Boston Scientific, bolstered by a steady stream of “tuck-in” acquisitions, has enjoyed a rebound in sales growth in the past two years that has helped it recover from an industry-wide slowdown in medical procedures during the pandemic.

Investors have rewarded the cardiovascular device maker’s focus on smaller-scale transactions that expand core product lines, which also include endoscopy, urology and neuromodulation, and the company’s shares today trade near an all-time high. That strategy has helped Marlborough, Mass.-based Boston Scientific boost sales 6.7% in 2022 to $12.7 billion with a net income of $642 million.

Now, the company may be preparing to veer from that growth strategy.

Bloomberg News reported on April 21 that Boston Scientific, which has a market value of about $77 billion, may buy Shockwave Medical, a maker of artery-clearing devices with a market capitalization of about $10 billion. The report cited people familiar with the matter.

With $570 million in cash on hand at the end of March, according to a regulatory filing, the deal would mean Boston Scientific likely would have to take on billions of dollars in debt or issue a raft of new shares at a time when interest rates are at their highest since 2007.

That has some analysts and investors concerned about the potential price of such a deal in the current macroeconomic environment, given the company’s past success in boosting growth through tuck-in deals.

“No way around it, a $10 [billion plus] acquisition for a $75 [billion] market cap company isn’t a tuck-in,” J.P. Morgan analyst Robbie Marcus wrote in a note to clients earlier this month.

Spokespersons at Boston Scientific and Shockwave declined to comment on the reports of a possible acquisition.

