Dive Brief:

- Integra LifeSciences is recalling all products manufactured at its Boston facility over the past five years after discovering a quality problem that could cause postoperative fever.

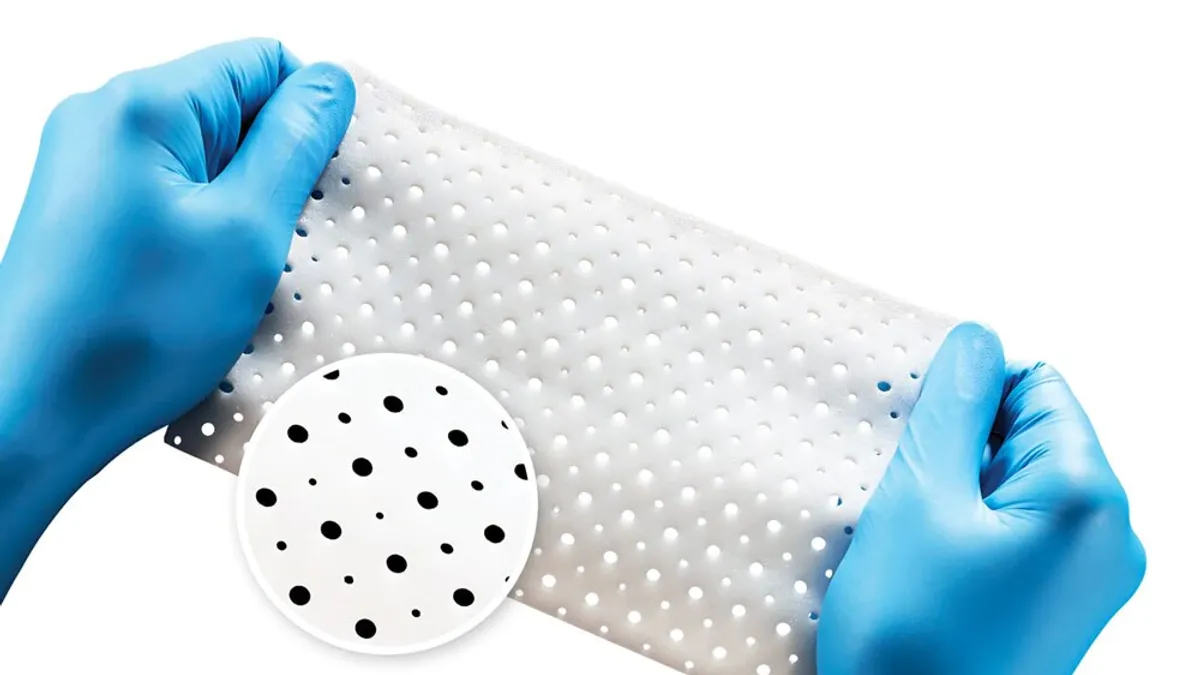

- The recall primarily affects tissue products, such as the SurgiMend collagen matrix, that account for 5% of the company’s revenues. Integra lowered its second quarter guidance by $24 million and warned the financial hit for the full year could reach $60 million.

- Analysts at BTIG said the recall raises “bigger questions” about Integra’s management and the “continued missteps” that the company has taken over the past year. Shares in Integra fell 20% to $40.48 after news of the recall broke Tuesday.

Dive Insight:

Integra initiated the voluntary recall after an internal investigation found endotoxin testing deviations. The deviations may have resulted in the release of medical devices with levels of endotoxins that exceed the levels permitted by the product specifications, the company said. Endotoxins can cause immune responses that result in postoperative fever.

The company has “no specific indication of any reported product complaints related to high endotoxin levels” but the risk of harm led it to start recalling products and extend a temporary halt on production at the facility. Integra will use the time to “implement additional detection and quality controls,” according to the company.

Management expects to incur a $22 million impairment charge related to the write-off of inventories of affected devices such as SurgiMend, PriMatrix, Revize and TissueMend. As a result, the company lowered its second quarter revenue guidance to the range of $372 million to $376 million, a $24 million reduction at both the top and bottom ends of the range.

Integra also warned that full-year revenue could land $60 million below its prior forecast if the manufacturing stoppage continues throughout 2023. Management told the team at BTIG “there would be further testing and validation required beyond 2Q23,” leading the analysts to conclude that “it's safe to assume the full $60 million impact.”

For analysts, the recall demonstrates a pattern of problems at the company.

Last year, Integra recalled its CereLink intracranial pressure monitor after some of the devices gave inaccurate readings.

Analysts listed other factors that have them questioning Integra’s management in a note to investors about the latest recall.

“The combination of a CFO loss (and no replacement announced as of yet), implied FY23 guidance which we had already viewed as challenging and requiring a significant step-up in growth 2H23, the continued impact of the CereLink recall, elongated [long-term] financial targets coming out of the FY23 analyst day, and now another recall (albeit somewhat voluntary) in Tissue Technologies are likely to shake investor confidence,” the analysts wrote.

Integra shares rose slightly on Wednesday morning, up 1.4%, or 56 cents, to $41.04 shortly after the market opened.