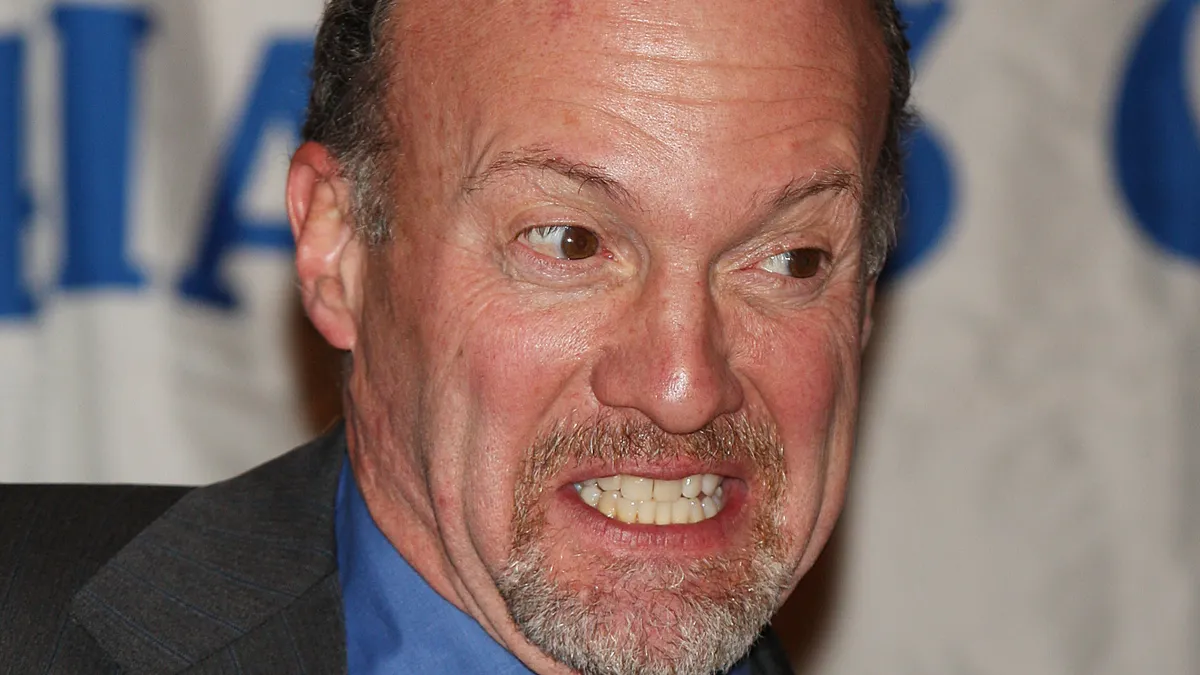

Medtech companies are seeing the beginnings of a bull market that is lifting shares across the sector, said Jim Cramer, host of CNBC’s long-running “Mad Money” show.

The medical device industry has been a long-term source of stock market “winners,” but the COVID-19 pandemic put a dent in that momentum when non-urgent procedures were postponed, Cramer said. Now, device stocks are benefiting from a recovery in demand for medical procedures that were delayed for years, in some cases.

“If there’s one thing we’ve learned this season, it’s that we’ve got a genuine bull market in medical devices,” Cramer said Monday on the show, which regularly features viewers calling in to get the financial analyst’s thoughts on their stock picks.

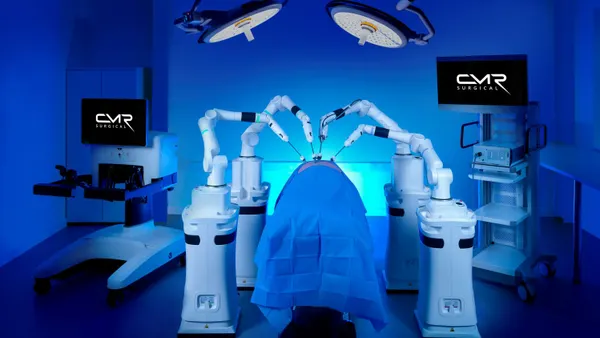

Cramer pointed to a series of positive earnings reports from companies across the industry, and renewed interest in growth stocks as the catalysts for a sector rebound. Stocks he currently favors include cosmetic surgery device maker InMode, surgical robot maker Intuitive Surgical, Johnson & Johnson and GE HealthCare, according to CNBC.

Of course, Cramer has his detractors, who suggest his show should be viewed more as entertainment than a place to get investment advice. James Kardatzke, who has followed Cramer’s stock recommendations even put together an “inverse Jim Cramer portfolio” that bets against the CNBC host’s selections.

“We track a backtested strategy that takes the opposite stock positions of what Cramer recommends, which has seen a return of 29.8% over the past year. When you add in the fact that he doesn’t have a background in MedTech, it might be worth exercising caution before following his recommendations,” Kardatzke, the CEO of Quiver Quantitative, wrote in an email to MedTech Dive.

Updates with comment from Quiver Quantitative CEO.