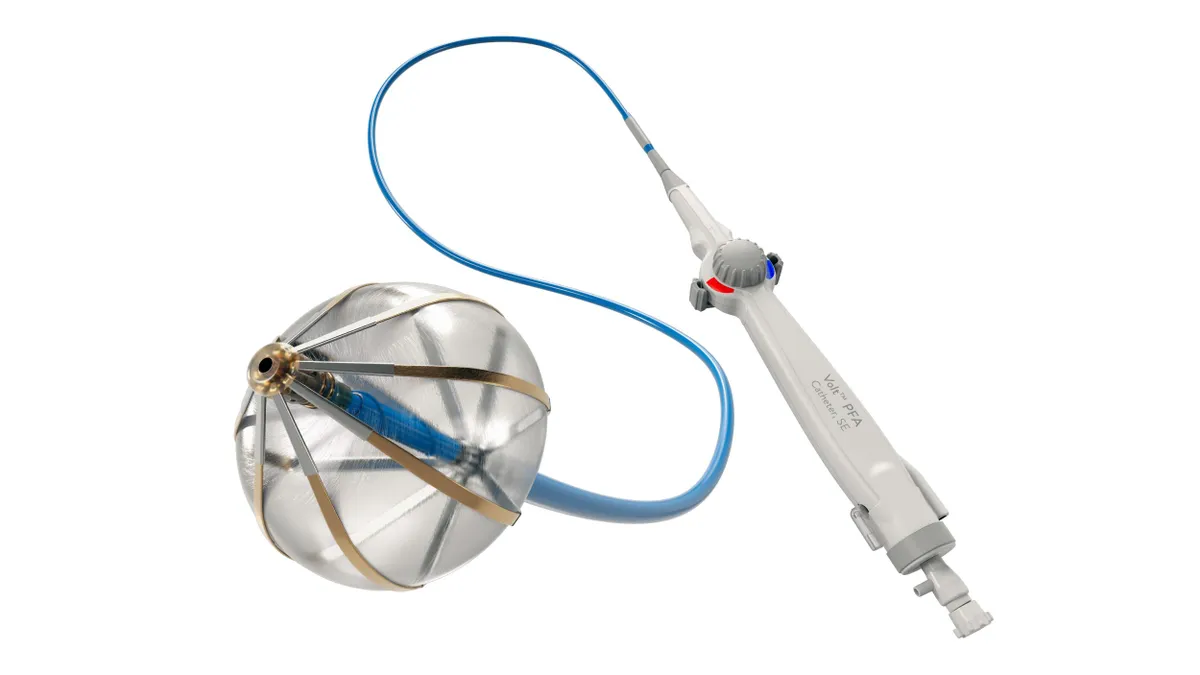

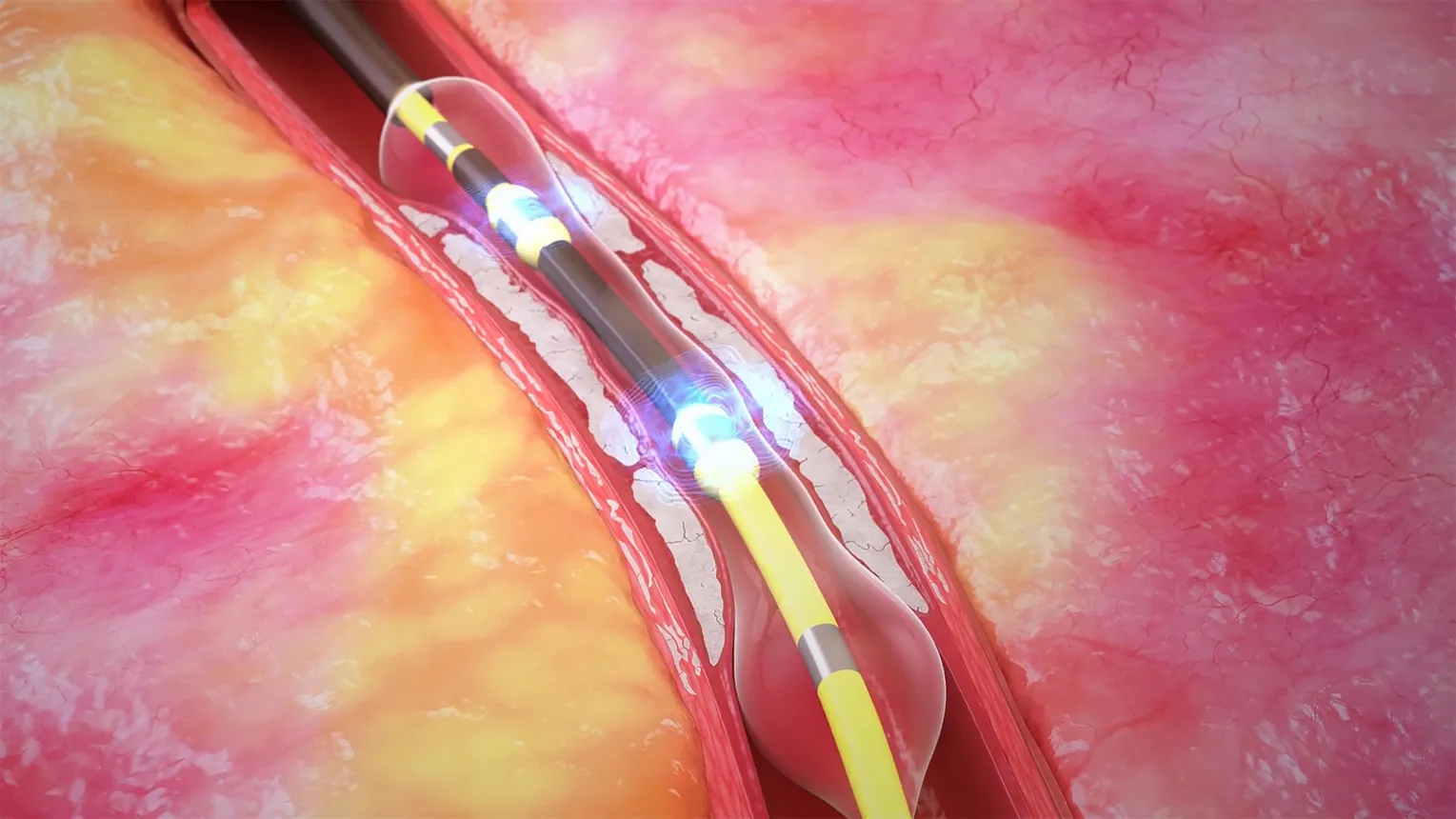

Buying Shockwave would add a complementary technology to Boston Scientific’s interventional cardiology and coronary stent portfolios with the potential to further accelerate the company’s revenue growth. Shockwave sells a catheter-based treatment that delivers sonic pressure waves to break up calcified plaque in coronary and peripheral arteries. An alternative to current blade- or laser-based approaches to removing vascular blockages, the technology is attracting strong demand in both the U.S. and global markets.

Still, the cost of the potential acquisition by Boston Scientific would raise some red flags even as the move may pay off in the long term, investors say.

“The valuation is extremely high right now,” Jeff Jonas, a portfolio manager at Gabelli Funds who focuses on the medtech sector, said of Shockwave’s market value.

At the same time, Shockwave has had “enormous growth,” he added. “They’re taking a lot of market share. They're building out the sales force. They’re doing extremely well with their new technology. That sort of high-growth phase can’t continue forever.”

Shockwave is a “high-quality asset and trades at a premium valuation to its MedTech peers,” at around 14.5 times its enterprise value divided by sales, wrote BTIG analysts Marie Thibault and Sam Eiber in a note last month. Still, buying Shockwave would strengthen Boston Scientific’s position in the cardiovascular device market and be “a formidable response” to Abbott Labs' pending acquisition of Cardiovascular Systems, they added.

Shockwave last week reported a 72% jump in revenue to $161.1 million in the first quarter compared to a year ago. The company said the Centers for Medicare & Medicaid Services has proposed three new billing codes specific to Shockwave’s intravascular lithotripsy (IVL) technology to address the higher average costs and generally longer hospital stays associated with the procedures, compared with cases in their previously assigned payment groups.

A report from StreetInsider.com last week suggested talks between Shockwave and Boston Scientific had broken down over price. StreetInsider, citing a single source, also reported that Medtronic and Johnson & Johnson could be interested in Shockwave.

