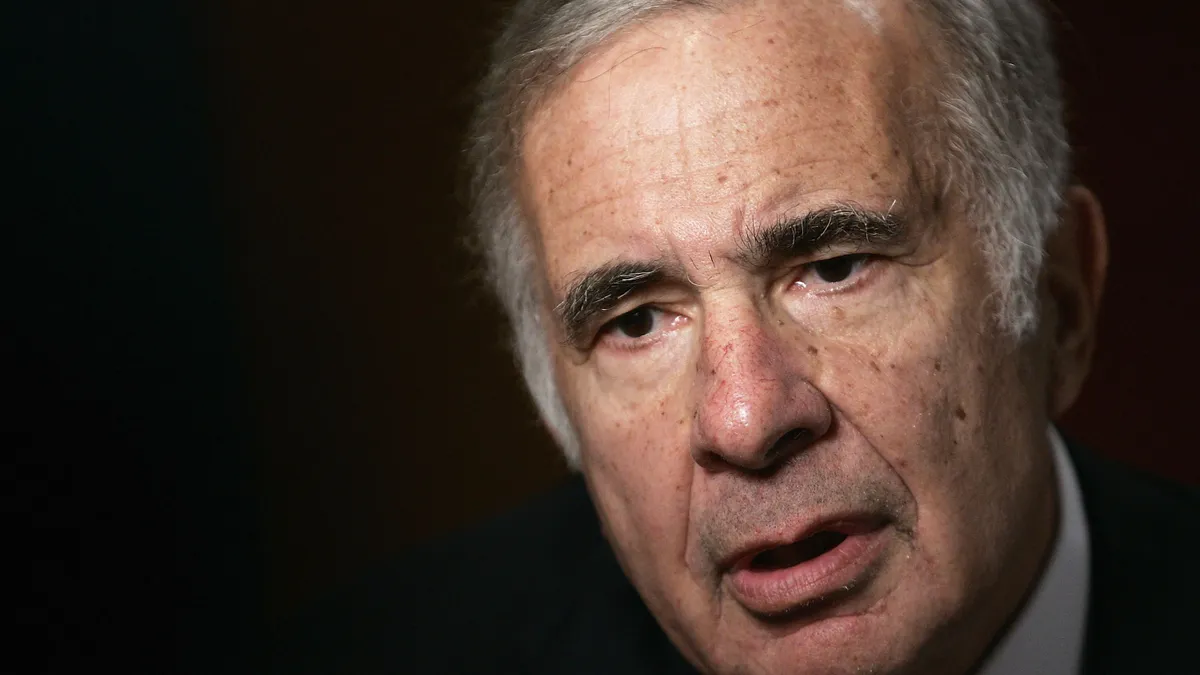

Carl Icahn, the 87-year-old activist shareholder who has been urging DNA-sequencing company Illumina to divest liquid biopsy test maker Grail, has stepped up his attacks on Illumina CEO Francis deSouza.

In a one-page “I-told-you-so” letter to Illumina shareholders after the U.S. Federal Trade Commission on Monday ordered the company to unwind its 2021 purchase of Grail, Icahn said a split is the only way to save both firms, and again called for deSouza to go.

“Illumina’s directors and CEO Francis deSouza have decided to continue their long history of appealing (and appealing again) in the hope of one day, at great expense, winning an almost impossible battle,” Icahn wrote.

But that battle may sink the company, he warned. “Our major concern as a large shareholder is that this multi-year battle will consume hordes of cash and go on for years, luxuries that Illumina does not have. Even in the best case for Mr. deSouza, the ability to own GRAIL will be a pyrrhic victory, as the core business deteriorates, and customers defect to rival sequencing platforms,” Icahn added.

“For the sake of both Illumina and GRAIL, these companies should be separated immediately to protect the long term growth prospects and viability of each entity,” he concluded.

Illumina bought Grail for $7.1 billion in 2021 while still facing antitrust challenges from U.S. and European regulators, who have said the combination could stifle innovation in the emerging market for blood-based early-cancer detection tests. Illumina had spun off Grail in 2015.

Illumina has vowed to appeal the FTC’s order to divest Grail, which was a reversal of an administrative law judge’s decision to dismiss antitrust charges initially brought in a complaint by FTC staff.

San Diego-based Illumina also is appealing the European Commission’s challenge to the Grail purchase. A final decision from the commission could come at any time, though some analysts have projected that both cases may not be decided until late this year or early 2024.

In his letter, filed with the Securities and Exchange Commission, Icahn also attacked deSouza.

“In the last few years, CEO Francis deSouza has allowed our potentially great company to deteriorate,” wrote Icahn, who served briefly as an adviser to the administration of President Donald Trump. “He has forced out many of Illumina’s talented employees. He has handpicked members of his board, who he believed would blindly follow him and overlook the fact that he knew very little about the genetics industry, while removing those who were a threat to his longevity.”

Icahn noted that revenue growth had dropped by “a staggering 90%,” under deSouza, and called the effort to buy Grail “a desperate ‘Hail Mary’ power grab,” that has cost shareholders $50 billion in value. “Illumina does not have the financial wherewithal to continue this fight,” he added.

Icahn called again for deSouza to be sacked. “The board of directors should dismiss Mr. deSouza immediately and bring back Jay Flatley (or someone else on his level) as CEO,” Icahn said, referring to the company’s previous leader.