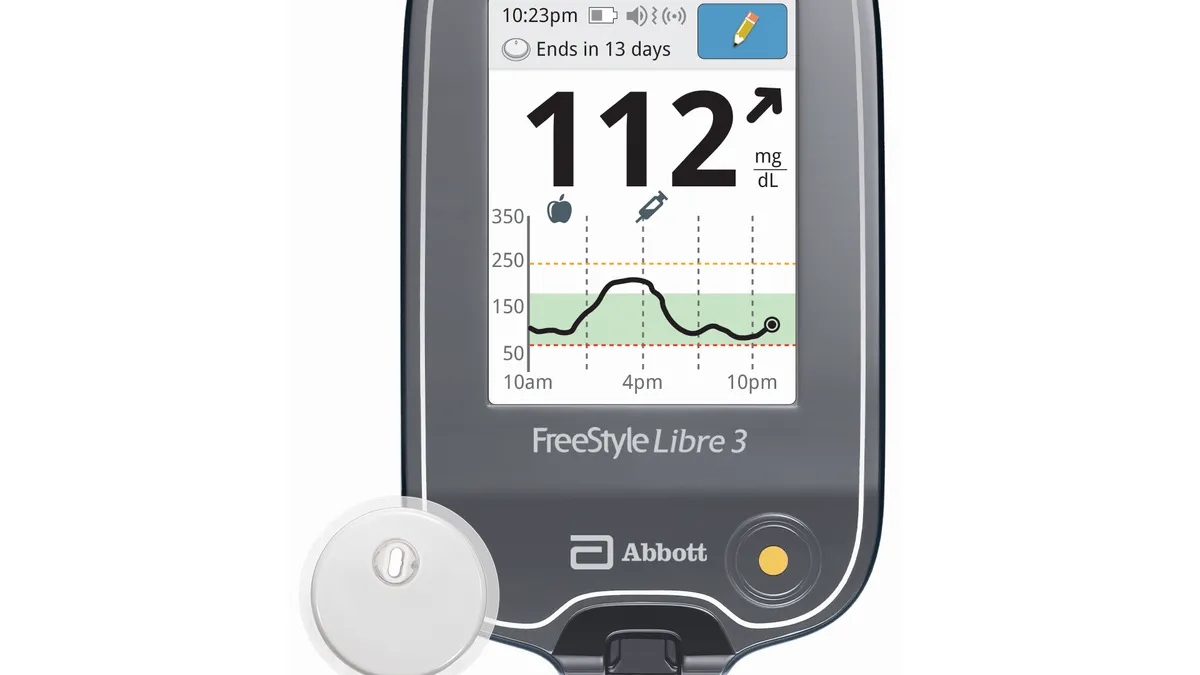

- Abbott’s analysis of U.S. pharmacy data has shown people on GLP-1 therapy wear their FreeStyle Libre sensors more.

- The rise of new GLP-1 treatments for diabetes and obesity has raised questions about whether the drug class will cut adherence to continuous glucose monitors such as Abbott’s FreeStyle Libre.

- However, the Abbott analysis suggests GLP-1 therapy has the opposite effect, leading analysts at Wells Fargo Securities to tell investors the drug class “could be a modest accelerator for Libre.”

Dive Insight:

The Food and Drug Administration first approved a GLP-1 receptor agonist in 2005. Interest in the drug class — and speculation about its impact on medtech companies — has taken off in recent years as Eli Lilly and Novo Nordisk have linked medicines to improved outcomes in diabetes and weight loss.

Dexcom allayed concerns about the impact of GLP-1 drugs on CGMs at the start of September, when it shared an analysis of Optum data that found use of the sensors increased as people started taking the medicines. Abbott’s analysis supports and complements the Dexcom findings.

Analyzing insurance claims in the U.S. retail channel, Abbott found FreeStyle Libre adherence is higher in patients who take GLP-1 drugs than in their counterparts who are not taking the medicines. The finding was consistent across data from 2019 and 2022, and between patients who inject insulin multiple times per day and their peers on non-intensive treatment regimens.

Abbott identified several benefits of CGMs that support their use with GLP-1s. The Wells Fargo analysts discussed the potential benefits and their implications for the CGM market in a note to investors.

“First, the data helps modify patient behaviors and provides accountability that drives higher compliance. CGM also supports GLP-1 dose titration. And lastly, CGM lowers the risk of hypoglycemia which is especially important in GLP-1 users on insulin. Overall we see this positive data suggesting that GLP-1s could actually be a modest tailwind for Libre, vs the headwind many feared,” the analysts wrote.

A spokesperson for Abbott declined to disclose the number of users its analysis covers, but did say it “is based on data from retail prescriptions in the U.S.” The analysis “includes people covered by commercial insurance, Medicare Advantage, Managed Medicare and Medicaid and other payment types, such as cash pay programs,” the spokesperson said, and “represents around two-thirds of all people who use FreeStyle Libre systems in the U.S.”