One year into the U.S. launch of pulsed field ablation systems from Boston Scientific and Medtronic, doctors in a survey said they planned to use the technology in about 56% of ablation procedures for atrial fibrillation (AFib) in 2025.

The figure is expected to climb to 68% of AFib ablations in 2026, supplanting radiofrequency ablation and cryoablation, according to the poll of 23 U.S. electrophysiologists and one cardiologist conducted by BTIG.

“Overall, these survey findings show that PFA use is accelerating faster than expected a year ago,” the BTIG analysts wrote in a report Monday.

The survey, conducted in mid-January, also suggests PFA adoption is running stronger than Boston Scientific’s most recent forecast for 40% to 50% of global AFib cases to be PFA in 2025 and more than 60% in 2026, the analysts noted.

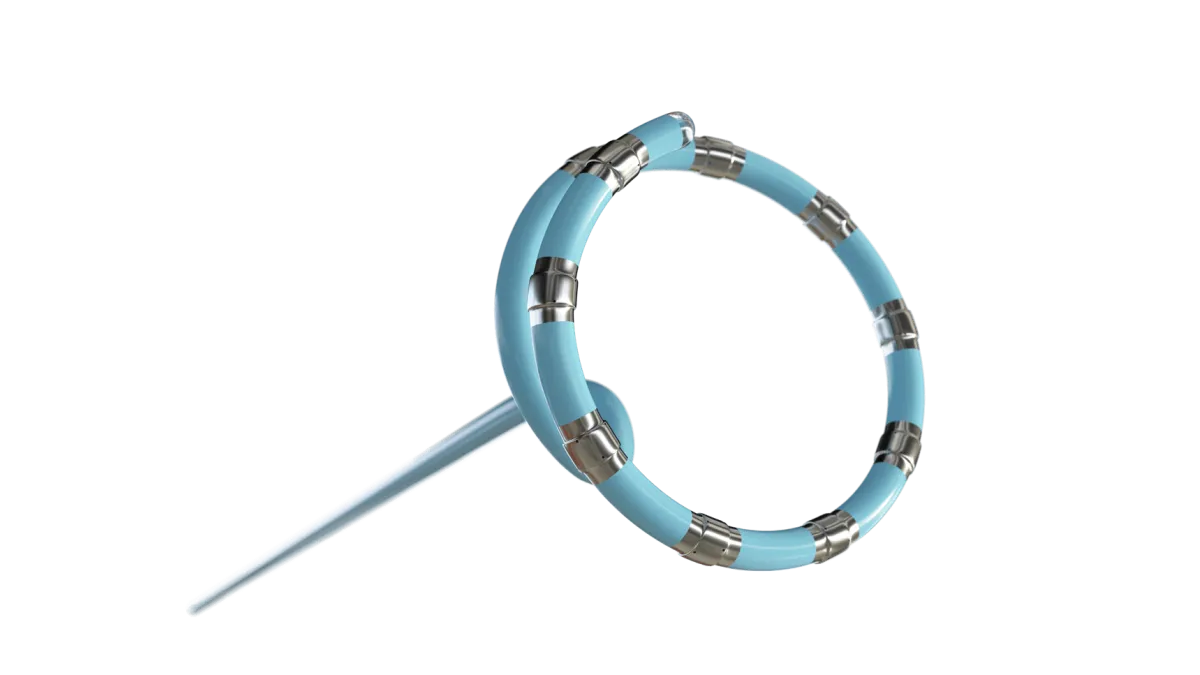

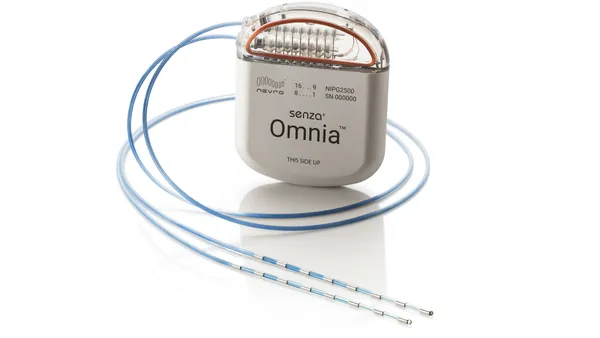

Since Boston Scientific launched its Farapulse PFA system and Medtronic introduced PulseSelect, the FDA has approved Medtronic’s Affera Sphere-9 system and Johnson & Johnson’s Varipulse device.

The doctors in the survey reported an average annual volume of about 151 AFib ablations in 2024.

Market share expectations

BTIG asked the doctors which devices they plan to use. The results, on a weighted average basis, projected market share in 2025 would be divided between Boston Scientific (58%), Medtronic (28%), J&J (11%), and Abbott (3%).

In 2026, the survey predicted Boston Scientific would lose share and J&J would gain it, with an expected PFA share split of Boston Scientific (48%), Medtronic (29%), J&J (20%) and Abbott (3%).

In 2024, the doctors used Boston Scientific devices in about 60% of their PFA cases, followed by Medtronic (about 32%), J&J (about 6%) and Abbott (about 2%).

J&J received FDA approval for Varipulse in November, while Abbott expects to launch its Volt PFA device outside of the U.S. later this year.

However, J&J this month said it paused all U.S. Varipulse cases to investigate the cause of four reported neurovascular events.

Impact of J&J pause

The BTIG analysts said the expected J&J share increases in the survey were surprising due to the pause of U.S. cases.

Of the 24 respondents, 16 said the pause was “worrying” or they were “concerned,” according to BTIG, and many said they would not use Varipulse until the problem was explained and resolved.

Six doctors said their usage would not be impacted. Those doctors said they expected a non-causal explanation or that the events were possibly related to off-label use, could happen with any technology or would likely be resolved soon, according to the report.

“We also think that evolving market dynamics, added FDA indications, and new products could allow [Boston Scientific] to retain more share in 2026 than these doctors project,” the analysts wrote.