Q1 Insights:

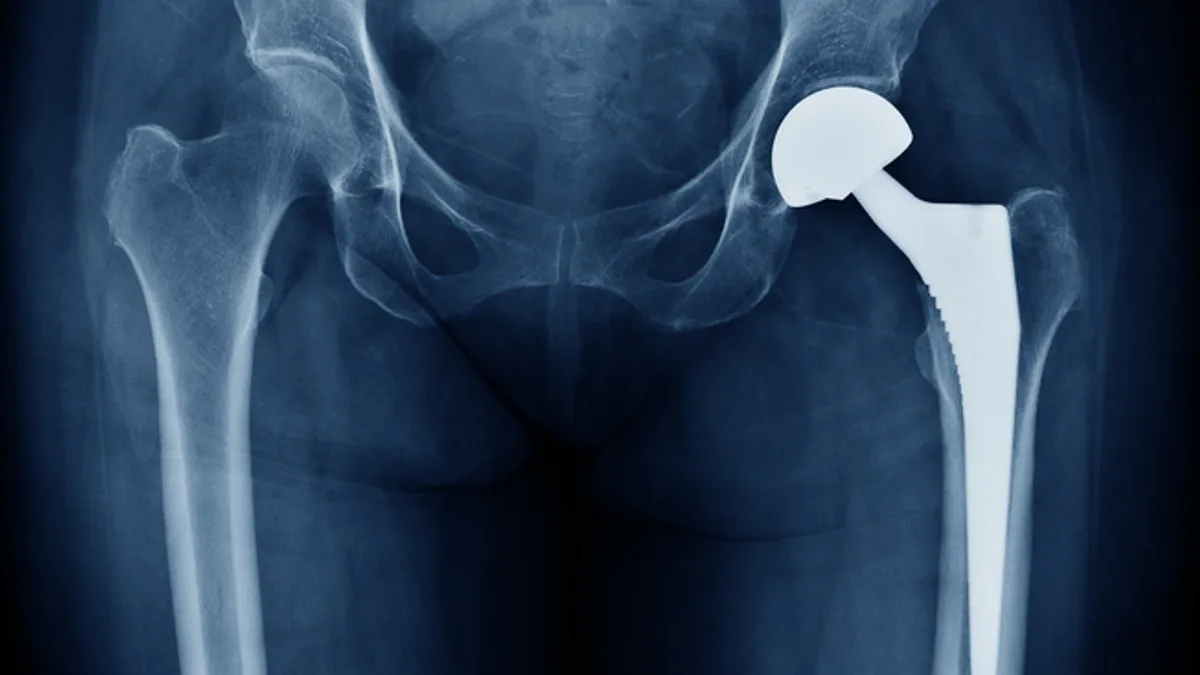

Stryker, a leading provider of orthopedic devices, reported growth in sales of key products as it benefited from installations of its Mako robot.

Speaking on Stryker’s conference call to discuss the results, Robert Marcus, an analyst at J.P. Morgan, said he was “kind of blown away by how good the growth rates were in hip, knee and extremity” in the first quarter. Stryker CEO Kevin Lobo attributed the “pretty breathtaking” knee growth outside the U.S. (OUS) to a mix of an easy comparison to the omicron-affected start of 2022 and other factors.

“Part of [the growth is] due to really picking up Mako installations OUS. It continues to be strong in the U.S., but OUS has a much longer runway and started much later. So, Mako will fuel that OUS growth in the same way that it's fueled our U.S. growth for many years,” Lobo said on the call.

Lobo cited Mako as a driver of the growth in hip sales too, adding that the launch of version 4.0 of the robotic software combined with the Insignia hip stem device increased sales. The CEO expects the combination to continue driving growth.

Procedures ramping up

The results reflect a quarter in which procedure volumes continued to ramp up “very nicely,” Lobo said on the call, furthering the recovery that began in the second half of last year. The upswing in the results drew a favorable response from analysts at BTIG, who expect to see further gains later in the year.

“[Stryker] is benefiting from improving end-markets, healthy order demand and new product cycles. It’s MedTech 101,” the analysts wrote in a note to investors. “We are of the view that any margin pressures will prove transitory as we move into 2H23 especially given the price benefit [Stryker] is now seeing.”

Shares in Stryker fell 2% to $293.44 in Tuesday morning trading. The BTIG analysts attributed the stock reaction to a mix of “high expectations and a lack of margin pull-through.”

Forecast:

Stryker raised its organic net sales growth target range to 8.0% to 9.0%, up from 7.0% to 8.5% in its earlier forecast, and increased its earnings per diluted share target too. In a statement, the company attributed the changes to its first quarter results, plus its “strong order book for capital equipment and ongoing procedural recovery.”