Fiscal Q3 insights:

Medtronic, the world’s largest medtech company, raised its outlook for the fiscal year after reporting better-than-expected revenue and earnings in the third quarter on strength in its cardiovascular and neuroscience businesses and improving supply chain dynamics.

Speaking to analysts on a call Tuesday, CEO Geoff Martha said the Minneapolis and Dublin-based medical device maker expects to make “significant” cost reductions to offset ongoing inflation and foreign currency pressures. Those lingering challenges will weigh on earnings in fiscal 2024, CFO Karen Parkhill said. The cuts in expenses, already underway and continuing through the fourth quarter, will allow the company to invest in growth areas, Parkhill added.

Third-quarter revenue rose 4% excluding a $379 million negative impact from foreign currency translation and a $26 million boost from the acquisition of Intersect ENT in the first quarter.

Revenue growth in the quarter was ahead of expectations, Medtronic said, even as the company grappled with continuing supply chain challenges affecting its surgical business in particular, as well as the impact of a volume-based purchasing policy for medical devices in China.

"I'm very encouraged by the rebound in our revenue growth, despite procedure volumes remaining a little softer in a few markets and volume-based procurement in China,” Martha said in a statement.

Shares of Medtronic were little changed at $84.85 in morning trading.

Hugo surgical robot:

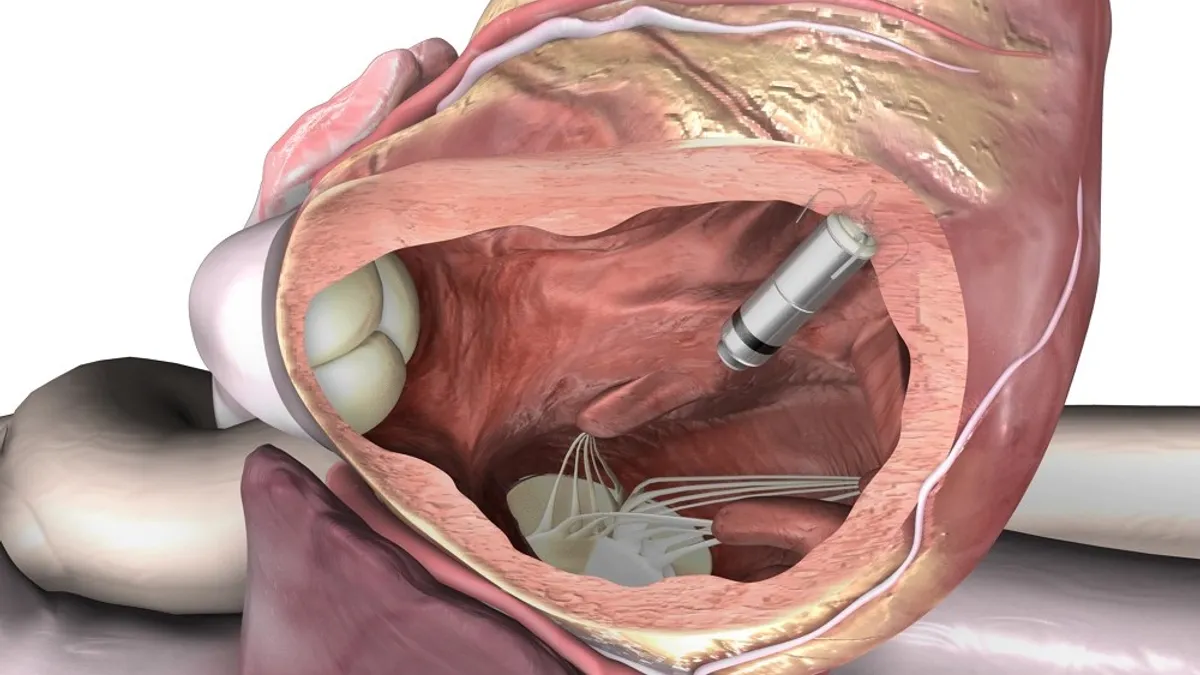

Medtronic is seeing “positive” sales momentum as it rolls out its Hugo surgical robot, a challenger to Intuitive Surgical’s da Vinci system, in international markets, Martha said. The company started its U.S. clinical trial for a urology indication for Hugo during the third quarter, he said.

“We expect our surgical robotics business to become a meaningful growth driver for Medtronic,” said the CEO, noting that less than 5% of surgical procedures globally are performed with the aid of a robot.

Diabetes warning letter:

Medtronic is focused on resolving a 2021 warning letter from the Food and Drug Administration and ready for the agency to reinspect its diabetes facility in Northridge, California, Martha said on the call.

The warning letter followed recalls of the company’s MiniMed 600 series insulin pumps and remote controllers for the MiniMed 508 and Paradigm pumps. The company has delayed the U.S. launch of its MiniMed 780G insulin pump.

In the latest quarter, diabetes revenue of $570 million fell 2%, dragged down by a mid-teens decline in U.S. revenue. The diabetes business generated revenue growth in the high teens in non-U.S. developed markets and low 20s in emerging markets, the company said.

Progress on spinoff:

Medtronic expects to close its renal care joint venture with DaVita in the fourth quarter and is making progress toward the planned spinoff of its patient monitoring and respiratory interventions businesses, which it anticipates will close in the second half of next fiscal year, Parkhill said. The three businesses account for 8% of company revenue.

Forecast:

The company said it expects fourth-quarter organic revenue growth of 4.5% to 5%, in line with consensus estimates and increasing the full fiscal year organic growth outlook. If foreign currency exchange rates as of the beginning of February hold, fourth-quarter revenue would be reduced by about $165 million to $215 million.

The company increased the lower end of its fiscal year 2023 non-GAAP earnings per share outlook, bringing the new range to $5.28 to $5.30, from the prior range of $5.25 to $5.30. The forecast includes an estimated 21-cent reduction from foreign currency at rates as of early February.

“We are confident in delivering durable revenue growth over the coming quarters as recent revenue headwinds continue to dissipate and we execute across our businesses,” Martha told analysts on the call.

The quarter was encouraging, which sets up the company to deliver a mid-single-digit growth outlook in fiscal 2024, RBC Capital Markets analyst Shagun Singh said in a report to clients after the earnings release.