Shockwave’s shares have gained about 5% since Bloomberg reported in late April that Boston Scientific may be interested in buying the company, while they are off a peak of $302.68 reached last week.

Focus on tuck-ins

CFO Dan Brennan said on Boston Scientific’s first-quarter earnings call that the company’s capital allocation priorities remain unchanged, while the firm is also committed to maintaining its investment-grade credit rating.

The first priority for capital allocation is high-growth and high-quality tuck-in acquisitions in segments adjacent to current markets, an “equation that’s worked well for us for many years,” Brennan said on the call. The second is share repurchases with any excess cash, he added.

One of the latest examples of that tuck-in strategy is the company’s $615 million acquisition of gastrointestinal device maker Apollo Endosurgery, which closed during the quarter, CEO Mike Mahoney told the analysts. Boston Scientific also struck a $523 million deal in late December to buy a majority stake in China’s Acotec Scientific Holdings, the leader in the region in drug-coated balloons to treat vascular diseases, he noted.

An ‘intentional journey’

Brennan, when asked about Boston Scientific’s debt ratio goals, said the company is “comfortable” with the rating status it has worked to achieve.

“It's been a focused and intentional journey for us to get back to BBB+ with all three rating agencies that rate us,” he said. BBB+ is the eighth-highest investment grade rating at Standard & Poor’s and Fitch Ratings.

Fitch Ratings analyst Yi Liu said Boston Scientific’s “consistent capital allocation strategy,” and expectations for that to continue, earned the device maker an upgrade from the agency to BBB+ in December.

“They’ve been working hard to deleverage” through a combination of debt reduction and growth in earnings before interest, tax, depreciation and amortization, Liu said in an interview.

Boston Scientific has paid down more than $1 billion in debt since its 2019 acquisition of BTG, a U.K.-based maker of devices used in minimally invasive procedures for cancer and vascular diseases. At $4.2 billion, that deal was the company’s largest since the 2006 purchase of heart device maker Guidant, for which it paid $27 billion through a combination of half cash and half stock. Boston Scientific issued bonds and took on debt to cover the cash portion of the Guidant transaction.

The company’s deleveraging efforts over the past several years have coincided with a steady decline in litigation payments related to its pelvic mesh products, Liu noted.

Boston Scientific is among a handful of manufacturers of transvaginal mesh that agreed to settle claims from thousands of women who reported complications after they received the implants. The Food and Drug Administration ordered mesh makers to stop selling the devices in 2019.

With large amounts of cash no longer flowing into legal settlements, “there's an extra buffer for the company to deploy toward their debt repayment,” Liu said.

Boston Scientific’s strategy of taking on earlier-stage companies that are on the verge of commercialization and guiding their innovations through regulatory approvals and into distribution channels has worked well, she said.

“They obviously have a very good platform for validating those technologies,” Liu added.

If the company were to acquire Shockwave and relied heavily on equity issuances to fund the transaction, it may not affect Boston Scientific’s credit rating, she said, adding that if it were to take on significant debt to fund a deal, the firm’s debt leverage would most likely increase.

“If it does increase their leverage, then we'll see. We need to observe whether the company has a pathway to return to their current leverage threshold. If we don't see that, then there could be a rating movement."

Yi Liu

Analyst, Fitch Ratings

BTIG’s Thibault and Eiber noted that given Boston Scientific’s cash level, long-term debt load and leverage ratio, the device maker “would likely need to use equity to fund this acquisition.”

Because Boston Scientific has done a number of smaller acquisitions in recent years, “I don’t think they have an enormous amount of flexibility to do a really big deal like Shockwave,” Gabelli’s Jonas said. He views Boston Scientific’s recent comments as an indication that the company is likely to stick to its game plan of pursuing tuck-in deals rather than a large acquisition.

Will they, or won’t they?

Still, other analysts say that Boston Scientific’s executives have left the door open to a potential Shockwave transaction.

“BSX didn’t say they weren’t interested, which could have been said directly or close to it if the case was so,” Wolfe Research analyst Mike Polark said in a report to clients after the call. He argued that Shockwave could be considered a tuck-in acquisition from an operational perspective, though not based on size.

“Does BSX need SWAV? Perhaps no. Might it create very interesting opportunities over the short-, mid- and long-haul? Yes,” Polark wrote.

Needham analyst Mike Matson estimated that a Shockwave deal could dilute Boston Scientific’s per-share earnings until 2026. At the same time, buying the company would add almost a percentage point to Boston Scientific’s organic revenue growth, he said in a research report.

Noting that Shockwave estimates the market opportunity for its IVL technology at more than $8.5 billion a year, “we think that SWAV would be highly complementary to BSX's cardiovascular business,” Matson wrote.

Gabelli’s Jonas disagrees and said he would prefer to see Boston Scientific stay the course.

“I’d rather see them do three to five small deals per year than one giant one that would probably take two to three years to integrate and pay off,” he said.