Johnson & Johnson is poised to join competitors Boston Scientific and Medtronic in seeking to win market share in the U.S. for a new method of treating heart arrhythmias.

The company is the latest of the three medical device firms to report the progress of U.S. clinical trials in pulsed-field ablation (PFA). While devices to treat the condition have been approved in Europe, they have yet to receive a nod from the U.S. Food and Drug Administration.

Boston Scientific and Medtronic already have their own U.S. trials underway.

Researchers with J&J’s Biosense Webster subsidiary, speaking at the International Atrial Fibrillation Symposium in Boston on Feb. 3, shared results of two small, single-arm studies that show the company’s devices are safe and effective.

PFA devices, which deliver short electrical pulses to scar heart tissue and interrupt irregular electrical pathways in the heart that trigger atrial fibrillation, pose less risk of damaging surrounding tissue than the current standard ablation procedures, which use heat or extreme cold, the researchers said.

If J&J can prove these claims to the FDA, PFA devices are expected to take a larger share of the global electrophysiology market, which competitor Boston Scientific estimated at $6.7 billion in 2021.

PFA is “enjoying early commercial success in Europe,” BTIG analyst Marie Thibault wrote in a research note. In the fourth quarter, Boston Scientific’s electrophysiology business grew by 40% internationally, driven in part by its Farapulse PFA device, according to Thibault.

Marlborough, Mass.-based Boston Scientific is expected to share results of a randomized trial of Farapulse in the second half of 2023.

Medtronic also is expected to share trial results next month for its PulseSelect system, one of the PFA devices it’s is developing. Last year, Dublin- and Minneapolis-based Medtronic acquired Affera, a company specializing in heart arrhythmias, for $925 million, adding two more PFA devices to its portfolio.

While Biosense Webster didn’t share a market estimate, it pointed to studies showing atrial fibrillation is the most common type of cardiac arrhythmia, affecting more than 5.5 million people in the U.S. and over 33 million people worldwide. Fewer than 12% of eligible patients receive cardiac ablation, J&J MedTech Worldwide Chairman Ashley McEvoy said in the company’s third-quarter earnings call.

“PFA is the next frontier in AFib treatment and may have a variety of benefits, including a better safety profile than RF ablation, without sacrificing long term effectiveness,” Anthony Hong, Biosense Webster’s vice president of preclinical and clinical research and medical affairs, said in a statement. “Biosense Webster is working to bring a versatile portfolio of PFA solutions — complementary to our RF ablation catheter portfolio — to address various ablation strategies in the treatment of AFib.”

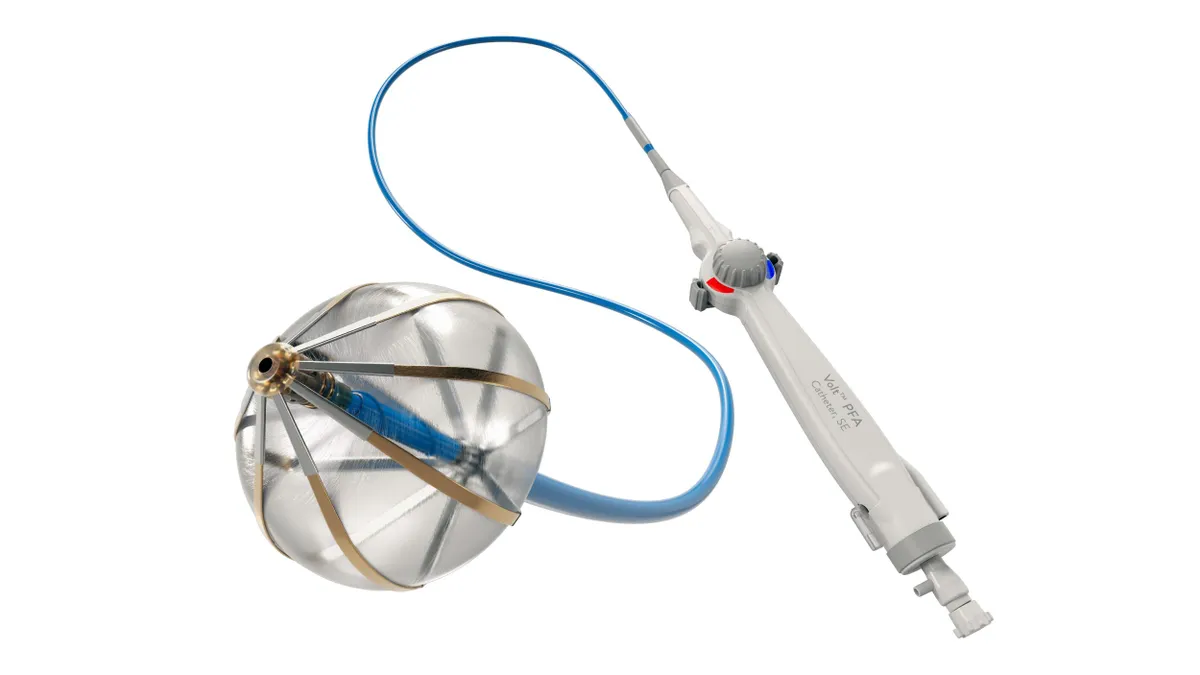

Biosense has two cardiac ablation products currently in trials. Early results from Biosense Webster’s inspIRE study showed 71% of patients treated with the company’s Varipulse Catheter and Trupulse generator were free from atrial arrhythmias longer than 30 seconds at one year. The catheter and generator are paired together to enable cardiac electrophysiological mapping and ablation and they’re not yet approved for use. No adverse events were reported in the single-arm trial of 226 people. The results were published in Circulation: Arrhythmia and Electrophysiology.

Another small, single-arm trial of Biosense Webster’s Heliostar balloon catheter, which the company launched in Europe last year, found that 67.7% of patients were free from atrial fibrillation, atrial tachycardia or atrial flutter at 12 months. The device has a CE Mark but isn’t yet approved in the U.S.

“With good efficacy outcomes and an impressive safety profile, we see these results as another validating datapoint for the prospects of PFA, which has the potential to become a new workhorse solution, likely starting with taking share from cryoablation, in our view,” J.P. Morgan analyst Robbie Marcus wrote in a research note. “These data are early, smaller in size, and single-arm (i.e. not randomized with a control arm), which makes them hard to compare vs. other EP devices, but that said, the data certainly appears promising — the PFA catheter more than the RF balloon catheter, in our view.”

BTIG’s Thibault also expects PFA to gain share from cryoablation devices if it can prove out results.

“We expect PFA is likely both faster and safer than existing thermal-based ablation technologies based on early findings. However, it is still unclear to us how much more effective current iterations of PFA systems will be in providing patients with sustained freedom from atrial arrhythmias, which PFA device will deliver the best outcomes and be easiest to use, and which cases are most optimal for PF use over RF or Cryo,” she wrote in a research note on Tuesday.