Boston Scientific posted higher quarterly sales that exceeded its expectations and boosted its full-year outlook for the second straight quarter, citing broad-based demand amid a healthy market for its medical devices.

Total sales in the second quarter climbed 12% on an operational basis, excluding the impact of foreign currency fluctuations and acquisitions, buoyed by steady momentum in both the U.S. and overseas markets, company executives said on a call Thursday.

CEO Mike Mahoney said physicians typically have waitlists for most procedures using the company’s devices. “We continue to see just very strong patient demand,” Mahoney told analysts. “We don’t see the current demand abating.”

Sales of Boston Scientific’s Watchman left atrial appendage closure device were a standout, growing 27% organically in the quarter, excluding foreign currency impact, the company said.

Endoscopy sales rose 14% on an operational basis, and sales of devices used in peripheral interventions were up 14%. In the cardiology unit, the company’s largest, sales increased 13%.

Sales of neuromodulation devices lagged, at 2.8%, but Mahoney said the company expects growth in the spinal cord stimulation business to pick up in the second half of the year.

“There frankly seems very little if anything to ‘pick at,’ other than Neuromod growth,” Stifel analyst Rick Wise wrote in a research note.

Product launches

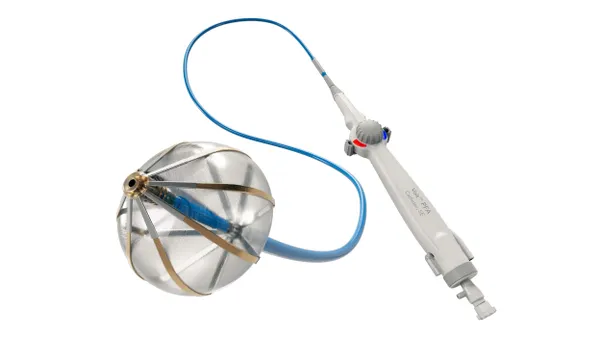

Mahoney said Boston Scientific expects upcoming new product introductions to be important growth drivers, starting with the U.S. launch of the Polarx cryoablation system for atrial fibrillation, anticipated in the third quarter.

“We do see a nice market for cryo in the coming years, and that's an area that really hasn't seen any innovation in nearly a decade,” Mahoney said.

In 2024, Boston Scientific expects to roll out in the U.S. its highly anticipated Farapulse pulsed field ablation device to treat atrial fibrillation. Demand for the device in Europe has exceeded the company’s ability to satisfy it due to supply chain constraints, Mahoney said. The company recently gained approval to manufacture the device in Minnesota and expects a significant increase in availability in the fourth quarter, he said.

Outlook

The company now estimates net sales growth for full-year 2023 to be about 10.5% to 11.5% on a reported basis and 10% to 11% on an organic basis. The company expects earnings per share on a GAAP basis in a range of $0.87 to $0.93 and adjusted EPS of $1.96 to $2.00, excluding charges.