Dive Brief:

- Spectrawave, a medical imaging company, has raised $50 million in a funding round led by Johnson & Johnson’s venture capital arm.

- The Series B round will support commercial expansion and product additions for Spectrawave’s Hypervue imaging system for patients with coronary artery disease, according to a Wednesday announcement.

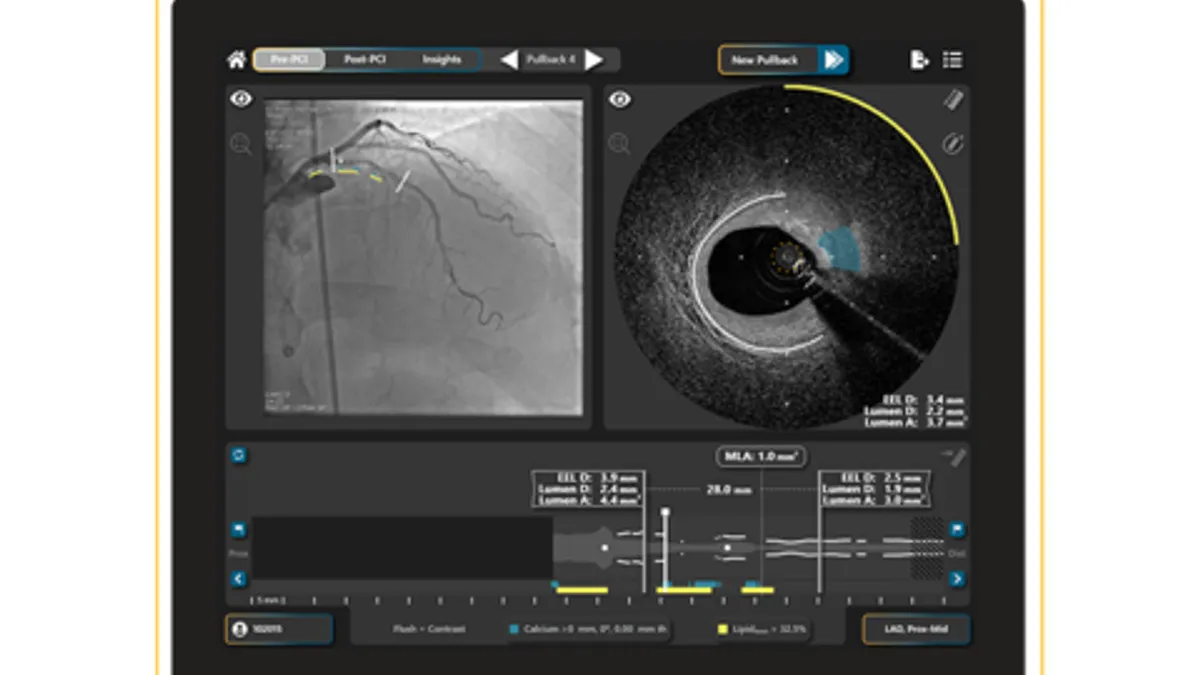

- Spectrawave said that it gained 510(k) clearance from the Food and Drug Administration for Hypervue, its flagship intravascular imaging system, in March 2023. Shortly after, it received an additional 510(k) clearance for enhancements that include contrast-free saline imaging and artificial intelligence algorithms to help identify clinical structures such as calcium.

Dive Insight:

Intravascular imaging is used to improve outcomes for patients undergoing stent procedures to treat blocked coronary arteries.

The technology offers information to help interventional cardiologists make decisions about plaque modification, stent and balloon sizing, risk of adverse events and more, according to Bedford, Massachusetts-based Spectrawave.

Recent studies have shown improved patient outcomes with use of intravascular imaging in percutaneous coronary intervention procedures to improve blood flow to the heart when compared with angiography, which uses a type of X-ray image.

“This evidence and broad recognition of impact has recently moved intravascular imaging to a 1A guideline recommendation in Europe, with an expectation that the United States will follow in due time,” Spectrawave CEO Eman Namati said in a statement.

Namati said the company’s system has been positively received during its initial U.S. launch.

“Increasing both the capabilities and the ease of use of intravascular imaging systems is now critical to expand the use of imaging and improve care for these patients,” the CEO said.

In addition to Johnson & Johnson Innovation - JJDC, participants in the new funding round include S3 Ventures, Lumira Ventures, SV Health Investors, Deerfield Management, NovaVenture, Heartwork Capital and undisclosed parties.